Singapore was one of the first countries to react to the Covid-19 outbreak, but initial success caused it to fall behind. It has been criticized for delaying a ban on short-term visitors hours after the first two deaths were reported, linked to a visitor infecting a local. Before the ongoing virus-related hit to the economy, January bankruptcies surged to levels not seen since October 2004 at 434. Companies in liquidation totaled 287 last year, the highest level on record. The GBP/SGD is well-positioned to extend its breakout sequence farther to the upside.

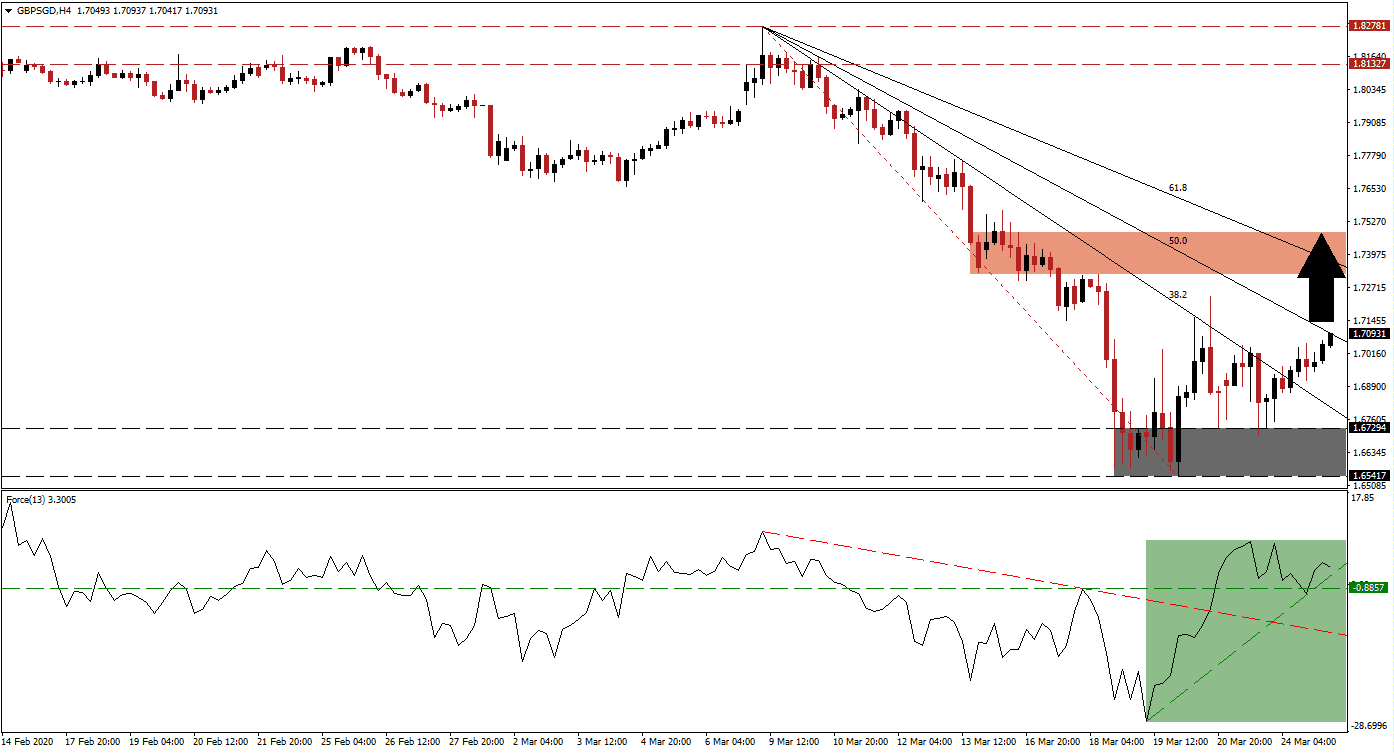

The Force Index, a next-generation technical indicator, reversed direction off of a new 2020 low, pushing through its descending resistance level. Bullish momentum sufficed to convert the horizontal resistance level into support, as marked by the green rectangle. An ascending support level formed, adding upside pressure on the Force Index. Bulls took control of the GBP/SGD after this technical indicator advanced into positive territory. You can learn more about the Force Index here.

Economic data showed the UK is suffering a steeper contraction than during the 2008 global financial crisis. A development echoed across the globe. Today’s inflation data is unlikely to move the British Pound. As central banks slashed interest rates and announced new quantitative easing measures, inflation reports will be closely monitored moving forward. After the GBP/SGD pushed out of its support zone located between 1.65417 and 1.67294, as identified by the grey rectangle, a breakout above its descending 38.2 Fibonacci Retracement Fan Resistance Level followed.

With the increase in bullish momentum, the GBP/SGD is anticipated to reclaim its 50.0 Fibonacci Retracement Fan Resistance Level. It will provide enough upside pressure to elevate price action into its short-term resistance zone located between 1.73206 and 1.74821, as marked by the red rectangle. The 61.8 Fibonacci Retracement Fan Resistance Level is on the verge of crossing below it. More upside will require a new catalyst but is likely to materialize.

GBP/SGD Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 1.70900

Take Profit @ 1.74800

Stop Loss @ 1.69800

Upside Potential: 390 pips

Downside Risk: 110 pips

Risk/Reward Ratio: 3.55

In case of a collapse in the Force Index below its descending resistance level, temporarily acting as support, the GBP/SGD is favored to retreat. The downside potential remains limited to the bottom range of its support zone. Forex traders are advised to consider this an excellent opportunity to add new buy orders, as the long-term fundamental outlook is increasingly bullish.

GBP/SGD Technical Trading Set-Up - Limited Reversal Scenario

Short Entry @ 1.68500

Take Profit @ 1.66400

Stop Loss @ 1.69250

Downside Potential: 210 pips

Upside Risk: 75 pips

Risk/Reward Ratio: 2.80