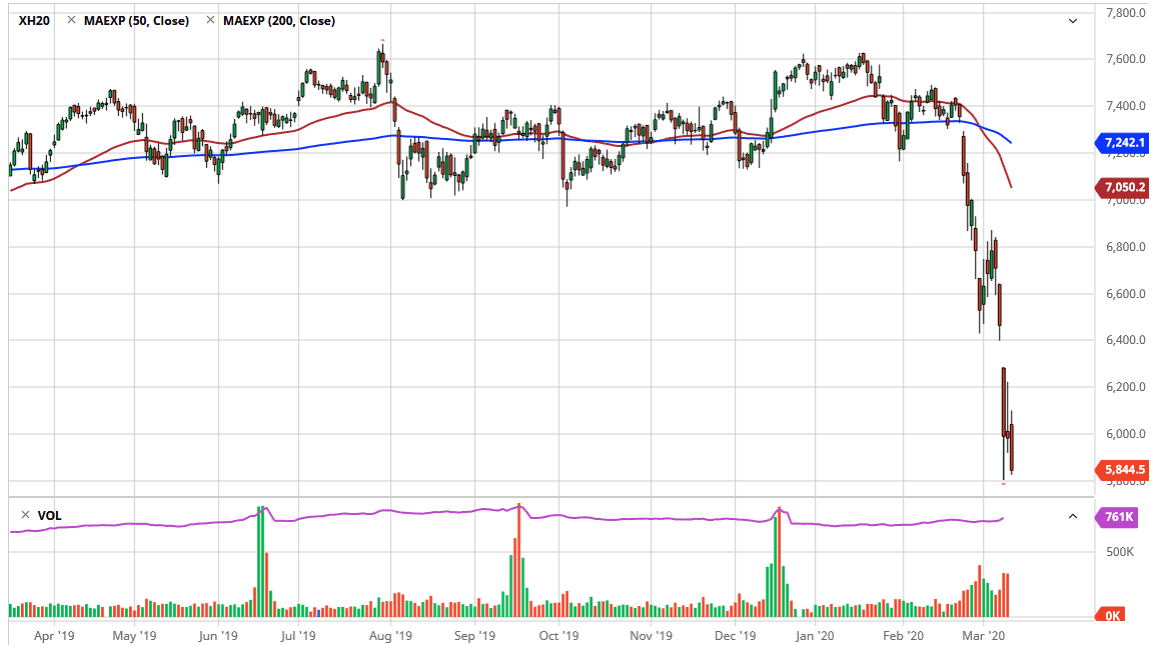

The FTSE 100 initially tried to rally during the trading session on Wednesday but broke down below the 6000 level as the futures market simply cannot hang on to gains. This makes sense, considering that the Bank of England has cut rates by 50 basis points, not so much in a bid to stimulate the economy, but more or less as a preventative measure. As coronavirus continues to rip through the world, there are a lot of concerns about the global economy, and of course Great Britain won’t be spared any of this.

The British have released a budget for the upcoming year, which originally would have been some type of remedy for Brexit, but at the end of the day coronavirus is by far the biggest issue. With the gap that we had formed a couple of days ago, it’s clear that the bearish pressure continues, and I think that it’s only a matter of time before rallies get sold into, with a gap extending all the way to the large, round, psychologically significant 6500 level. Any signs of weakness will be jumped upon, as there is no real way to price risk at the moment.

After all, looking around the world the one thing that we do understand is that the market is going to have to figure out exactly how much economic damage is done by people not meeting in large crowds, and perhaps not going to work. In other words, this could be disastrous. Granted, it’s not the end of the world nor is it the apocalypse but it certainly will run for quite some time. The economic damage will be lasting much longer than the actual virus itself, as there will be a bit of a lag when it comes to any type of recovery.

Ultimately, this is a market that will continue to see a lot of volatility and I do believe at this point rallies are not to be trusted. However, if we were to close above the 6500 level then it suggests that the market is changing trends again. I don’t anticipate seeing that in the short term so more than likely we will get exhaustion candles on bounces, and most certainly follow through on a move lower if we break down below the 5800 level. The FTSE 100 futures market is going to follow the rest of the world stock markets much lower.