With trade talks between the EU and the UK set to begin under time pressure to display progress by June, the British Pound is well-positioned to continue its advance. Economic data surprised to the upside, indicating a resilient economy eager to expand. Unlike many central banks expected to ease interest rates in response to Covid-19, the Bank of England is likely to remain on the sidelines, with the next adjustment anticipated to be an increase. The GBP/CAD corrected from a price spike, but a new breakout sequence is pending on the back of a bullish momentum recovery.

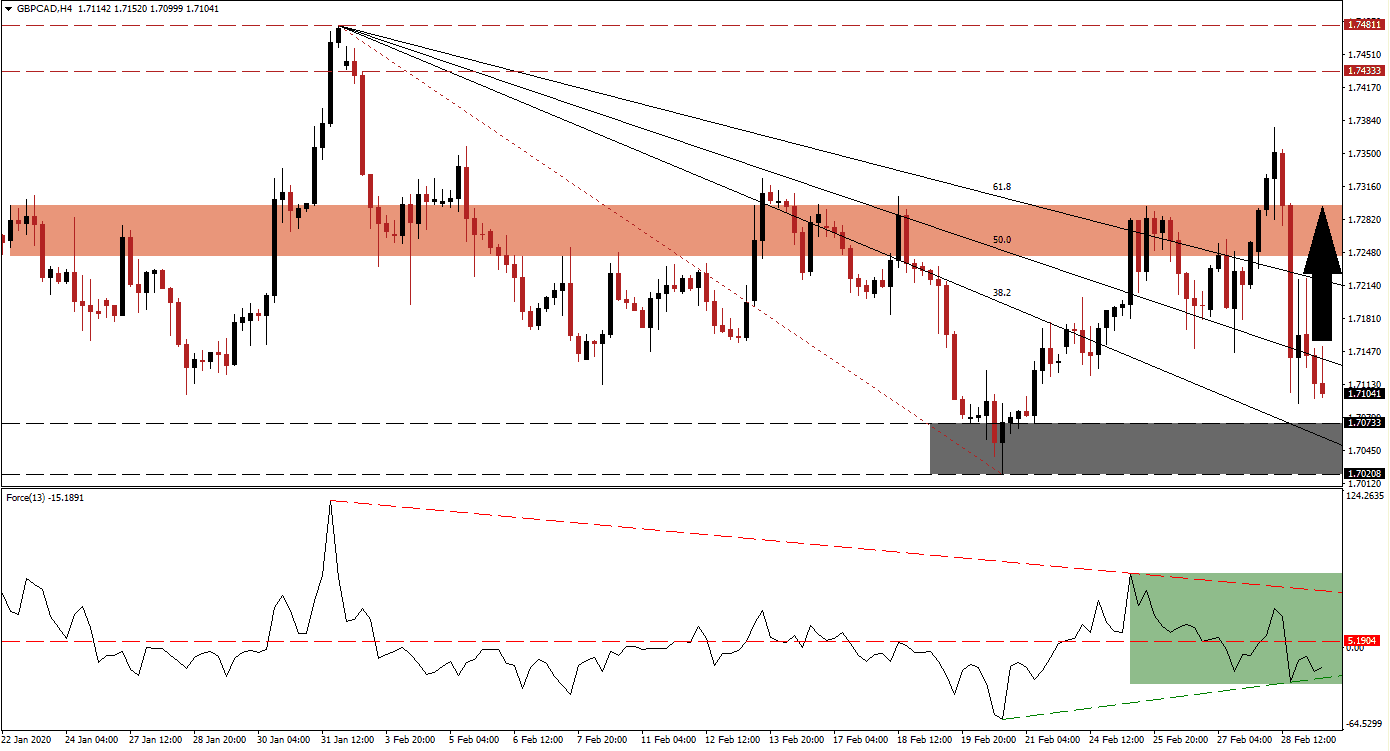

The Force Index, a next-generation technical indicator, stabilized after reaching its ascending support level, as marked by the green rectangle. It is favored to pressure the Force Index above its horizontal resistance level, converting it back into support. Bulls will then retake control of the GBP/CAD with a push into positive conditions. This technical indicator is cleared to advance into its descending resistance level from where a breakout cannot be ruled out.

An end to the correction from current levels will create a higher low, adding to bullish developments in this currency pair. The GBP/CAD is currently positioned above its support, zone located between 1.70208 and 1.70733, as marked by the grey rectangle. The descending 38.2 Fibonacci Retracement Fan Support Level has entered this zone. A move in price action above its 50.0 Fibonacci Retracement Fan Resistance Level is required to end the sell-off and initiate an advance.

While disruptions in the global manufacturing sector are priced into markets, the services sector represents a critical sector to monitor. Weakness in PMI reading will signal more broad-based economic damage from the virus than anticipated. The Canadian economy faces disruptions from strikes and blockades of rail transport by indigenous groups and climate activists, impacting over 25% of Canadian businesses. Therefore, the GBP/CAD is set to challenge its short-term resistance zone located between 1.72466 and 1.72964, as marked by the red rectangle. You can learn more about a resistance zone here.

GBP/CAD Technical Trading Set-Up - Recovery Scenario

Long Entry @ 1.71000

Take Profit @ 1.72950

Stop Loss @ 1.70400

Upside Potential: 195 pips

Downside Risk: 60 pips

Risk/Reward Ratio: 3.25

In the event of a correction in the Force Index below its ascending support level, the GBP/CAD may attempt a breakdown. The downside potential remains limited to its next support zone located between 1.69189 and 1.69409, allowing Forex traders to enter new buy orders. Fundamental developments favor more upside in this currency pair, supported by emerging technical conditions.

GBP/CAD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 1.70100

Take Profit @ 1.69300

Stop Loss @ 1.70400

Downside Potential: 80 pips

Upside Risk: 30 pips

Risk/Reward Ratio: 2.67