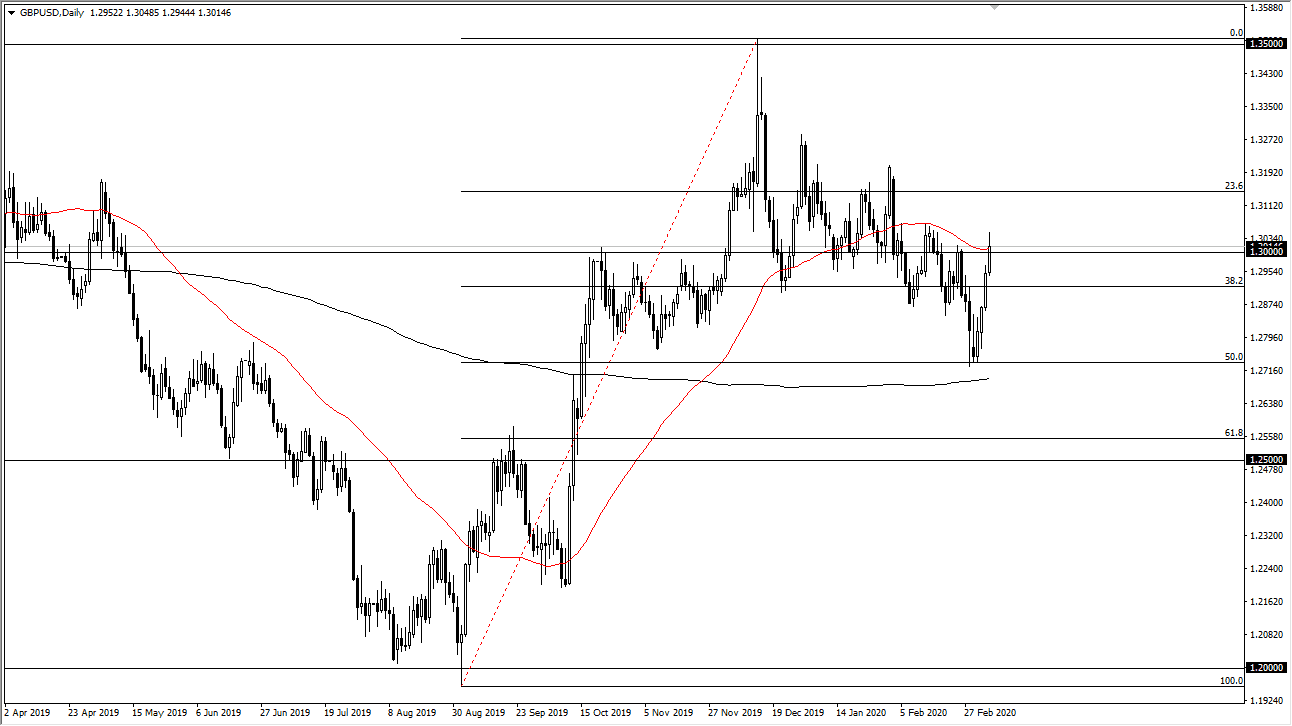

The British pound has rallied a bit during the trading session on Friday, as we have broken above the 50 day EMA. This was true even though the United States produced extraordinarily bullish jobs numbers for the month of February. The fact that the British pound could rally above the 50 day EMA suggests that the market is so anti-US dollar right now that short-term pullback should continue to offer plenty of buying opportunities.

Underneath, I would anticipate that the first level of support should be the 1.30 level. Underneath that, the 1.29 level is the next support level, followed by the 1.28 handle. At this point in time it’s very likely that the market will bounce and go higher. I don’t have any interest in shorting the British pound, or I should say that I don’t have any interest in buying the US dollar. That being said, it is certainly lagging in comparison to the EUR/USD pair, but it should follow suit.

The 1.32 level above should be a target given enough time, and I think we will probably see that level tested in the next week or two. If we were to break above that level, then the market could go towards the 1.35 handle which I think is the longer-term target but obviously there is going to be some give-and-take along the way. To the downside, I do expect to see buyers on dips based upon value. The Bank of England has given a bit in the way of mixed signals when it comes to interest rate decision, so having said that it’s likely that the British pound could outperform based on that basis alone.

The move has been rather strong over the last week or so, and that does tell me that we are very likely to continue to see the trend change come into effect. That being said though, nothing can go straight up in the air, so pullbacks will be necessary for building a certain amount of momentum. Overall, I am bullish, but I also am cautious. I think when markets are as erratic as these have been, it makes quite a bit of sense to keep your position size relatively small and billed as the market works out in your favor. The market has a lot of noise just above it so don’t think that it’s going to be easy to hang on to your long positions.