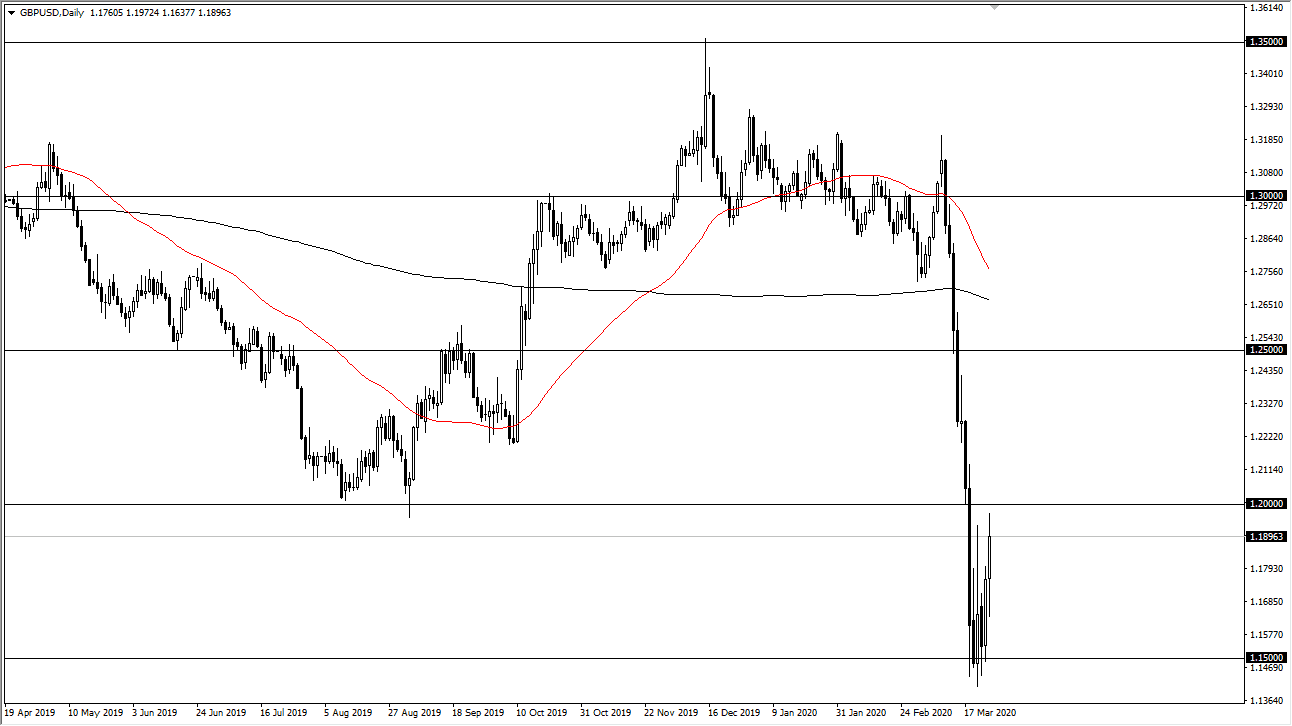

The British pound rallied significantly during the trading session on Wednesday, but as you can see on the chart the 1.20 level continues to cause all kinds of issues for buyers. This area should cause a lot of resistance based upon previous action, and of course the fact that it is a large, round, psychologically significant figure. Furthermore, there are a lot of questions as to whether or not the market can support the British pound rallying at all. The United Kingdom is on complete lockdown and that of course works against the currency itself.

Looking at the chart, I think that we are probably trying to carve some type of range out, but in the short term I think it’s going to be very volatile. The market closing above the 1.20 level on a daily close would be a very bullish side, it could open up the door to the 1.2250 level and then towards the 1.25 handle after that. Having said that, it’s difficult to imagine that the British pound is going to hang on to gains for a significant move given what is going on around the world right now. After all, even though the Federal Reserve is loosening up monetary policy, there is still an insatiable demand for US dollars.

Furthermore, the British pound itself has a lot of other issues attached to it. Not the least of which would be the fact that even once we get past the coronavirus issues, we have to worry about the negotiations between the British and the Europeans. It’s difficult to imagine that we are suddenly going to get everything resolved in one shot. Don’t be wrong, I believe that this is going to be the “buy of a lifetime” given enough time, but we simply aren’t there yet. I think in the meantime you have to look at various levels as selling opportunities including the most obvious one, the 1.20 level. The 1.2250 level will be resistive, and so will the 1.25 handle. I believe that the 1.15 level underneath will serve as a short-term floor the market, but if we were to break down below there we could really unwind rapidly at that point. That being said, we are oversold so a bounce in this general vicinity does of course make quite a bit of sense. Markets can’t go in one direction forever after all.