A £350 billion war-time like rescue package was announced by the UK to combat the economic fallout from Covid-19. It consists of £330 billion, or 15% of GDP, in guaranteed loans to businesses and £20 billion in tax cuts and grants. The Bank of England additionally agreed on a new lending facility for large companies. Homeowners will receive a three-month mortgage holiday. The amount of capital will be increased if necessary as the UK is operating from a position of relative fiscal strength. After the measures were announced, the British Pound stabilized, and the GBP/JPY settled into its support zone.

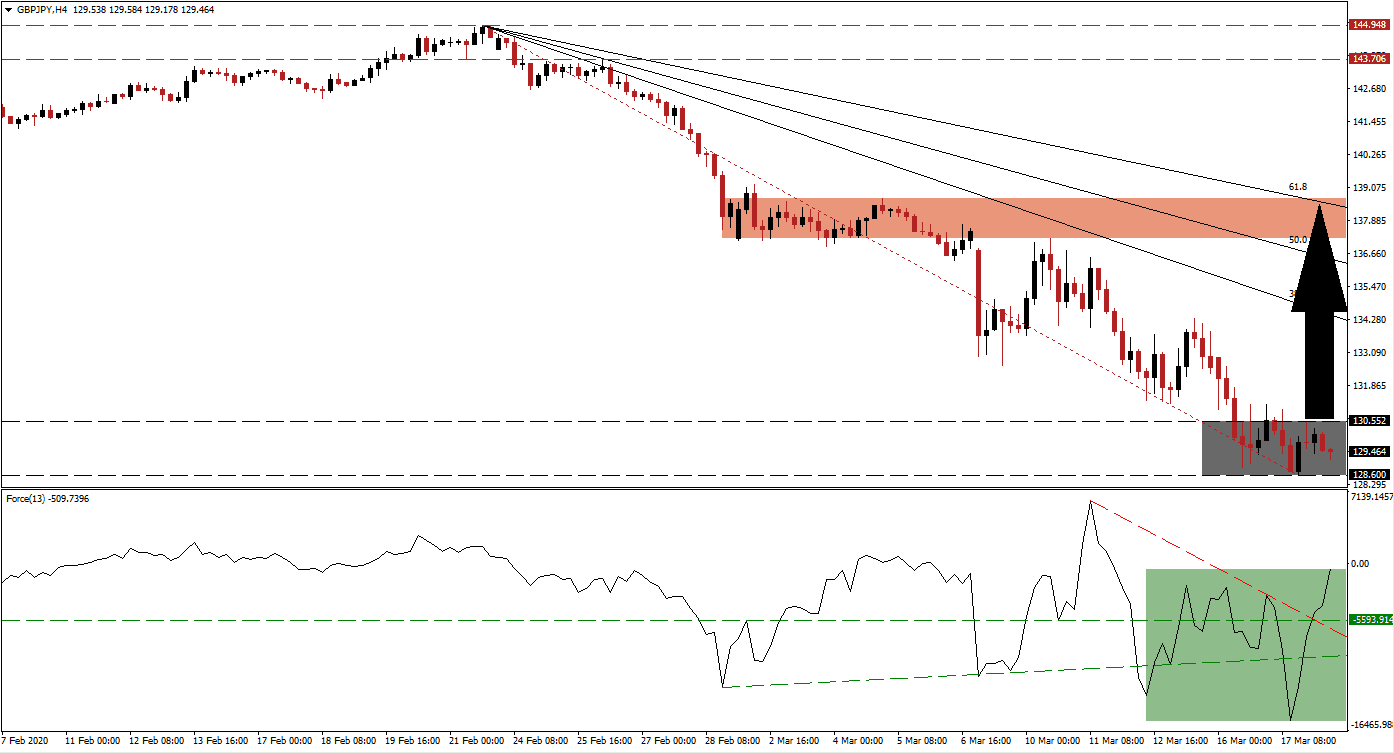

The Force Index, a next-generation technical indicator, points towards a sharp increase in bullish momentum, expected to lead this currency pair into a new breakout sequence. Following the plunge to a 2020 low, the Force Index quickly reversed and reclaimed its ascending support level. It also converted its horizontal resistance level into support and pushed through its descending resistance level, as marked by the green rectangle. This technical indicator is now on track to cross above the 0 center-line, allowing bulls to take charge of the GBP/JPY.

Japan reported a smaller than forecast contraction for February exports, but imports collapsed. Safe-haven demand is favored to remain elevated over the coming weeks as more economic data will be released. The Bank of Japan is likely to intervene directly in the Forex market, to prevent the Japanese Yen from strengthening significantly, in an attempt to support its export-dependent economy. A short-covering rally is now awaiting a breakout in the GBP/JPY above its support zone located between 128.600 and 130.552, as marked by the grey rectangle. You can learn more about a breakout here.

More governments are announcing massive stimulus packages, replicating their response to the global financial crisis of 2008. Fiscally stable economies, like the UK with a debt-to-GDP ratio near 2.0%, are in a position to bridge the economic disruptions without sacrificing future growth. It provides a long-term bullish catalyst to the British Pound. A breakout from current levels will close the gap to its descending 38.2 Fibonacci Retracement Fan Resistance Level, positioned the GBP/JPY to extend its advance into its short-term resistance zone. This zone awaits between 137.202 and 138.663, as marked by the red rectangle.

GBP/JPY Technical Trading Set-Up - Short-Covering Scenario

Long Entry @ 129.450

Take Profit @ 137.850

Stop Loss @ 127.850

Upside Potential: 840 pips

Downside Risk: 160 pips

Risk/Reward Ratio: 5.25

In case of a breakdown in the Force Index below its ascending support level, the GBP/JPY is anticipated to extend its corrective phase. With the announced stimulus and fiscal health of the UK economy, the outlook is increasingly bullish. The UK’s exit from the European Union is adding an additional long-term positive catalyst. Forex traders are advised to consider any breakdown as an outstanding buying opportunity with the next support zone located between 124.818 and 126.540.

GBP/JPY Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 127.450

Take Profit @ 125.450

Stop Loss @ 128.250

Downside Potential: 200 pips

Upside Risk: 80 pips

Risk/Reward Ratio: 2.50