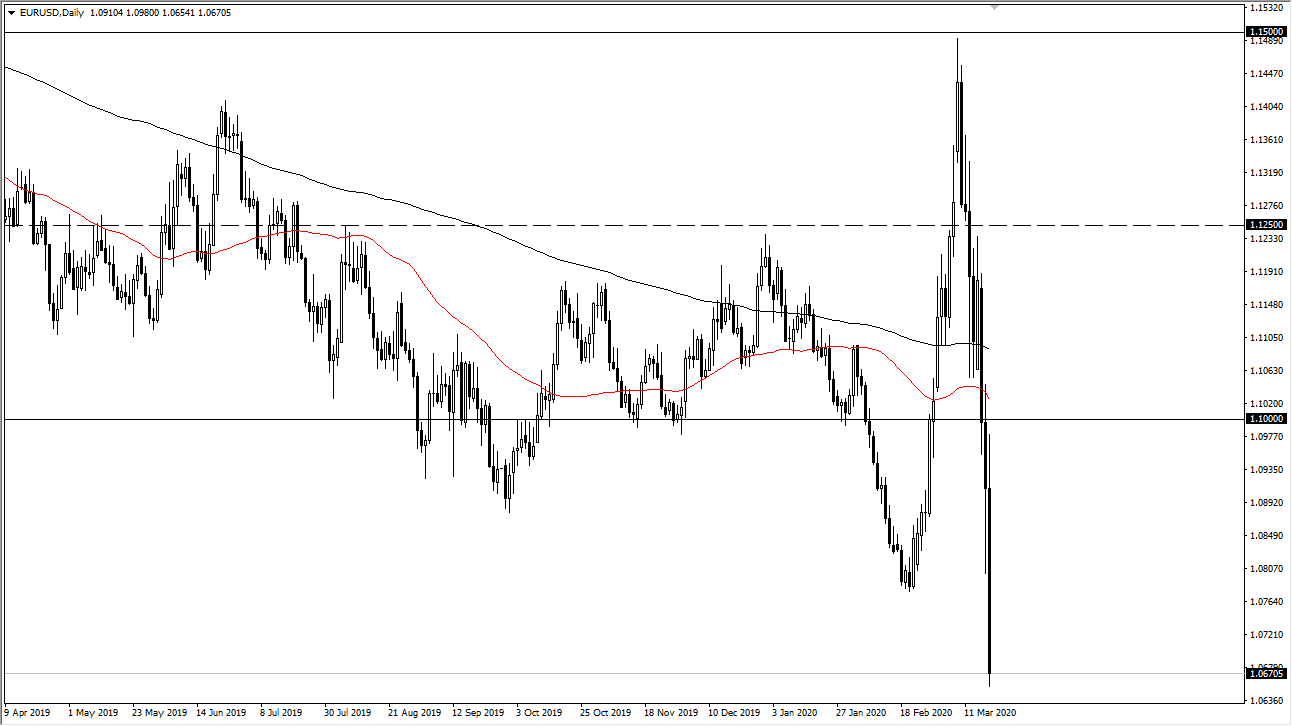

The Euro initially tried to rally during the trading session but found the area near the 1.10 level would be far too resistive to continue going higher. We have broken well below the 1.07 level since then, although we have had a lot of volatility during the trading session. What it’s worth noting here is that there was a major gap that got filled near the 1.0750 level. Now that the gap is filled, one would expect more of a rally, but we have sliced right through it and it’s likely that we will go towards the major support level on the monthly chart which is found down at the 1.05 handle. If that level were to give way, this is a market that will probably go looking towards parity, something that seems almost unbelievable at this point.

The candlestick is huge, but that seems to be the case time and time again Ian currency pairs that I have been following. I think ultimately this is a market that is out-of-control so it will be interesting to see how this plays out but eventually the Euro needs to bounce. That bounce should be sold into, with the 1.10 level offering significant resistance. I think the market is likely to continue to offer quite a bit of volatility and heading into the weekend it’s possible that we could see a huge move as traders trying to square their positions.

With the ECB stepping in and buying a ton of bonds, that has put negative pressure on the Euro yet again, and with the US dollar demand around the world it’s very likely that we will continue to see negativity in what has already been a major downtrend over the longer term. One thing is for sure, you need to keep your position size relatively small, because quite frankly it’s only a matter of time before we see some type of massive headline that comes across and makes the market move in a very violent manner. This market, which has been putting me to sleep for three years suddenly has become almost untradable. Overall, I would look at any rally at this point with a significant amount of skepticism and jump on a short position as soon as I get an opportunity. It’s not until we break significantly above the 1.10 level that I would believe in any type of rally that occurs.