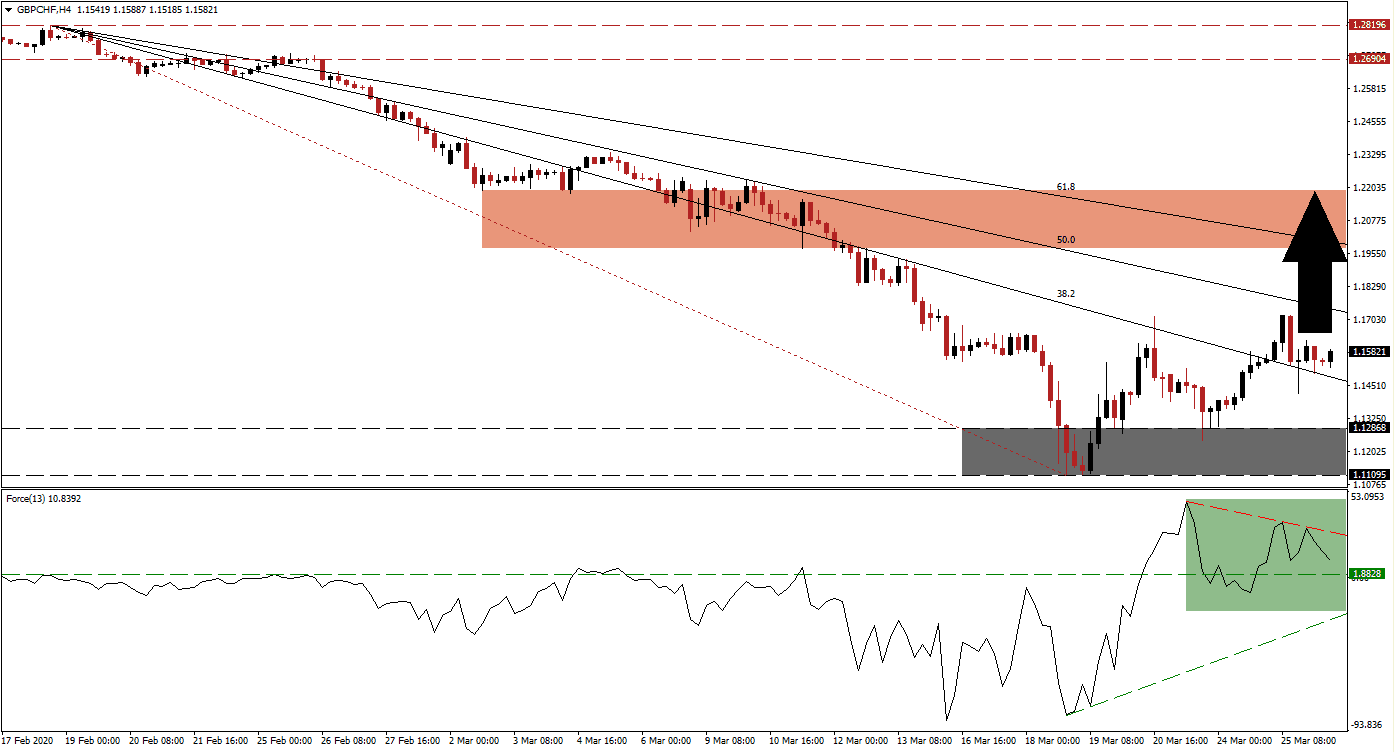

A bullish chart pattern is emerging in the GBP/CHF, following the collapse in this currency pair on the back of panic selling. Multi-year lows in price action were not backed by existing fundamental conditions. Unlike many other economies, the UK is operating from a base of relative fiscal strength. The £350 billion stimuli, or roughly 15% of GDP, is the most significant rescue bill passed by any government based on this measure. Following the breakout above its support zone, this currency pair has more room to the upside.

The Force Index, a next-generation technical indicator, accelerated from a marginally higher low to a multi-week high before retreating. A descending resistance level materialized and is pressuring the Force Index towards its horizontal support level, as marked by the green rectangle. While a brief contraction below it cannot be excluded, the ascending support level is expected to provide a catalyst to the upside. This technical indicator currently remains in positive territory and bulls in control of the GBP/CHF.

Over 500,000 volunteers signed-up to a UK government appeal of 250,000, for assistance with the strained National Health Service. Covid-19 has overwhelmed health systems globally, increasing the risks to the population. With the UK better equipped than the rest of Europe, the economy is set for a speedier recovery. After the GBP/CHF pushed out of its support zone located between 1.11095 and 1.12868, as marked by the grey rectangle, it was able to convert its descending 38.2 Fibonacci Retracement Fan Resistance Level into support. A series of higher highs and higher lows formed a distinct bullish chart pattern.

Price action is well-positioned to extend its breakout sequence above the 50.0 Fibonacci Retracement Fan Resistance Level and into its short-term resistance zone. This zone awaits the GBP/CHF between 1.19729 and 1.21917, as identified by the red rectangle. Switzerland announced a second economic aid package, as Covid-19 cases surged past 9,000. While the Swiss Franc is a safe-haven asset, the underlying strength of the UK economy is anticipated to drive price action into a sound recovery. You can learn more about a breakout here.

GBP/CHF Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 1.15750

Take Profit @ 1.21900

Stop Loss @ 1.14200

Upside Potential: 615 pips

Downside Risk: 155 pips

Risk/Reward Ratio: 3.97

In the event of a sustained move in the Force Index below its ascending support level, the GBP/CHF is likely to revisit its support zone. Forex traders are advised to consider this an excellent buying opportunity, on the back of fiscal stability out of the UK. Once Covid-19 cases flatten, markets will shift focus to the costs of bailouts, and debt-to-GDP ratios. The long-term outlook for this currency pair is increasingly bullish.

GBP/CHF Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 1.13500

Take Profit @ 1.11500

Stop Loss @ 1.14200

Downside Potential: 200 pips

Upside Risk: 70 pips

Risk/Reward Ratio: 2.86