In light of a temporary pause in the recent US dollar gains, the EUR/USD pair got a momentum towards the 1.0888 resistance, but the pair soon retreated strongly to the 1.0730 support and from there to stability around 1.0820 at the time of writing, with the continued pressure on the European single currency due to the rapid spread of the deadly Corona virus, Europe has become a hotbed that outreached China, the source of the primary epidemic. Recent actions by the US Federal Reserve with unlimited purchases were against dollar gains. This is while German politicians are talking about stimulus plans to deal with the epidemic. Investors sold the dollar on Tuesday after China said it would left its “closure” of its people in Hubei Province, and some European countries reported a second consecutive drop in the number of new cases of coronavirus despite increased tests, giving markets hope that the killer pneumonia was under Control in some of the most affected areas to date. This has raised the price of the Euro against the dollar from the lowest levels experienced last week.

Unprecedented actions by the Federal Reserve halted strong dollar gains for two weeks in a row. As these measures crush American yields, increase the supply of the dollar and reduce the attractiveness of the currency to investors. Meanwhile, European efforts to limit the spread of the coronavirus have shown signs that they are beginning to pay off.

In the recent past, the Euro lost its previous rise of 6% against the dollar after investors disposed of all financial assets in light of a sharp decline in liquidity in the financial markets, with the dollar being the global reserve currency, and therefore was the best performer in the current period. Coronary virus outbreak of in the United States is gaining momentum and thus pressuring the dollar, and in return, the policy of tight closure of the movement of citizens in Italy, France and Spain is beginning to pay off.

To stimulate the European economy, German Finance Minister Olaf Scholes told Bild on Tuesday that the government would likely spend large sums to push the economy forward once the coronavirus was contained. This comes after getting rid of the "debt braking" that has continuously prevented targeted government borrowing, and in order to facilitate a large aid package, it will see the provision of 150 billion Euros to troubled companies and families, along with hundreds of billions of more provided in debt guarantees.

European stimulus may be enough to influence expectations for the European Union and the United States. The economic growth difference is in favor of the Euro, especially if the US strategy to contain coronavirus prolongs the fight against it. On Monday, the White House suggested that it wanted to "reopen the economy" in two weeks, while the United States saw its largest one-day increase in new infections with the Coruna virus. Meanwhile, lawmakers in Congress again failed to agree a package of aid for American companies and families, which could worsen the already serious situation of the US economy.

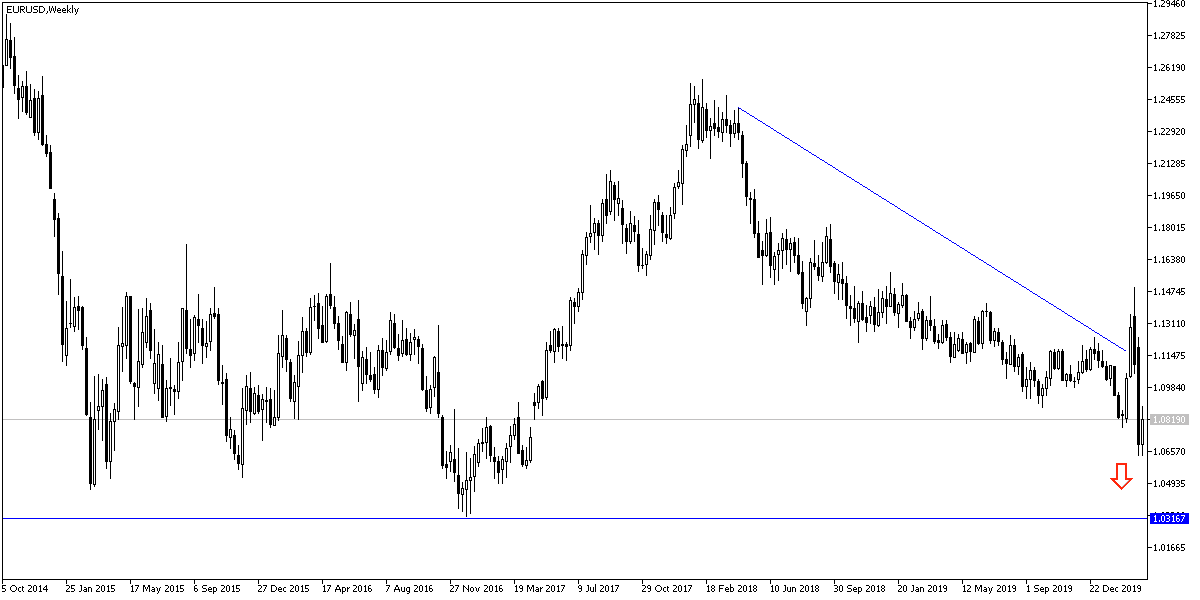

According to the technical analysis of the pair: Despite the EUR/USD attempts to rebound upwards, the general trend is still bearish, and gains may remain new selling targets. The nearest resistance levels are now at 1.0830, 1.0900 and 1.1040, respectively. At the same time, its stability below the 1.0800 psychological support will continue to support the bear's control. On the daily chart, there have been no signs of breaking the violent bearish channel recently. Investors are ignoring the technical indicators reaching strong oversold areas. All focus is on the economic shock of the Corona epidemic and how to respond to it.

As for the economic calendar data: IFO will announce the German business climate. From the United States, durable goods orders and crude oil stocks data will be announced.