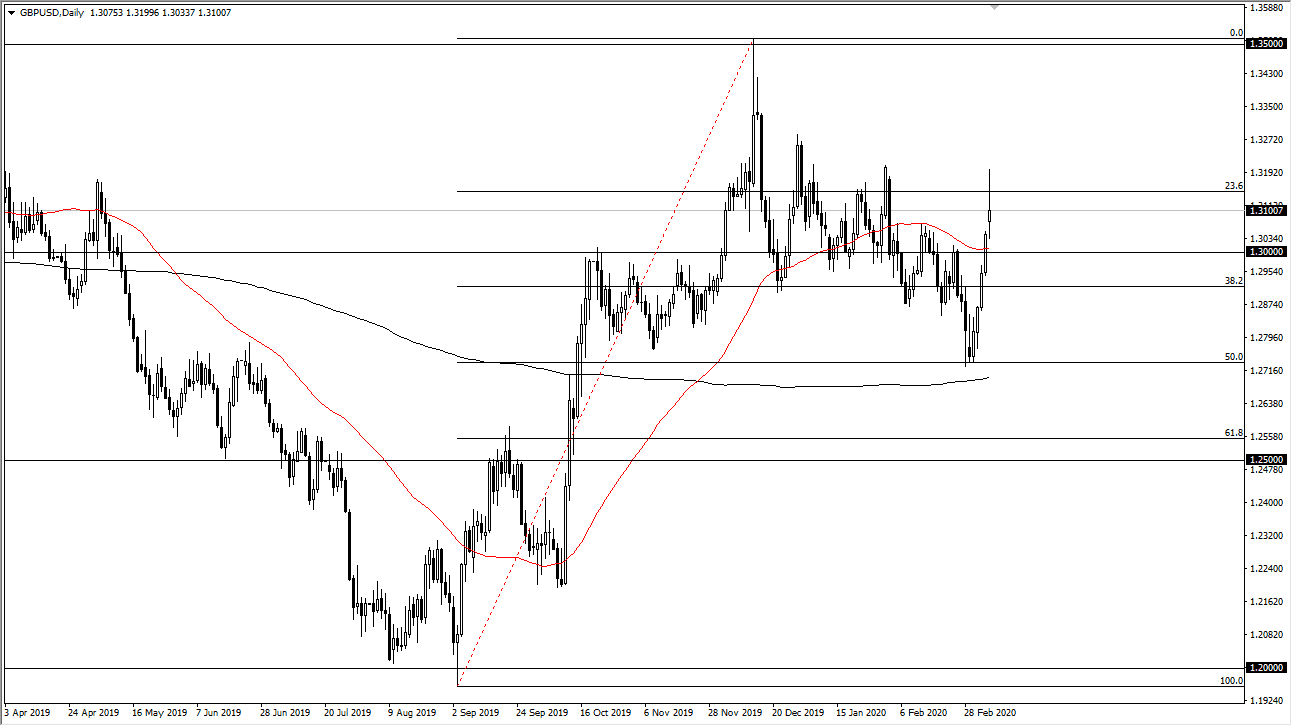

The British pound initially surged during the trading session after gapping higher on Monday. That being said, this was a general “anti-dollar” type of move, as the greenback got hit against almost everything out there. The British pound did spike towards the 1.32 level, but unlike some of the other major currencies, it did not keep some of the gains against the US dollar.

The resulting candle was a shooting star which of course is a negative sign, but it doesn’t necessarily mean that it’s time to sell this pair, as it certainly has shown a lot of strength as of late. I think what it means more than anything else is that we may have possibly gotten a bit overbought in the short run. To the upside, the 1.32 level should be rather resistive so if we were to break above that level, it would be a very bullish sign for the British pound. I do believe that we probably get a short-term pullback towards the 50 day EMA though, which would be closer to the 1.30 level.

If we see this market break above the 1.32 handle, then it’s very likely that the market then goes towards the 1.35 handle. To the downside, if the market were to break down below the 1.30 level, the next support level is closer to the 1.29 handle. That being said, this is a market that will continue to be very noisy and choppy, but at this point it’s likely that the volatility is only going to pick up, because there are so many different pieces on the chessboard when it comes to risk appetite.

The US dollar has gotten hit due to the fact that the Federal Reserve is very likely to cut rates, and at this point it’s likely that the US dollar will continue to suffer based upon the fact that 100 basis points of interest rate cuts are probably coming. It isn’t so much British pound strength that we are talking about, rather that we are trying to reevaluate the balance between interest rates. At this point, it’s very likely that we will continue to see a lot of volatility, but pullback should offer buying opportunities unless something changes in Great Britain itself. The Federal Reserve is almost sure to do some type of market softening type of move in the next few days, quite frankly the markets are demanding it.