Following the second unscheduled interest rate cut by the US Federal Reserve on Sunday before the US futures market opened for trading, the Bank of Canada delivered a second interest rate cut in as many weeks. The benchmark interest rate was lowered by 50 basis points to 0.75%. It also announced more liquidity for markets, with its first C$500 million purchase listed for today in the 30-year bond market. An additional C$7 billion is scheduled for Tuesday in shorter-dated maturities. The GBP/CAD completed a breakout above its support zone, and more upside is possible.

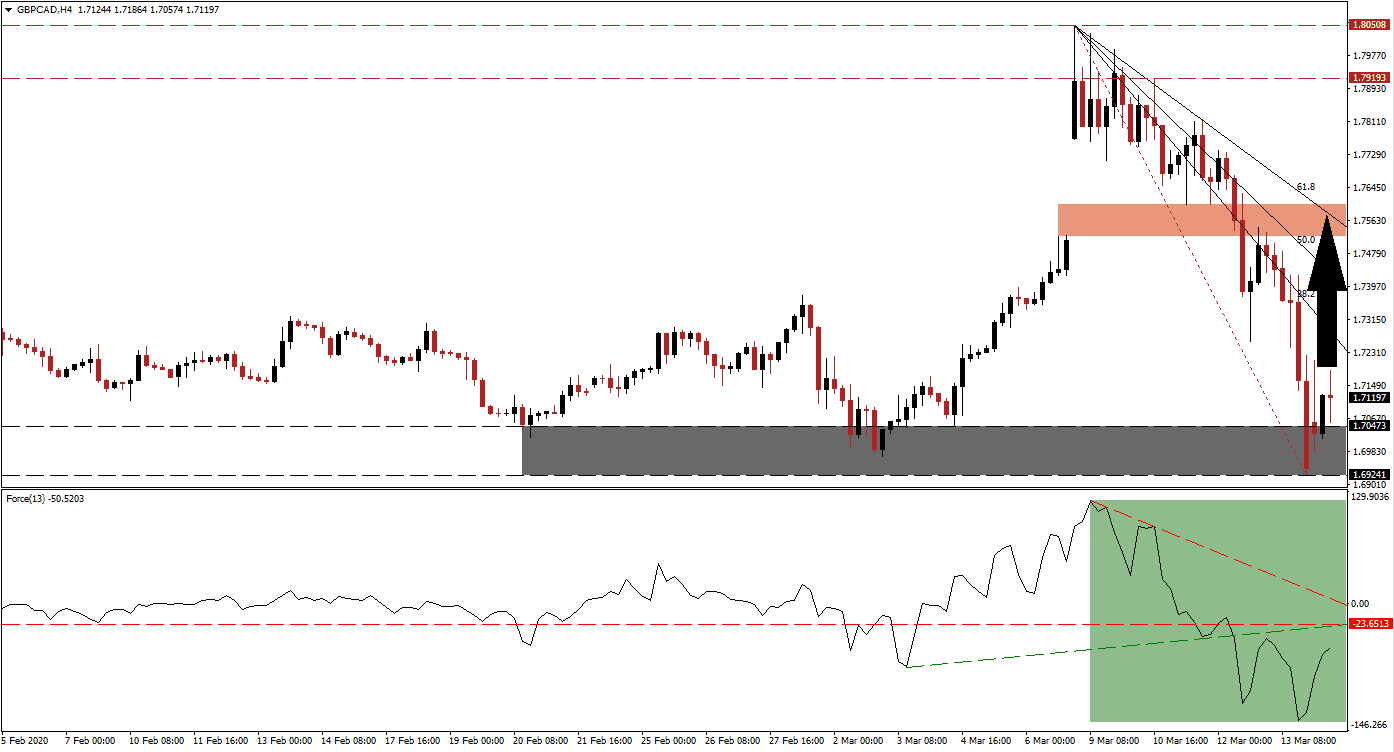

The Force Index, a next-generation technical indicator, points towards a bullish momentum recovery and is now approaching its ascending support level, acting as temporary resistance. A triple breakout is favored to materialize with the descending resistance level closing in on its horizontal resistance level. This technical indicator is well-positioned to spike into positive territory, ceding control of the GBP/CAD to bulls, leading a more massive advance in this currency pair. You can learn more about the Force Index here.

Trade negotiations between the EU and the UK will be impacted by the spread of Covid-19 and its global disruptions. The Bank of England cut interest rates in an ill-advised move last week by 50 basis points to 0.25%, the last one by outgoing Governor Carney. It was delivered in an attempt to boost confidence but added to selling pressure in the GBP/CAD and depleted the central bank’s arsenal. Price action stabilized inside of its support zone located between 1.69241 and 1.70473, as marked by the grey rectangle.

Downside pressure on the GBP/CAD remains in place, provided by its descending Fibonacci Retracement Fan sequence. A short-covering rally is pending after the breakout in this currency pair. Forex traders are advised to monitor the intra-day low of 1.72443, the low before this currency pair collapsed to a lower low. A push higher will elevate it above its 38.2 Fibonacci Retracement Fan Resistance Level and initiate the next wave of net buy orders. It will also clear the path into its short-term resistance zone located between 1.75237 and 1.76020, as marked by the red rectangle.

GBP/CAD Technical Trading Set-Up - Short-Covering Scenario

Long Entry @ 1.71100

Take Profit @ 1.75500

Stop Loss @ 1.69650

Upside Potential: 440 pips

Downside Risk: 145 pips

Risk/Reward Ratio: 3.04

Should the Force Index reverse to the downside, driven lower by its descending resistance level, the GBP/CAD is anticipated to attempt a breakdown. Forex traders are recommended to consider any contraction in this currency pair as an excellent buying opportunity. The fundamental outlook for this currency pair remains increasingly bullish, supported by technical developments. The next support zone is located between 1.67182 and 1.67681.

GBP/CAD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 1.68750

Take Profit @ 1.67500

Stop Loss @ 1.69250

Downside Potential: 125 pips

Upside Risk: 50 pips

Risk/Reward Ratio: 2.50