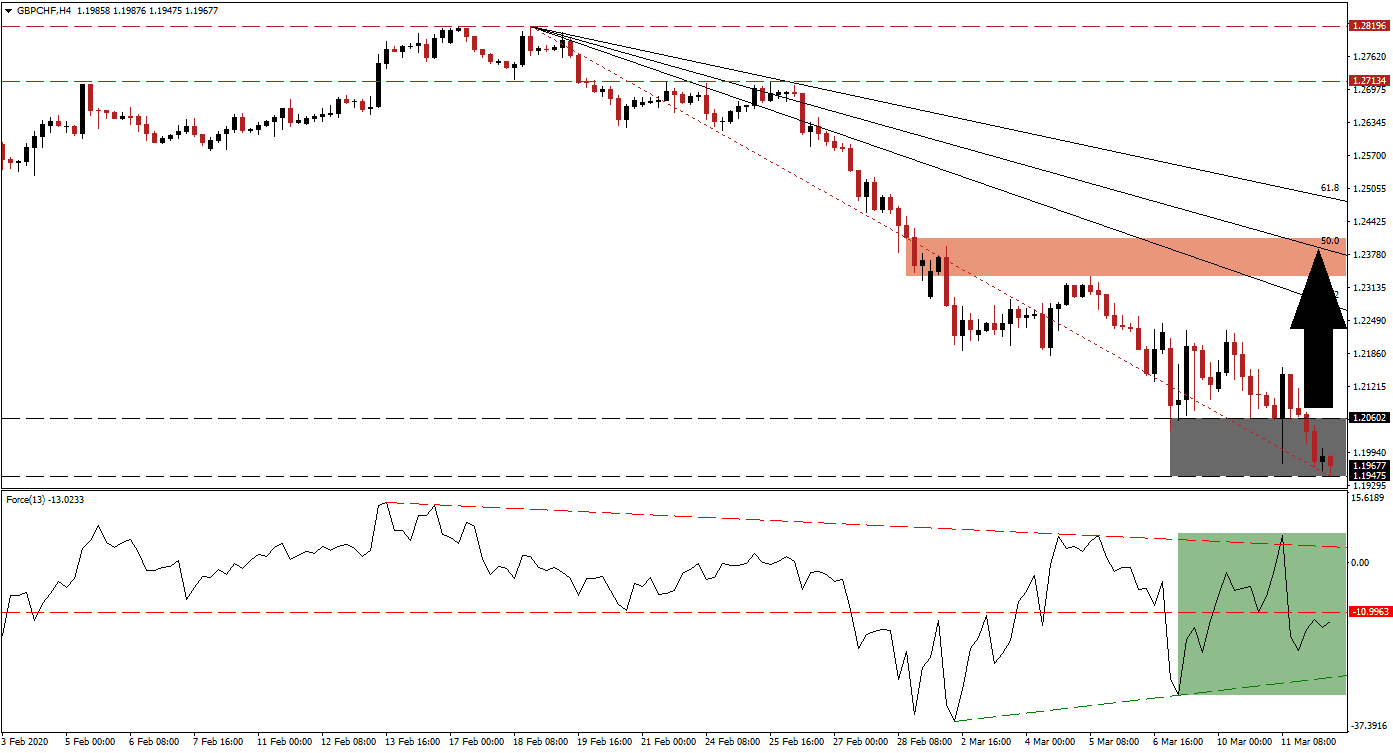

Despite the Bank of England’s 50 basis point interest rate cut to 0.25%, the British Pound held up well. The central bank announced the unusual move before the official MPC meeting in what appears to be an overreaction fueled by panic. Even the 2008 financial crisis did not result in fear-driven decision making. Economic data showed GDP was flat in January with more disruptions anticipated due to the raging Covid-19 virus, officially declared a global pandemic by the World Health Organization. Bullish momentum is on the rise after the GBP/CHF descended into its support zone.

The Force Index, a next-generation technical indicator, provided an early sign that a price action reversal is imminent. During the descend in this currency pair, the Force Index recorded a series of lower highs, allowing for a positive divergence to develop. The ascending support level is now favored to pressure this technical indicator above its horizontal resistance level, as marked by the green rectangle, converting it into support. An extension of the pending advance into its descending resistance level is expected to lead the GBP/CHF into a fresh breakout sequence.

A breakout in price action above its support zone located between 1.19475 and 1.20602, as marked by the grey rectangle, should spark a short-covering rally. While global economic disruptions related to the virus are unavoidable, the British economy is well-positioned to accelerate out of a challenging first-half. Safe-haven demand for the Swiss Franc has been countered by resilience in the British currency, reducing downside risks in the GBP/CHF from current levels. You can learn more about a short-covering rally here.

Market manipulation by the Swiss National Bank cannot be dismissed, adding a fundamental catalyst to price action. One essential level to monitor is the intra-day high of 1.21586, the peak of a failed breakout attempt. A sustained push above this level will close the gap between the GBP/CHF and its descending 38.2 Fibonacci Retracement Fan Resistance Level. A breakout will elevate this currency pair into its short-term resistance zone located between 1.23360 and 1.24099, as marked by the red rectangle, enforced by its 50.0 Fibonacci Retracement Fan Resistance Level.

GBP/CHF Technical Trading Set-Up - Short-Covering Scenario

Long Entry @ 1.19650

Take Profit @ 1.23650

Stop Loss @ 1.18800

Upside Potential: 400 pips

Downside Risk: 85 pips

Risk/Reward Ratio: 4.71

In the event of a breakdown in the Force Index below its ascending support level, the GBP/CHF is likely to attempt an extension of its sell-off. The next support zone awaits this currency pair between 1.16736 and 1.17370, presenting Forex traders a unique buying opportunity. With the long-term outlook for the British economy distinctly bullish, more downside remains extremely unlikely.

GBP/CHF Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 1.18200

Take Profit @ 1.17000

Stop Loss @ 1.18800

Downside Potential: 120 pips

Upside Risk: 60 pips

Risk/Reward Ratio: 2.00