The Euro has been all over the place during the Monday session, as the Federal Reserve has suggested that it was going to expand quantitative easing yet again. The market tested the lows from the Friday session, and then turned around and rocketed straight up in the air when it was announced that the Federal Reserve was going to be buying corporate bonds, and mortgage-backed securities again. In other words, quantitative easing is about to go parabolic again. That being said though, the market is likely to see a lot of back and forth going forward, and I do believe that it’s only a matter of time before the market find sellers again due to the fact that the US dollar is still highly favored overall.

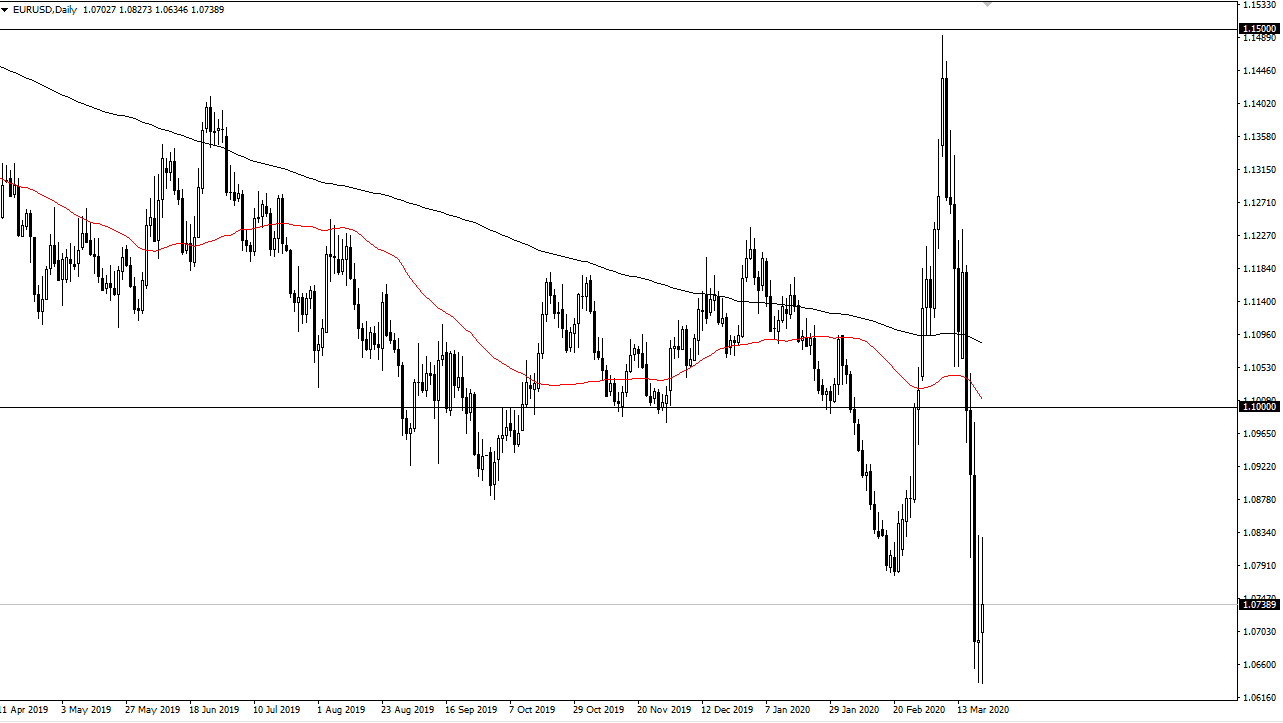

The Euro of course is going to continue to struggle due to the fact that the European Union is going to continue to struggle due to the coronavirus, and of course the situation in Italy has been so difficult. Ultimately, the Euro tried to rally significantly but then gave back over 100 pips by the time Wall Street was done. That being the case, the market is likely to continue to be very noisy and it’s obvious to me that there are a couple of areas that could cause some issues. The 1.08 level is an obvious area, and then again at the significant 1.10 level after that.

If we were to break above the 1.10 level, then it could be rather explicit to the upside, but it’s going to be quite difficult to break above there. Judging by the way that the Euro has rolled over, it’s very likely that we continue to go lower over the longer term. The 1.05 level underneath will be a target, and then if we were to break down below that level it’s likely that we could go down to parity given enough time. It doesn’t seem believable, but then again, I could have said the same thing about the Euro dropping down to the 1.10 level several months ago. With this, it looks like the pain for the Euro continues and doesn’t seem to have an end in sight. Even with the Federal Reserve doing quantitative easing, it doesn’t look like traders are willing to jump into the EU at this point and therefore I think we see more of the “fade the rally” attitude going forward.