The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases, it will be trading the trend. In other cases, it will be trading support and resistance levels during more ranging markets.

Big Picture 1st March 2020

In my previous piece last week, I forecasted that the best trade was likely to be long of Gold in AUD terms. Over the week, Gold in AUD terms unfortunately declined by 1.75% so this was a losing trade.

Last week’s Forex market saw the strongest rise in the relative value of the Japanese Yen, and the strongest fall in the relative value of the Australian Dollar.

Fundamental Analysis & Market Sentiment

The last week has seen a sharp change of market focus and sentiment, as the coronavirus spread out from China and began to infect people in other countries, threatening a pandemic. While fatality rates do not seem to be especially high, the fear of economic damage which has been and will be caused by quarantines has sparked the strongest weekly fall in global stock markets seen since the financial crisis of 2008. Almost all stock markets have seen their benchmark indices fall by more than 10% from recent peaks, and the S&P 500 Index has now closed the past two days below its key 200-day moving average.

The strong risk-off environment has boosted safe haven currencies while hitting risky currencies and other assets hard. The primary beneficiaries of this flow have been the Japanese Yen, the Swiss Franc, and the Euro. Interestingly, precious metals and the U.S. Dollar seem to not be benefiting from the flow anymore. This is partly caused by a growing fear that the coronavirus will have such an impact upon economic growth and stock prices that central banks, especially the Federal Reserve, will be forced to loosen monetary policy still further. This feeling is falling most heavily on the USD at present, which is weakening it.

Risky assets such as the commodity currencies, crude oil and stocks are of course falling, with the Australian Dollar the primary currency victim. This is due to the Aussie’s strong exposure to far eastern economies especially China, but the Australian Dollar was already weak anyway without the coronavirus.

The Japanese Yen has been surprisingly strong considering how exposed Japan seems to be to the coronavirus.

Sentiment on the British Pound has soured as it is appearing less likely that the E.U. and the U.K. will be able to agree a positive trade deal by the end of 2020.

It seems clear that everything will now depend upon whether the spread of the coronavirus is contained or not. If it is, we will probably see a strong rebound in stock markets. If it is not, we will see further flight to safety. It is unlikely this question of the virus will be resolved within days, so we can probably expect at least a few weeks of market turbulence and high volatility.

Technical Analysis

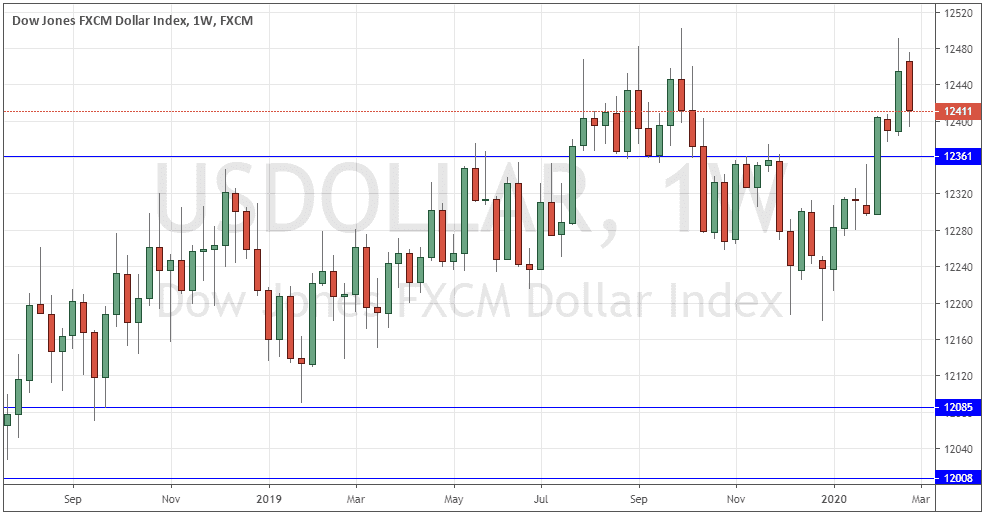

U.S. Dollar Index

The weekly price chart below shows last week printed a normal-sized bearish inside candlestick which closed down not far from the low of its range. It is above its price from 3 months ago but below its price from 6 months ago, suggesting a lack of trend, although a wider look at the price chart below suggests that there is still a very weak, slow, choppy bullish trend persisting. Overall, there is no decisive technical evidence suggesting it is worth trying to forecast next week’s price movement, which looks very uncertain. Sentiment is certainly against the USD and this is likely to persist until the coronavirus threat lifts or the Federal Reserve makes a rate cut.

AUD/JPY

The AUD/JPY currency cross just made its lowest weekly close in approximately eleven years. The weekly candlestick was very large and closed within the lower third of its price range. These are all bearish signs, and the price looks likely to fall further over the coming week, with the AUD clearly the weakest and the JPY clearly the strongest currency in this risk-off market environment.

WTI Crude Oil

WTI Crude Oil has been falling quite strongly due to the reduction in demand caused by the coronavirus slowdown which has particularly affected a China, a large consumer of crude oil.

The weekly price chart below shows that the price has reached an area of long-term lows at around $42.50 per barrel. We might either see a strong breakdown from here, or a reversal if it becomes apparent that the virus looks likely to be contained.

Conclusion

This week I forecast the best trade is likely to be short of the AUD/JPY currency cross.