Trade talks between the EU and the UK are closing the first week with significant differences, a development that was widely expected. The EU insists on the status quo, failing to accept the UK’s exit from the trading bloc and its regulations. After Prime Minister Boris Johnson secured an overwhelming majority in the House of Commons, economic data out of the UK bested EU data consistently in a trend favored to accelerate. The GBP/AUD is well-positioned to extend its dominant bullish trend, enforced by its ascending Fibonacci Retracement Fan sequence.

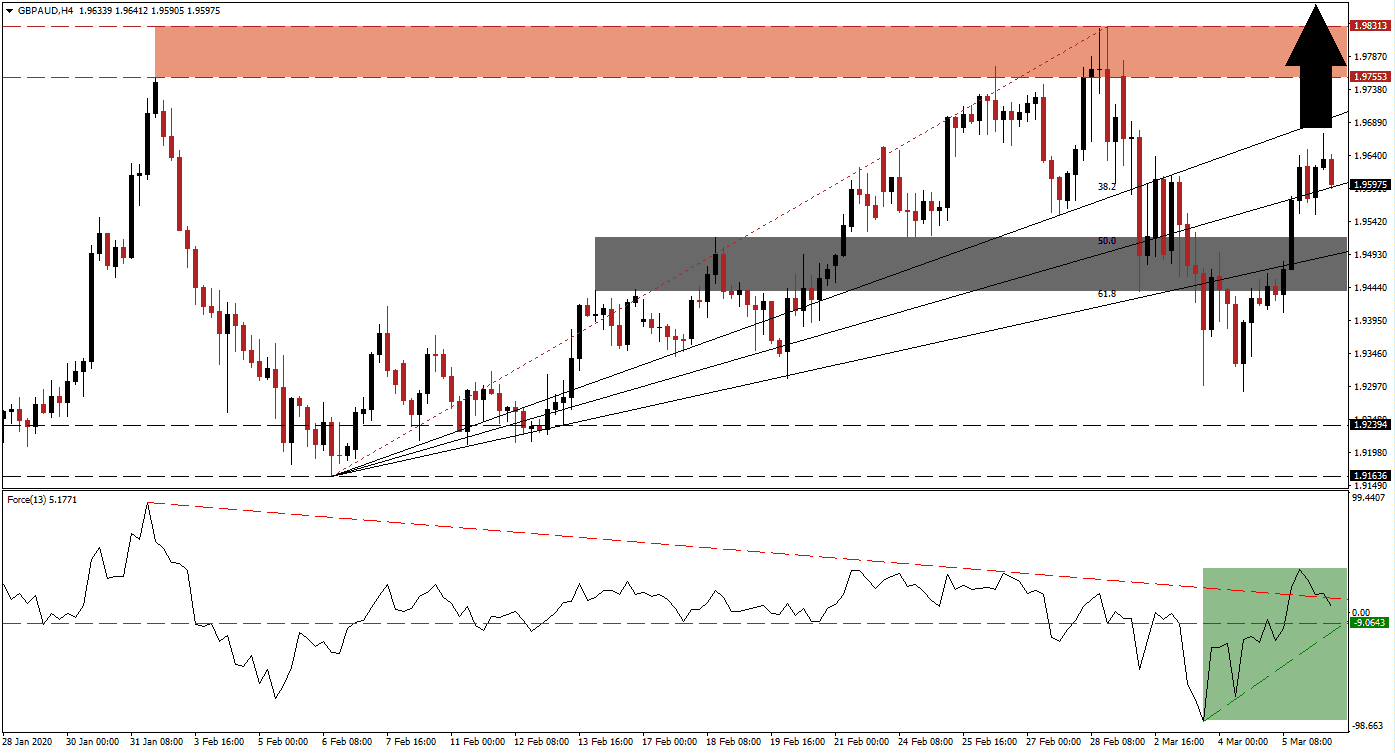

The Force Index, a next-generation technical indicator, contracted to a new 2020 low as this currency pair entered a violent sell-off from its 2020 high. A quick recovery emerged, assisted by the materialization of a new ascending support level. The Force Index converted its horizontal resistance level into support, as marked by the green rectangle, followed by a push above its descending resistance level. This technical indicator has now reversed below it while maintaining its position above the 0 center-line, allowing bulls to remain in control of the GBP/AUD.

Following the most recent sell-off, which took price action briefly below its short-term support zone located between 1.94386 and 1.95177, as marked by the grey rectangle, a higher low was formed. It confirmed the existence of a long-term bullish chart pattern. The 61.8 Fibonacci Retracement Fan Support Level is passing through the short-term support zone, applying steady upside pressure in the GBP/AUD, and limiting downside potential. You can learn more about a support zone here.

Forex traders are advised to monitor the intra-day high of 1.96719, the peak of the current recovery. A breakout is anticipated to attract the next wave of net buy orders in the GBP/AUD, providing a necessary catalyst to push price action above its resistance zone. This zone is located between 1.97553 and 1.98813, as marked by the red rectangle. More upside is likely to follow, taking this currency pair into its next resistance zone located between 2.03420 and 2.05307.

GBP/AUD Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 1.96000

Take Profit @ 2.04000

Stop Loss @ 1.94000

Upside Potential: 800 pips

Downside Risk: 200 pips

Risk/Reward Ratio: 4.00

In case of a contraction in the Force Index below its ascending support level, the GBP/AUD is favored to attempt a breakdown. With an increasingly bullish outlook for the British economy, in conjunction with weakness out of Australia, any push to the downside should be viewed as an outstanding buying opportunity for Forex traders to consider. The next support zone is located between 1.91636 and 1.92394.

GBP/AUD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 1.93400

Take Profit @ 1.91800

Stop Loss @ 1.94000

Downside Potential: 160 pips

Upside Risk: 60 pips

Risk/Reward Ratio: 2.67