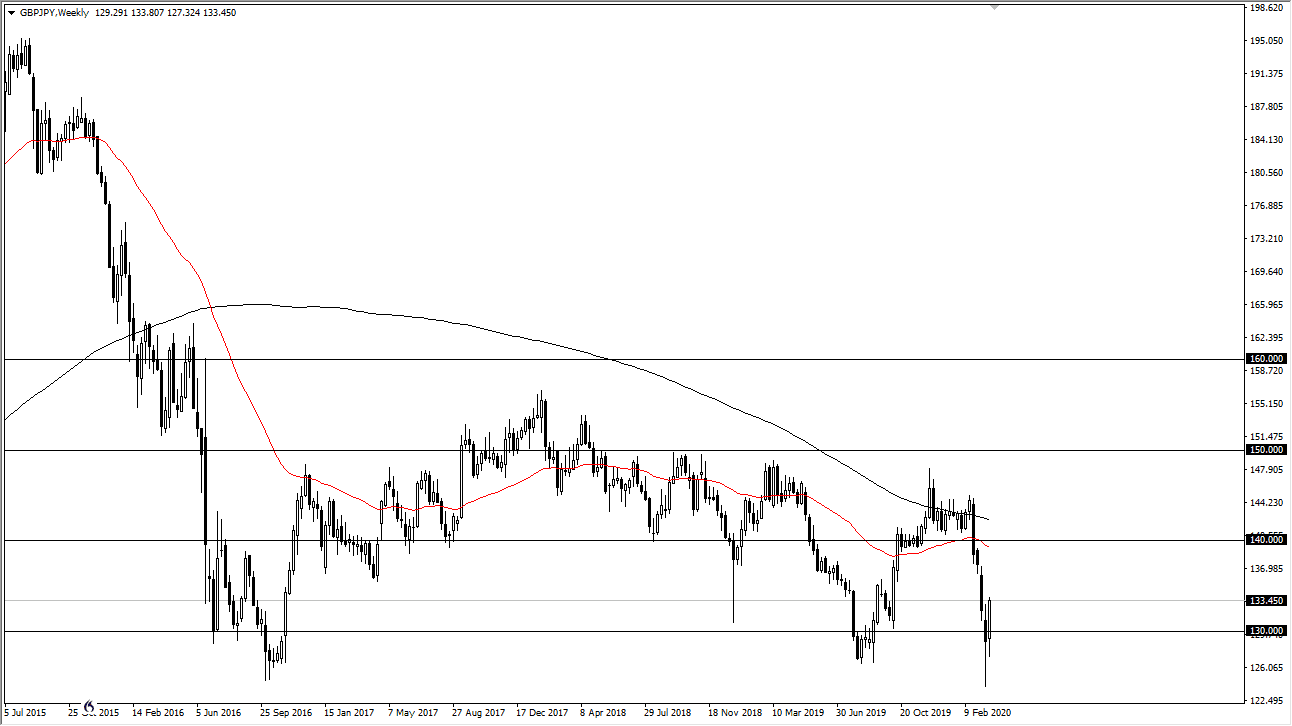

The British pound has fallen rather hard during the month of March, as a complete “risk off” feel has enveloped most of the markets anyway. At this point, the market has turned around to form a nice-looking hammer, followed by a positive candlestick. The ¥130 level looks to be somewhat crucial support, and it is an area that we have tested a couple of times before. I do believe at this point it’s likely that we could see a little bit of a bounce, but that bounce will more than likely be sold into eventually as massive selloff like this typically get tested again sooner or later.

I’m not sure whether or not the pullback happens during the month of April or May, because quite frankly we may see the markets calm down a bit simply due to exhaustion. That being said, there are a lot of concerns when it comes to global growth, and therefore it would make sense that the Japanese yen may be targeted for purchase. The British pound of course has other issues to worry about as well so that something that we should be paying attention to.

The British pound of course has to deal with the fact that the United Kingdom is locked down, and one has to wonder whether or not that will continue to be an issue. Furthermore, the market will more than likely start to focus on the UK/EU trade negotiations as soon as this virus situation is contained. While I do not expect that to happen rapidly, sometime in the next month or two we will start to focus on that again in the British pound will probably struggle due to that. This isn’t to say that it’s all over for Sterling, I think it is historically cheap and it could be an excellent buying opportunity for a longer-term “buy-and-hold” type of investor.

To the downside, if we were to break back down below the ¥130 level, then it’s likely that we are going to go lower as it would be a significant breach of support again, and at that point one would have to wonder how much is left in the tank for the buyers? To the upside, I believe that the gap near the ¥137 level will be significant resistance, just as the psychologically and structurally important ¥140 level will be.