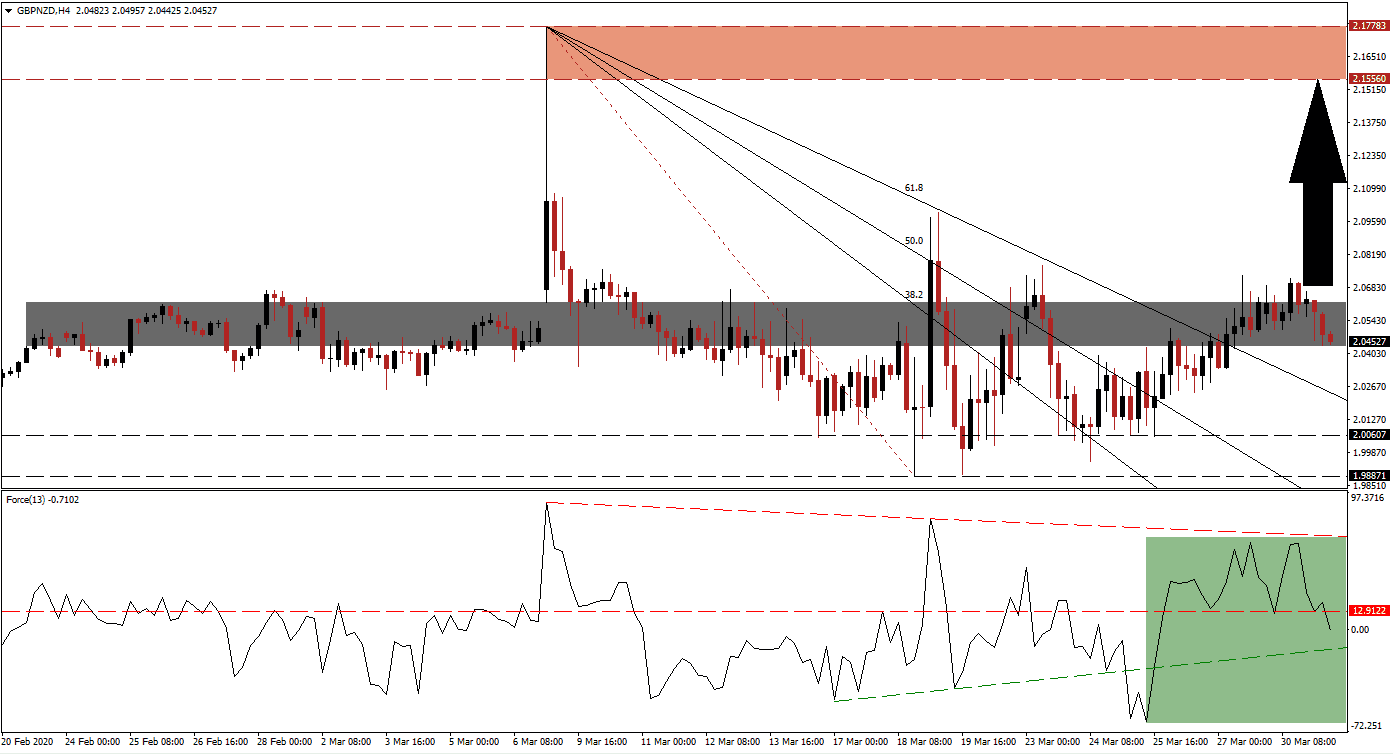

Chinese PMI data showed an unexpected expansion in March on the back of a spike in production for medical supplies. While the New Zealand economy is heavily dependent on the Chinese economy, this surge is focused domestically and on exports. It sufficed to lead the GBP/NZD into a minor retracement off of its most recent peak, following the breakout above its short-term resistance zone, which has since turned into support. While a temporary dip into its descending 61.8 Fibonacci Retracement Fan Support Level cannot be excluded, a new breakout is anticipated to keep the long-term advance intact.

The Force Index, a next-generation technical indicator, was unable to eclipse its shallow descending resistance level. It collapsed below its horizontal support level, converting it into resistance, as marked by the green rectangle. The Force Index is likely to move into its ascending support level before reversing to the upside. This technical indicator crossed below the 0 center-line, but with the proximity of the ascending support level, bulls remain in charge of the GBP/NZD. You can learn more about the Force Index here.

New Zealand entered a full lockdown in an attempt to stop the spread of Covid-19, threatening the global economy with a recession. Deputy Prime Minister Peters dew comparisons to the US post-Great Depression of 1933, noting the country can emerge wealthier out of the crisis. He proposed converting the economy to a domestic-focused one rather than relying on imports. His remarks are not expected to prevent a resumption of the uptrend in the GBP/NZD, following a second breakout above its short-term support zone located between 2.04316 and 2.06176, as marked by the grey rectangle.

Adding to the bullish bias in this currency pair is the push above its 61.8 Fibonacci Retracement Fan Support Level. One essential level to monitor the intra-day high of 2.07314, the peak of the current breakout sequence in the GBP/NZD. A push higher will take it to its minor resistance level provided by its intra-day high of 2.09981, from where the path is cleared into its resistance zone. This zone is located between 2.15560 and 2.17783, as identified by the red rectangle, and the bottom range dates back to May 2015.

GBP/NZD Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 2.04550

Take Profit @ 2.15550

Stop Loss @ 2.02300

Upside Potential: 1,100 pips

Downside Risk: 225 pips

Risk/Reward Ratio: 4.89

A contraction in the Force Index below its ascending support level is favored to ignite a sell-off in this currency pair. Given the existing dominant fundamental condition, the downside potential is limited to its long-term support zone located between 1.98871 and 2.00607. Forex traders are recommended to view any breakdown from current levels as an outstanding buying opportunity.

GBP/NZD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 2.01750

Take Profit @ 1.99000

Stop Loss @ 2.03000

Downside Potential: 275 pips

Upside Risk: 125 pips

Risk/Reward Ratio: 2.20