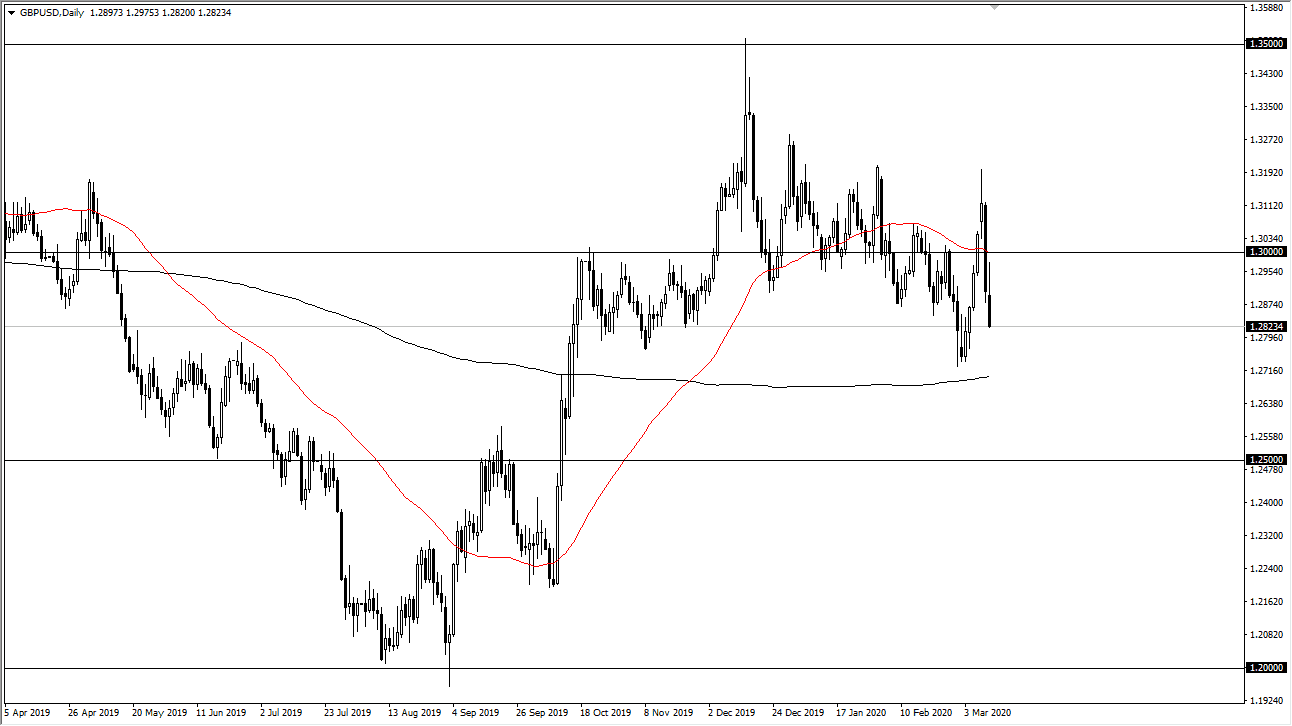

The British pound initially tried to rally during the trading session on Wednesday but gave back the attempt at gaining above the 1.30 level. That being the case, it’s very likely that the market is going to struggle to get above the 1.30 level going forward, as it is a large, round, psychologically significant figure and of course an area that the market has previously seen as both support and resistance. Beyond that, the 50 day EMA is sitting right there at this area, and it’s very likely that the market will see that as a barrier that’s difficult to get through. Ultimately, the market has seen the British pound struggle overall, as it looks likely to reach down towards the 200 day EMA.

The British pound reaching towards the 200 day EMA means that we should be going down towards the 1.27 level. As the Bank of England cut interest rates by 50 basis points, the British pound of course suffer due to that but longer-term it’s probably a nonevent due to the fact that the reason for the cut had a lot less to do with monetary policy and more to do with an attempt to calm things down in general. At this point, the market looks as if that will be an area of attention, and if we can hold that then it’s possible that we can bounce. If we get past the 200 day EMA, then it’s likely that the market goes down to the 1.25 handle next.

The entire world is waiting to see what some governments do for stimulus, not the least of which is going to be the US government. So far, they have done nothing so the entire situation involving the US dollar is still a bit of a question at this point. Because of this, I think that there is still plenty of instability in this market and then eventually we will get a bigger “risk off” type of situation and therefore it’s very likely that we will see signs of exhaustion on short-term rallies that you can continue to fade. For a bullish case, we need to break above the 1.30 level on a daily close, something that’s going to take an extraordinarily bullish market to suddenly turn around and do. I remain bearish, but I would look for short-term rallies in order to sell so that you can get a little bit better risk to reward ratio.