After this currency pair ascended to a fresh 2020 high, the oil price collapse on Monday resulted in a profit-taking sell-off. It took the GBP/SGD into its next short-term support zone, providing a healthy pullback, and ensuring the longevity of the dominant bullish uptrend. Economic data out of the UK has surprised to the upside, delivering a fundamental catalyst. Singapore appears to have contained Covid-19, but economic damages will continue to impact performance. It was evident in the latest manufacturing data, which clocked in below 50.0, indicating a recession.

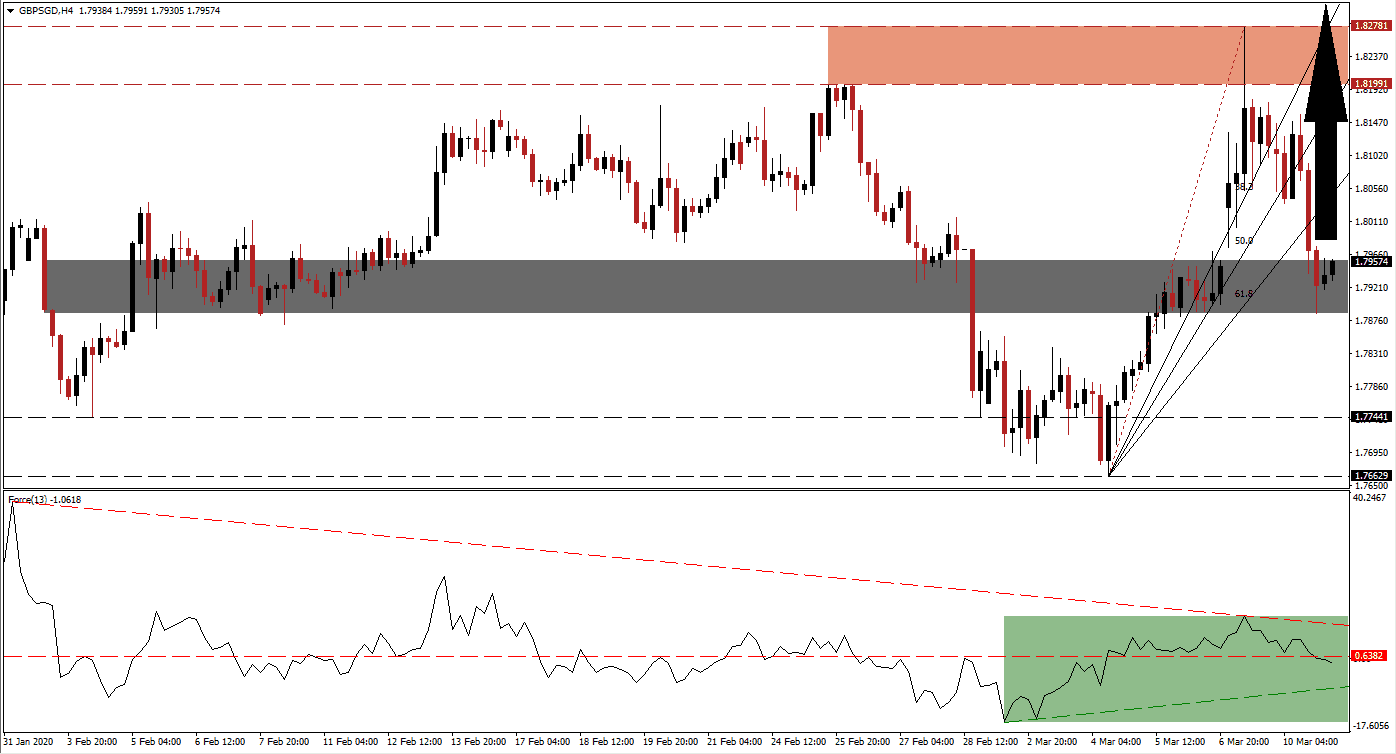

The Force Index, a next-generation technical indicator, offered an early warning that the advance is vulnerable to a sell-off. While the GBP/SGD pushed into a fresh yearly peak, a lower high was recorded by the Force Index. The descending resistance level pressured it below its horizontal support level, converting it into resistance, as marked by the green rectangle. This technical indicator may contract into its ascending support level from where recovery is likely to take it above the 0 center-line, ceding control of the GBP/SGD to bulls.

Trade negotiations between the EU and the UK are ongoing with deep divisions. Prime Minister Johnson outlined plans for the UK to prepare for a WTO governed relationship if no progress has been made by June. Additional data points towards a healthy and expanding economy in either scenario, delivering a long-term catalyst for the British Pound. Price action is expected to reverse off of its short-term support zone located between 1.78863 and 1.79579, as marked by the grey rectangle, initiating a new breakout sequence in the GBP/SGD. You can learn more about a support zone here.

One significant level to monitor is the intra-day high of 1.80174, the high before this currency pair accelerated to its current intra-day low from where the Fibonacci Retracement Fan originates. A breakout will take the GBP/SGD back above its ascending 61.8 Fibonacci Retracement Fan Resistance Level, clearing the path into its resistance zone. This zone is located between 1.81991 and 1.82781, as marked by the red rectangle. More upside is favored to take this currency pair to new highs for the year. You can learn more about a breakout here.

GBP/SGD Technical Trading Set-Up - Price Action Reversal Scenario

Long Entry @ 1.79550

Take Profit @ 1.82750

Stop Loss @ 1.78750

Upside Potential: 320 pips

Downside Risk: 80 pips

Risk/Reward Ratio: 4.00

In the event of a contraction in the Force Index below its ascending support level, the GBP/SGD is anticipated to extend its corrective phase. The downside potential remains limited to its next support zone, located between 1.76629 and 1.77441, which will present Forex traders an excellent buying opportunity. Due to the fundamental outlook, supported by technical developments, this currency pair carries a distinct bullish bias.

GBP/SGD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 1.78250

Take Profit @ 1.77000

Stop Loss @ 1.78750

Downside Potential: 125 pips

Upside Risk: 50 pips

Risk/Reward Ratio: 2.50