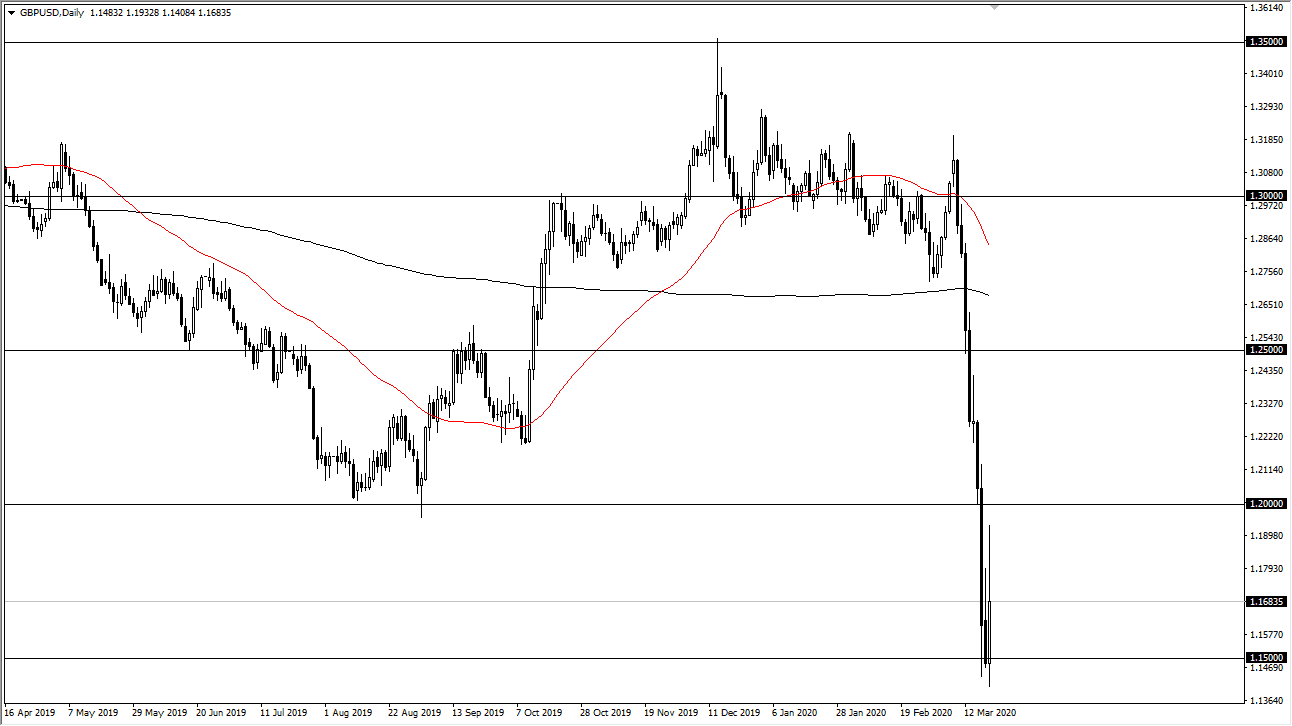

The British pound had a nice rally during the trading session on Friday but gave back a significant portion of the gains. By doing so, it shows just how tenuous any rally will be in the British pound, and it does make sense that we sold off near the 1.20 level as it offers a major psychological barrier.

With the Bank of England cutting interest rates down to 0.1%, the interest rate differential, albeit minuscule” does favor the US dollar. That’s not exactly why people were trading this right now though, as the market is simply looking for safety.

A lot of traders are concerned that the United Kingdom will become the next hot spot for the coronavirus outbreak, and therefore have been punishing the British pound as a result. Furthermore, you have to worry about the Brexit situation which obviously is on the back burner right now. While the United Kingdom has left the European Union, the reality is that there is still a ton of issues to work through as far as the breakup is concerned. In a twist of irony, the coronavirus could possibly extend the time it takes for the British to leave, or at least scrap the temporary agreement that everybody is working on.

It’s not until we break above the 1.20 level that I would take any rally in the British pound seriously, and the fact that we gave up so much during the day on Friday shows just how susceptible to pressure this pair is going to be. Don’t get me wrong, it is extraordinarily oversold, but these are extraordinary times. If we do break above the 1.20 level then I will be looking to sell closer to the 1.2250 level, barring some type of unforeseen fundamental change in the outlook for the currency pair. I do believe that the US dollar shortage will continue and therefore people will be looking for greenbacks against most currencies, and of course the British pound will be different. To the downside, if we can break down to a fresh, new low then we will go towards the 1.1250 level, possibly followed by the 1.10 level. One thing is for sure though, there is going to come a day when the British pound stabilizes. When it does, this will be the buy of a lifetime, offering a huge profit possibility as the British pound is historically cheap right now.