In the beginning of this week's transactions, we noticed violent price gaps, amid increasing global fears of a growing Corona spread, which paves the way for a global economic recession that no one is excluded from. The US dollar was the most prominent loser in the Forex market. The EUR/USD price succeeded in having a strong rally, pushing it to the 1.1496 resistance, the highest level since January 2019. Profit taking operations pushed the pair to correct at the 1.1365 level, but soon it returned to rise strongly to the 1.1455 resistance area at the time of writing, which confirms the strength of the bulls control over the performance for the long term.

The single European currency ignored the widespread outbreak of the epidemic in many countries of the Union, most notably Italy, France and Germany. Whereas, the biggest concerns are about the state of the US economy if it is exposed to what the Chinese economy was exposed to.

The Italian government, with almost the same measures as China, have isolated millions of people, stopped studying and banned gatherings and events, in a bid to further prevent the outbreak. The French government has also stopped work in hundreds of schools suspected of being close to disease hotspots, as infected cases exceeded 111,000 people around the world, and is now closer to killing 4,000 people. It has spread to 90 countries around the world since the epidemic crossed the borders of China, the source of the deadly virus as.

On the economic side. Eurozone investor sentiment was significantly weakened in March, reflecting fears of a global economic recession amid the spread of the Coruna virus, or COVID19. Therefore, the Sentix Research Institute announced that the investor confidence index fell to a reading of -17.1 in March from 5.2 in February. The drop was by 22.3 points, the steepest monthly drop since the survey's was launched. The last reading was the lowest since April 2013.

Global stock markets are still subject to more severe losses in light of fears of a global economic recession that exceeds the global financial crisis 2008-2009. International oil prices suffered from the worst percentage losses since the beginning of the Gulf War in 1991.

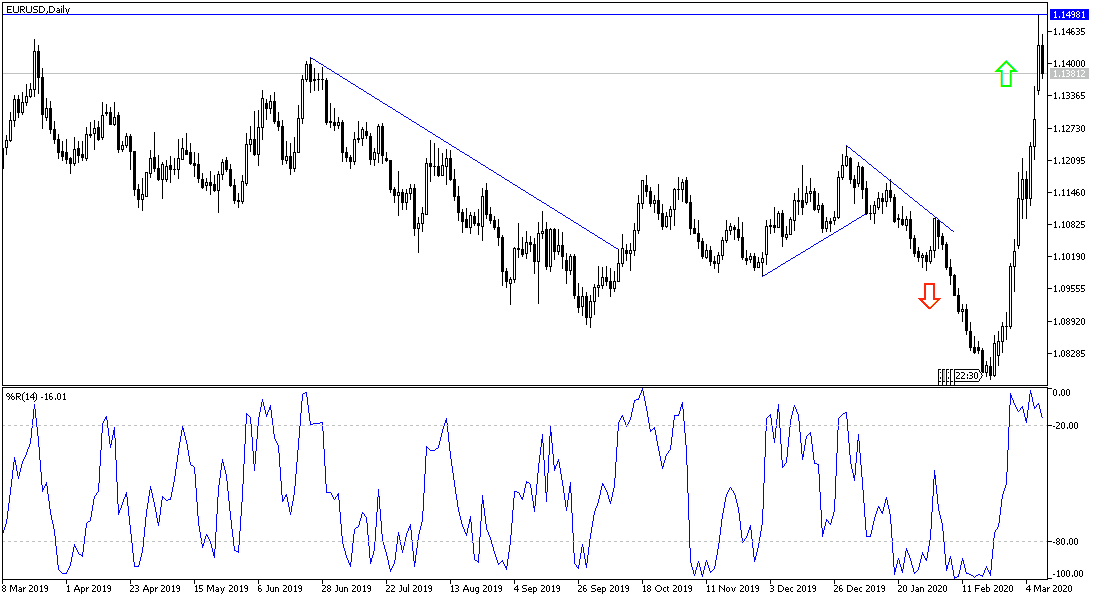

According to the technical analysis of the pair: On the daily chart, the general trend of the EUR/USD pair remains upward, and interest in the Euro may remain more than the dollar in the current period, until the European Central Bank announces its monetary policy on Thursday, amid market expectations that the bank will move in the same direction as the global central banks, by announcing stimulus plans to support the European economy in facing the risks from the Corona virus. Resistance levels 1.1520, 1.1600 and 1.1685 could be easy targets for bulls in upcoming trading sessions. Bears will not have new control over performance without returning to the 1.0900 support.

As for the economic calendar data today: For the second day in a row, the agenda has no important American economic data. From the Eurozone, French industrial production and the bloc's gross domestic product growth rate will be announced, along with the change in employment.