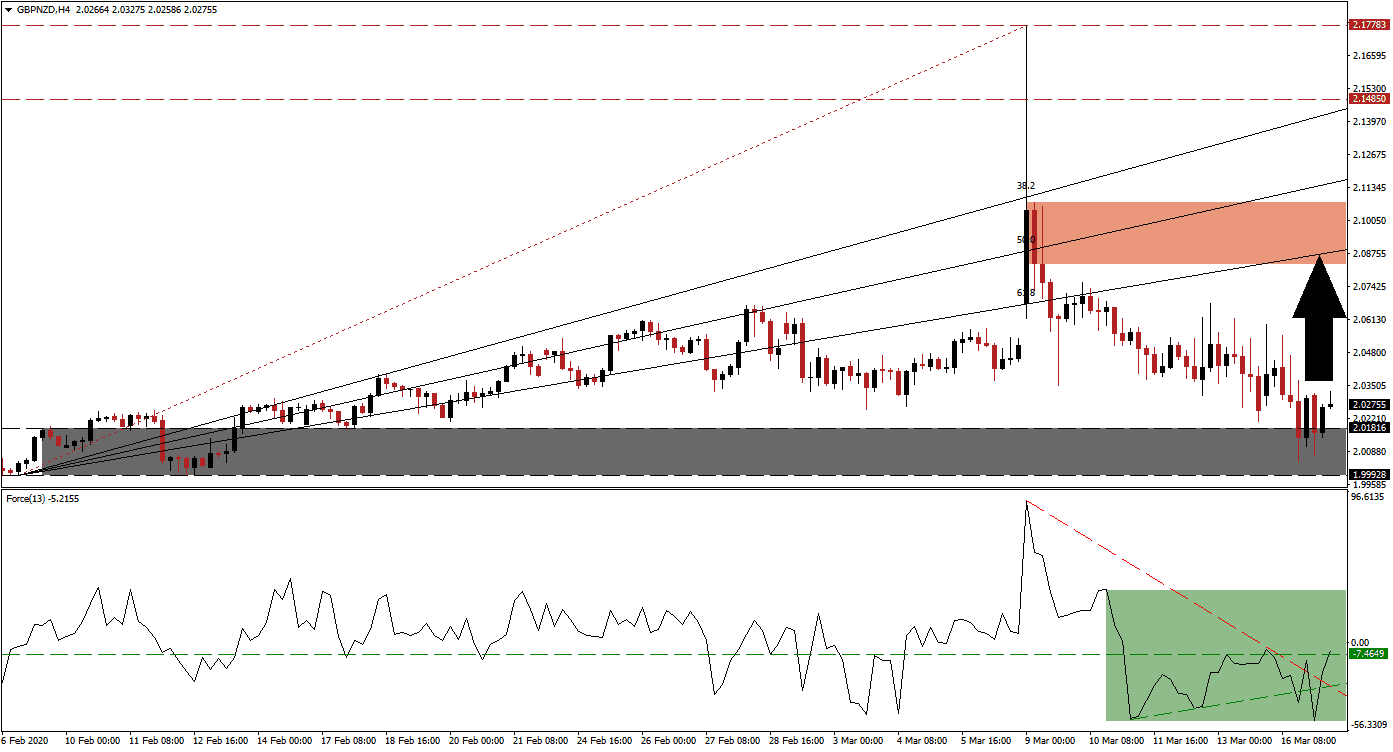

More governments realize that Covid-19 has placed the global economy on track to a recession. The UK announced a £30 billion package to strengthen its strained National Health System, but Chancellor of the Exchequer Sunak noted the difficulties ahead. New Zealand announced an NZ$12.1 billion economic rescue package after its central bank slashed interest rates to a record low of 0.25%. The GBP/NZD was able to complete a breakout above its support zone following a volatile correction after a price spike took recorded an intra-day high of 2.17783.

The Force Index, a next-generation technical indicator, points towards a built-up in bullish momentum after reversing a temporary breakdown below its ascending support level. It led to a push in the Force Index above its descending resistance level, as marked by the green rectangle. This technical indicator has now converted its horizontal resistance level into support from where an advance into positive territory is expected to place bulls in control of the GBP/NZD. You can learn more about a Force Index here.

A short-covering rally is now pending following the breakout in this currency pair above its support zone located between 1.99928 and 2.01816, as marked by the grey rectangle. Price action maintains its position above the psychological support level of 2.00000. One significant intra-day low to monitor is at 2.03496, the low which led to a brief price spike before the extension of the sell-off in the GBP/NZD into its support zone. More new buy orders are favored once price action moves above it, adding upside momentum to the anticipated recovery.

This currency pair is well-positioned to accelerate into its ascending 61.8 Fibonacci Retracement Fan Resistance Level. It has entered the short-term resistance zone located between 2.08321 and 2.10749, as identified by the red rectangle, which will reinvigorate the bullish chart pattern. An extension of the advance is possible, but a new catalyst is preferred to initiate a breakout in the GBP/NZD. The UK economy remains in a stronger position to handle recessionary threats than New Zealand, providing a long-term fundamental boost.

GBP/NZD Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 2.02750

Take Profit @ 2.08750

Stop Loss @ 2.00750

Upside Potential: 600 pips

Downside Risk: 200 pips

Risk/Reward Ratio: 3.00

Should the Force Index drop below its descending resistance level, currently providing temporary support, the GBP/NZD is likely to be pressured to the downside. Forex traders are recommended to consider any contraction below the 2.00000 level as a great buying opportunity. The long-term outlook remains increasingly bullish for this currency pair, with the next support zone located between 1.97588 and 1.98365.

GBP/NZD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 1.99250

Take Profit @ 1.97750

Stop Loss @ 2.00000

Downside Potential: 150 pips

Upside Risk: 75 pips

Risk/Reward Ratio: 2.00