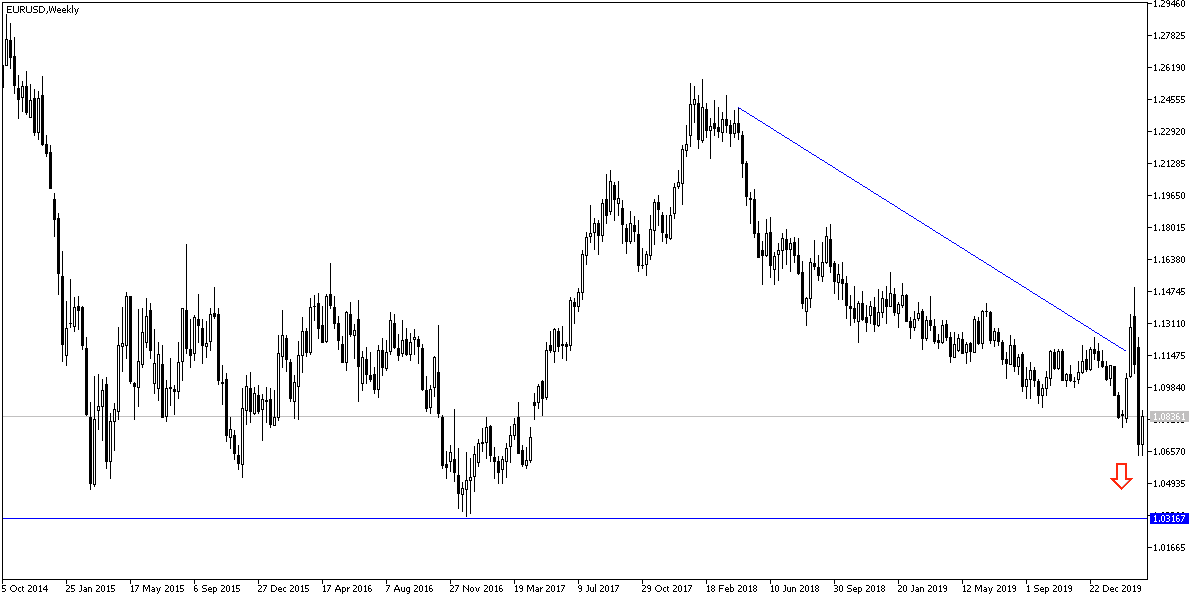

Today, investors' attention will turn to the announcement of the readings of the purchasing managers' index for the industrial and services sectors of the Eurozone economies, to decide the extent of their vulnerability to the spread of the deadly Corona epidemic within European countries, most notably Italy. Prior to the important data, the EUR/USD pair tried to correct higher, but gains did not exceed 1.0822 after its recent losses, which pushed the pair towards the 1.0635 support, the lowest level since April 2017. The demand for buying the US dollar increased by investors and markets in light of the continuous efforts On the part of the US Federal Reserve and the Trump administration to stimulate the US economy from the consequences of Corona virus. The Federal Reserve is helping companies and individuals pay their bills and survive a devastating crisis.

With lending in the treasury and mortgage markets threatening to close, the Federal Reserve announced a host of robust programs on Monday in an effort to calm these markets. To do this, the bank committed to buy as much government-supported debt as possible. For the first time ever, the Fed said it was planning to buy corporate debt as well.

The Fed’s intervention aims to ensure that families, companies, banks and governments get the loans they need while their income dries up quickly as the economy stops. And the comprehensive efforts made by the Federal Reserve to support the flow of credit through the economy that has been devastated by the epidemic so far, exceeded the extraordinary campaign it had made to save the economy from the 2008 financial crisis.

"The coronavirus epidemic causes tremendous suffering to the United States and the whole world," the Fed said in its statement. "Aggressive efforts must be made across the public and private sectors to reduce job and income losses and promote a rapid recovery once the unrest fades," he added. Through its new programs, the Federal Reserve, led by Jerome Powell, is trying to stabilize the economy and calm panic in financial markets. With the need for cash increasing between many companies and city and state governments, large companies were benefiting as much as possible from existing borrowing relationships with banks.

US stock markets did not benefit much from the bank's announcement and continued to decline and appear to be awaiting congressional approval of a $ 2 trillion bailout package.

According to the technical analysis of the pair: Despite the EUR/USD rebound attempts, the general trend is still bearish, and as long as it is stable below the 1.1000 level, bear’s control remains stronger. The pair is still subject to further losses in the event of increased numbers of infections and deaths due to the Corona epidemic within Europe, and things got out of control, today’s economic figures were less than expected. The next bear targets may reach 1.0735, 1.0660 and 1.0545, respectively. The US stimulus in the face of the crisis is much stronger than what the Eurozone is doing, so the demand for the dollar may remain stronger for a while.

As for the economic calendar data today: The focus will be on the PMI readings for the industrial and services sectors of the Eurozone economies. From the United States, industrial and services PMI’s, and new home sales data will be released.