The Euro has been very difficult to trade over the last couple of days because quite frankly although it has been bullish during most of the time, it keeps pulling back rather rapidly. This shows just how confused the market is right now when it comes to the greenback, as the US dollar continues to be in high demand but at the same time the Federal Reserve is starting to throw tons of quantitative easing into the market. Because of this, the Euro continues to find a bit of a bid, but the European Union is a complete basket case at this point. The rally probably has more to do a short covering than anything else.

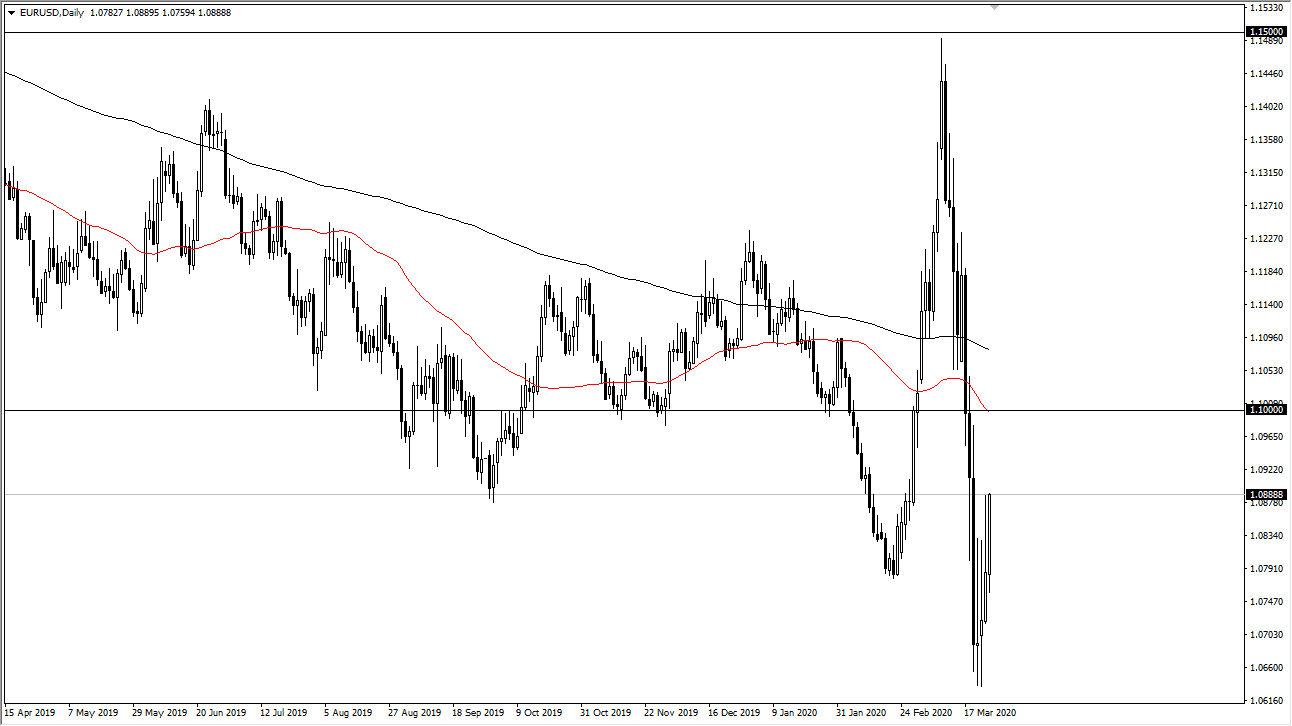

I do believe that the market breaking to the upside probably has the Euro looking at the 1.10 level as the next battleground. I think selling their makes quite a bit of sense as market participants will pay attention to these large, round, psychologically significant figure levels as a bit of a guideline. I just don’t see this scenario for the Euro to suddenly take off to the upside and more importantly, keep those gains. After all, just a couple of weeks ago the thing was going straight up in the air, only to collapse again.

There are entire parts of the European Union that seem to be completely shut down at this point, most notably Italy. In that environment, economic growth is going to come to an absolute standstill. Furthermore, the European Union had a lot of issues going into this crisis, so one would have to think that things are only getting worse.

All of that being said, the candlestick for the trading session was pretty impressive, so it does suggest that we have a little bit more follow-through to the upside coming. Short-term traders may wish to take a long position to aim for the 1.10 level, but I do expect a lot of resistance in that general vicinity. At this point, if we get some type of exhaustion candle in that region, I am more than willing to start selling because it makes sense based upon the longer-term trend. However, with the noise that we have seen it’s important to keep your position size relatively small, because the volatility has been so over the top. We are jumping around based upon the latest headline, so therefore keeping your trading account safe is your most important job right now.