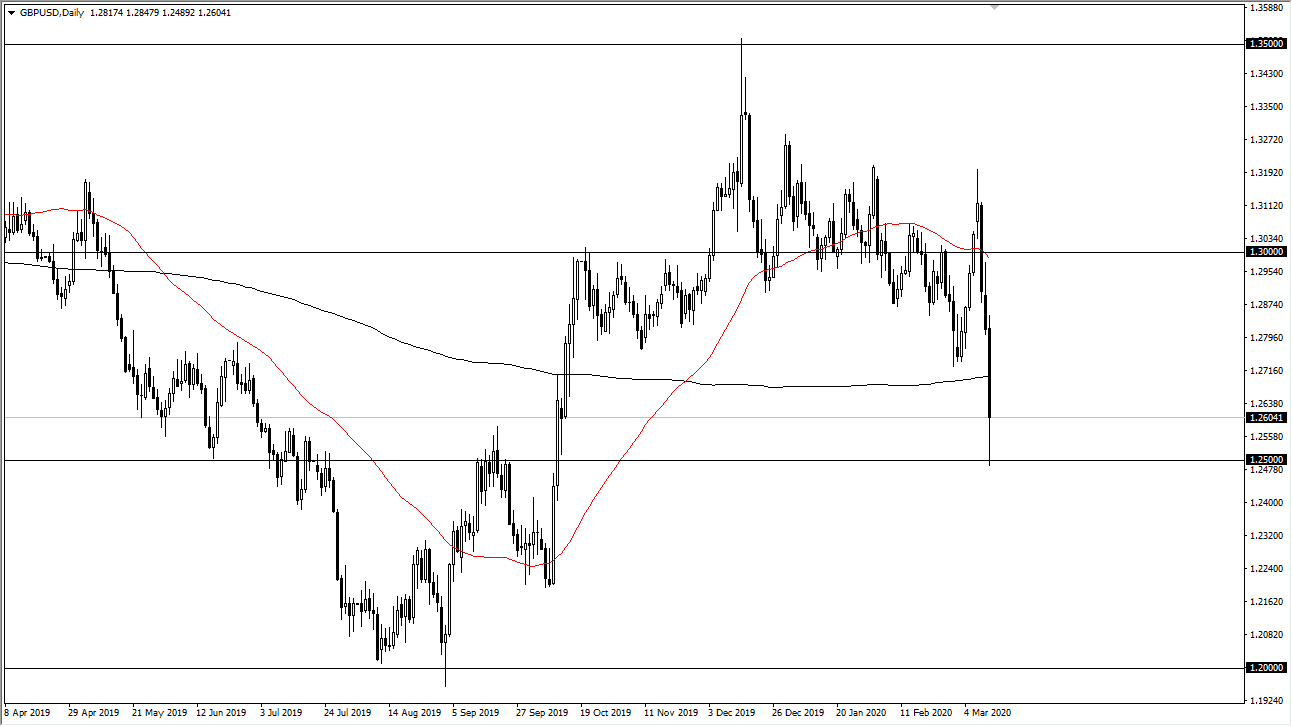

The British pound broke down significantly during the trading session on Thursday, breaking below the 200 day EMA without much trouble. This is a market that looks extraordinarily soft, and the fact that the British pound underperform the Euro against the US dollar also tells me that there is more underlying weakness in Sterling. This is perhaps due to the fact that Christine Largarde did not announce a rate cut coming out of the ECB, and that has shock to the markets somewhat. Remember, the Bank of England cut interest rates by 50 basis points just the other day.

Obviously, this is a market that noted the 1.25 level as crucial, CNET act as support as the market bounced about 75 pips. However, it should be noted that the Euro bounced more than twice that from the bottom. In other words, the British pound continues to be softer than the Euro, but at this point the real trade may not even be in either one of these pairs, it might be in the EUR/GBP pair, as you are able to marry strength and weakness.

That being said, this pair does break down below the 1.25 handle, is very likely that the market drops down to the 1.2250 level, perhaps even down to the 1.20 level after that. Ultimately, this is a market that is moving based upon fear more than anything else and I think also that rallies will be sold into. The 200 day EMA which is currently near the 1.27 level, will more than likely offer a significant amount of resistance that we could see sellers come back into. The length of the candlestick is rather impressive, and the fact that we are closing closer to the bottom than the middle suggests that we could get a little bit of follow-through coming.

If we were to rally and clear the 1.27 level on a daily close that could send this market looking towards 1.29 handle, but I think it’s more likely to see this market fade rallies than trying to hang on to him. The US dollar will still be in great demand due to the safety part of the trade itself. I believe that we are just now seen the markets truly unwind and show their fear. We probably have quite a bit more ahead of us.