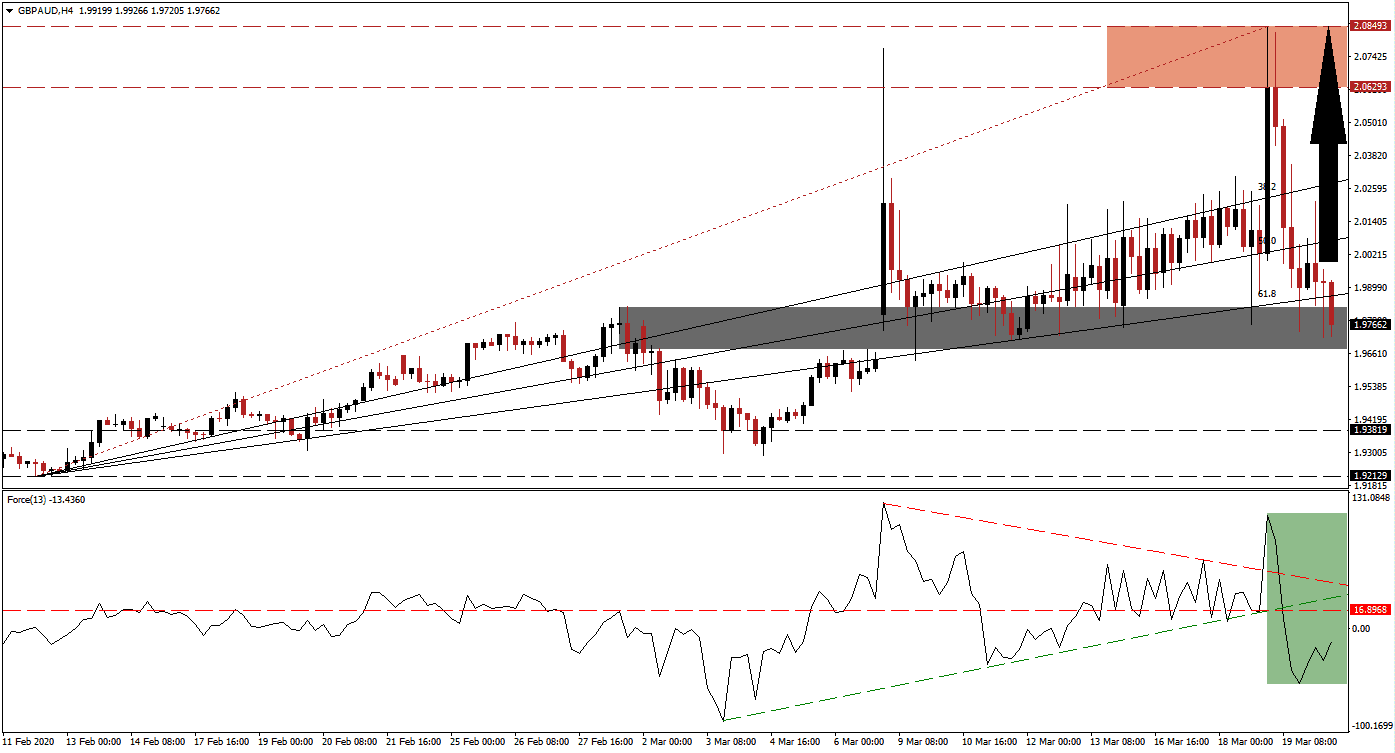

After the Bank of England announced its second unscheduled emergency interest rate cut in March, further reducing the rate by 15 basis points to an all-time low of 0.10%, the British Pound attempted to stabilize. It followed a 25 basis point emergency cut by the Reserve Bank of Australia to 0.25%, also its second reduction in response to Covid-19. The GBP/AUD has collapsed into its short-term support zone following a price spike to a new multi-year high not recorded since January 2016. You can learn more about a support zone here.

The Force Index, a next-generation technical indicator, contracted below its ascending support level, but started to recover, as marked by the green rectangle. A crossover above the 0 center-line is favored to convert its horizontal resistance level into support, placing bulls in control of this currency pair. Price action can then reclaim its ascending support level, extending its recovery above its descending resistance level. It is expected to lead the GBP/AUD into a reversal.

This currency pair experienced a significant price spike and retracement into its short-term support zone, nine trading sessions ago, before continuing its long-term advance. The same conditions are present to allow the GBP/AUD to repeat the same pattern. This zone is located between 1.96736 and 1.98290, as marked by the grey rectangle. It includes a previous price gap to the upside. The People’s Bank of China decided to keep its interest rates unchanged, surprising markets, and adding bearish pressures to the Australian Dollar.

Volatility is favored to remain elevated, but the GBP/AUD is well-positioned to retake it ascending 61.8 Fibonacci Retracement Fan Resistance Level, converting it into support. The entire Fibonacci Retracement Fan sequence has crossed above the short-term support zone, making a push into it vital to the survival of the uptrend. This currency pair is favored to accelerate back into its resistance zone located between 2.06293 and 2.08493, as marked by the red rectangle. A new fundamental catalyst is necessary to force a breakout.

GBP/AUD Technical Trading Set-Up - Price Action Reversal Scenario

Long Entry @ 1.97700

Take Profit @ 2.07700

Stop Loss @ 1.95500

Upside Potential: 1,000 pips

Downside Risk: 220 pips

Risk/Reward Ratio: 4.55

Should the Force Index reverse, pressured to the downside by its descending resistance level, the GBP/AUD is vulnerable to a breakdown. The next support zone awaits this currency pair between 1.92129 and 1.93819. Forex traders are advised to view this as an outstanding opportunity to enter new net buy orders on the back of a long-term bullish fundamental outlook.

GBP/AUD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 1.94700

Take Profit @ 1.92900

Stop Loss @ 1.95550

Downside Potential: 180 pips

Upside Risk: 80 pips

Risk/Reward Ratio: 2.25