For the fifth straight day, the EUR/USD pair continues to correct for gains that reached the 1.0933 resistance, where it is stable at the time of writing, amid a record and historical stimulus to the American economy to face the economic shock of the fatal Corona pandemic, which increased the optimism of investors after suffering heavy losses since the beginning the crisis. Investors welcomed a US $2 trillion government economic aid package worth about 10% of gross domestic product and aimed to help companies and families overcome the effects of the coronary virus that disrupts business and personal income. This was decided before the German parliament approved a package of 750 billion Euros, and as the markets absorbed the results of a meeting between Eurozone finance ministers and central bankers, a European financial response was discussed.

So far, Brussels' response to the Corona Virus crisis has been limited to a 37 billion Euro spending package, or the easing or removal of rules that could prevent the disease from being contained, alongside the European Central Bank actions, although this is changing rapidly, and broader and unprecedented efforts can be made now, which are to be agreed within days. Discussions and price movement took place as most European countries entered into "harmful" economic "insurance" in an attempt to limit the spread of the disease. The Coronavirus is causing an economic downturn that has already caused the biggest change to the Crisis Kit. The United States this week adopted “helicopter money” to support families.

Eurozone heads of state have not yet agreed to issue so-called “Corona bonds,” which represents a long jump from financially fragmented Europe to the point where the monetary union meets the financial union, but some measures were agreed by the finance ministers on Tuesday which may be signed at the European Council meeting on Thursday. The agreement aims to allow the use of a crisis-fighting fund that provides up to 2% of GDP in mutual underwriting financing for Eurozone members whose companies and families - entire economies - have been besieged by the coronavirus.

European Commission President Ursula Von Der Lin and European Central Bank President Christine Lagarde have called, among others, for the issuance of joint debts called "Corona Bonds" to increase the European Union's response to the epidemic and to help support weak countries with little space to borrow and spend. The idea, which has since been debated among member states and in the market, gives more hope that a fragmented European financial space may soon be associated with everyone's response to the crises, which will have long-term and significant implications for Europe's economies and currencies.

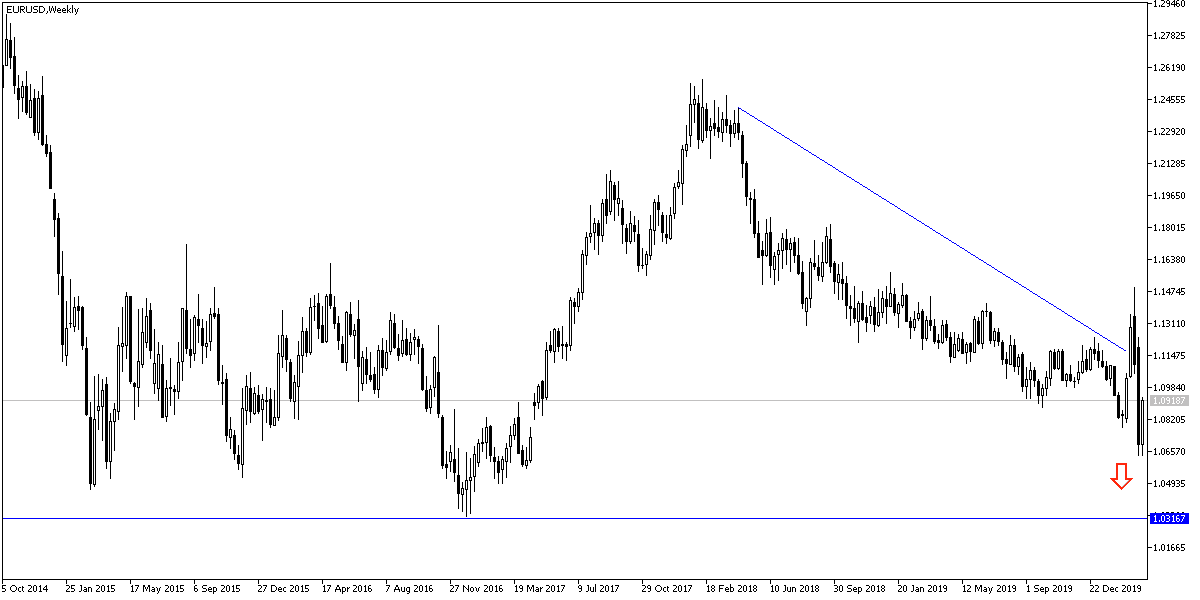

According to the technical analysis of the pair: The general trend of the EUR/USD pair remains downward, even after the last performance, and there will be no chance for the pair to reverse this trend without moving towards the resistance levels 1.1040, 1.1120 and 1.1230, respectively. The continuation of the move below the 1.1000 resistance level still supports the bear's control. In general, the varied economic performance and monetary policy between the United States of America and the Eurozone will continue to support the sales of the pair from each upper level.

As for the economic calendar data today: the German consumer climate GFK will be announced, then the monthly report from the European Central Bank. During the American session, the most important announcement will be the U.S GDP growth rate, then weekly jobless claims.