A strong setback for the US dollar against most other major currencies during last week's trading, influenced by the recent weak economic data and the massive financial stimulus of the US government worth 2 trillion dollars. This supported stronger gains for the EUR/USD, with gains reaching the 1.1147 resistance, the highest level for two weeks, and closed the week's trading near that level. A new attempt by the pair to reverse the trend. US President Donald Trump signed the stimulus law designed to respond to the economic repercussions of the Coronavirus epidemic after the House of Representatives voted to approve it this afternoon.

The vote was taken by the House of Representatives after the unanimous approval of the House of Representatives last Wednesday evening. Details of the massive stimulus plan include a total of $250 billion in direct payments to individuals and families, $350 billion in small business loans, $250 billion in unemployment insurance benefits and $500 billion in loans to troubled companies.

The legislation is supposed to provide direct payments of $1,200 for individuals who make $75,000 annually, $2,400 for couples making $150,000 and an additional $500 per child. It is also reported that the bill includes $130 billion to finance hospitals, in addition to $150 billion for state and local governments.

The US dollar index DXY fell to 98.27, giving up almost 1.1% from the previous close.

In terms of economic data: Data from the University of Michigan showed that consumer sentiment in the United States deteriorated far more than preliminary estimates in March. Where the consumer confidence index for March recorded a reading to 89.1 from the initial reading at 95.9. The consumer confidence index has now fallen sharply from the February final reading at 101.0, reflecting the fourth largest monthly drop in almost half a century. The Commerce Department report showed that personal income rose 0.6% in February, in line with the increase seen in January. Economists had expected income to rise 0.4%. Meanwhile, personal spending rose 0.2% for the second month in a row, in line with expectations.

According to a report released by the Labor Department, US jobless claims increased to 3,283,000 in the week ending March 21, up by more than 3 million. Economists had expected jobless claims to rise to about 1.5 million from the 281,000 announced the previous week.

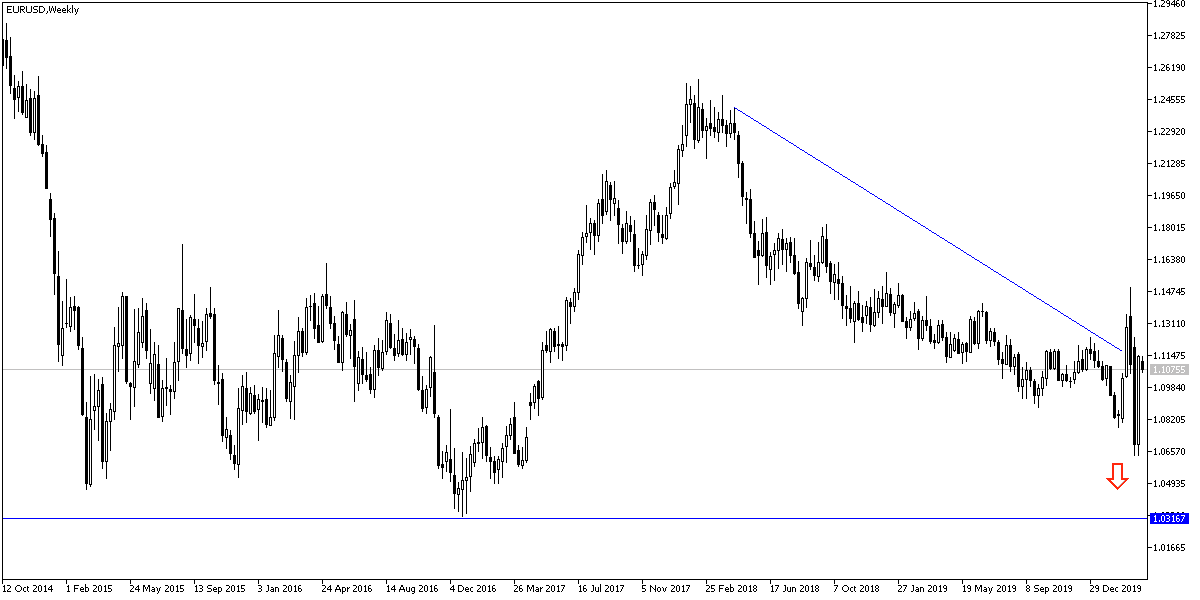

According to the technical analysis of the pair: On the daily chart, and according to the performance of technical indicators, the EUR/USD pair reached the overbought areas, and therefore it is possible to correct via sales operations soon, especially if the numbers received from Europe were worse with the losses from the Corona epidemic, especially from Italy. The closest resistance levels are now at 1.1185, 1.1330 and 1.1500, respectively. Bears may gain control of the performance again if the pair returned to move towards support levels 1.1065, 1.0980 and 1.0880, respectively. On the long term, the pair is still suffering from a great downward pressure, according to market sentiment. The pair became very volatile recently but is still trading within a declining channel.

As for the economic calendar data today: From the Eurozone, the German consumer price index and the Spanish consumer will be announced. And from the US, pending home sales numbers will be released.