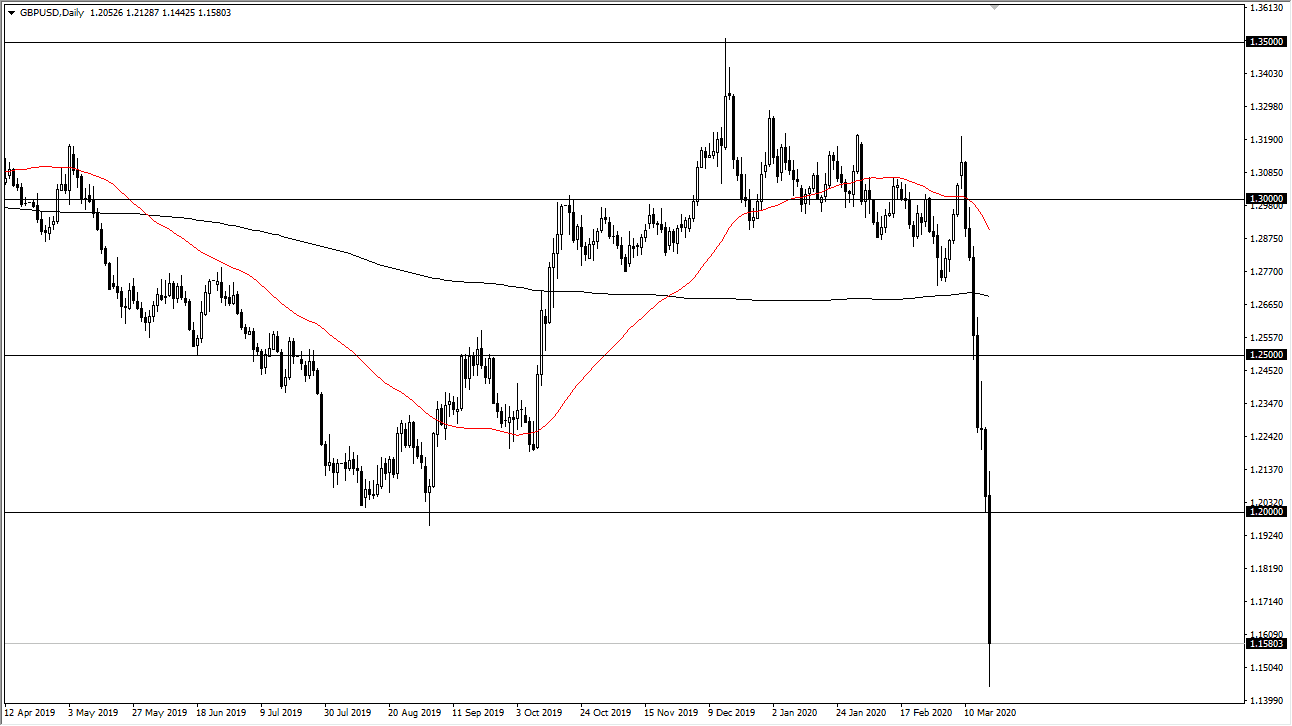

The British pound has collapsed during the trading session on Wednesday, slicing through the psychologically and structurally important 1.20 level as traders continue to sell off Sterling due to a perceived lack of seriousness by the British government when it comes to fighting the coronavirus. Furthermore though, a lot of this comes down to the US dollar strength in general. Right now, there is a huge demand for US dollars and then should continue to be the case. Nonetheless, the British pound is oversold and therefore I would not be surprised at all to see a bit of a bounce from here.

The market actually reached towards the 1.15 handle, but when you look at the last week or so, it is clearly oversold. In this type of environment, one would have to wonder how many sellers are left out there? For myself, the way I will be trying to trade this market is to short it on signs of exhaustion. I think rallies at this point, and especially near the 1.20 level, are very unlikely to continue much further. Simply looking for an opportunity to short this market from a higher level makes the most sense as there should be some type of relief rally but ultimately the British pound is falling for several reasons. One of the most obvious reasons is the entire mess with the Brexit that is still going on, and a relatively poor performing economy.

The size of the candlestick is rather impressive and to recover that type of loss, the market will probably need a few days. I just can’t imagine a scenario where we turn around and spike to the upside but if we do without some type of earth shattering news, I am more than willing to sell into that as it should offer plenty of opportunity. The market can’t be bought yet but clearly the British pound is oversold and eventually we will help buyers come in and try to pick up a bit of value. I’m not ready to do that yet, but I will let you know when I get that longer-term signal. Until then, I’m jumping on shorter term rallies that show signs of exhaustion that I can sell into. The 1.15 level should be rather supportive, but if we were to break down below their it’s likely that the 1.1250 level will be the next target overall.