For seven consecutive trading sessions, the EUR/USD pair is trading in the range of a declining channel driven by the strong demand the US dollar after the recent Federal Reserve Bank decisions that stimulate the American economy in the face of a possible economic recession, with the Corona outbreak in all the American states. The pair fell to the 1.0800 psychological support, its lowest level in a month. Before stabilizing again around the 1.0910 level at the time of writing, after a sudden rebound to the 1.0981 level after new decisions from the European Central to stimulate the European economy. The risk evasion has increased investor appetite for the US currency and safe havens such as the yen and the Swiss franc, as investors continue to seek more liquidity.

The Euro appreciated against the dollar by 6% during the first trading sessions of March, as investors liquidated the bets on risk assets and then repurchased the Euro as a financing currency. In recent times, the single European currency fell sharply as it faced bad expectations, as some analysts expect growth to decrease by -24% in the second quarter, amid the outbreak of the deadly Corona epidemic in the bloc countries led by Italy. Even before the virus first appeared in Chinese Wuhan, the European economy was markedly weak due to the prolonged global trade war, and since then, three of the four largest economies in the Eurozone have entered a strict form of "closure" to prevent more casualties.

German Chancellor Angela Merkel said on Wednesday she was open to using "joint debt issuance" to tackle the economic repercussions of the virus, an old objection that has dragged on for a long time, if not preventing debt relief in the Eurozone. This has severely affected the bloc's economic performance since the 2011/12 debt crisis.

At the same time, any decision to proceed with the "issuance of joint debts", whether intended or not, would be a step towards a "fiscal union" to match the "monetary union" that was in preparation long before the official launch of the Euro in 1999. The absence of such a financial union, or risk-sharing mechanism, is widely referred to as an essential factor in the weakening of chronic economic performance in the Eurozone as it is now.

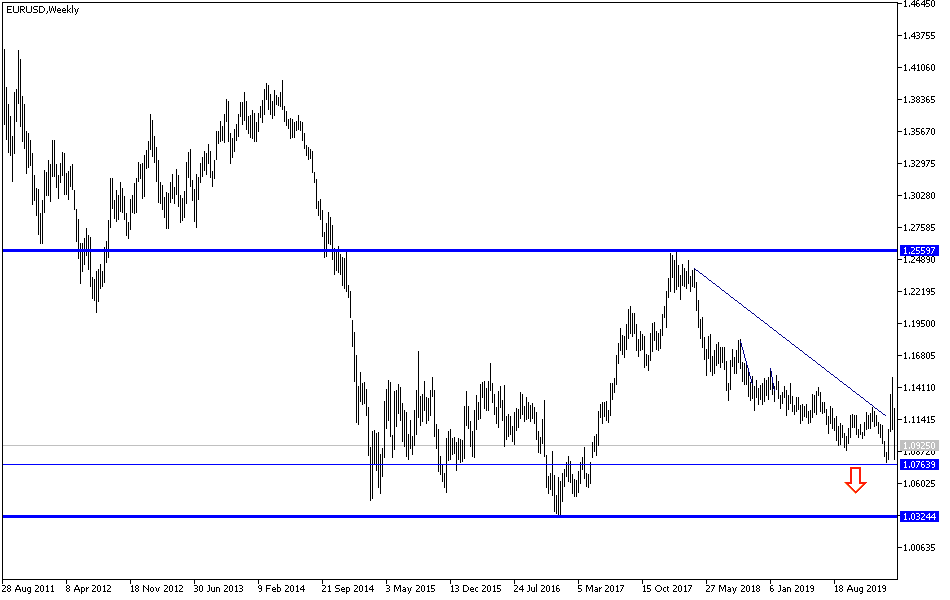

According to the technical analysis of the pair: Bears dominate the performance of the EUR/USD pair on the daily chart, and tested the 1.0800 psychological support. This confirms the reversal of the general trend to a downward trend after strong optimism about its gains last week. Continued concern about the future of global economic growth due to the Corona outbreak will continue to be a factor for pressuring the Euro in case it moves to return to achieve gains. Without a return to the 1.1160 resistance level and stability above it, there will be no chance of an upward correction.

As for the economic calendar data today: The focus will be on the US economic data; the Philadelphia Industrial Index, the unemployed claims and the current account.