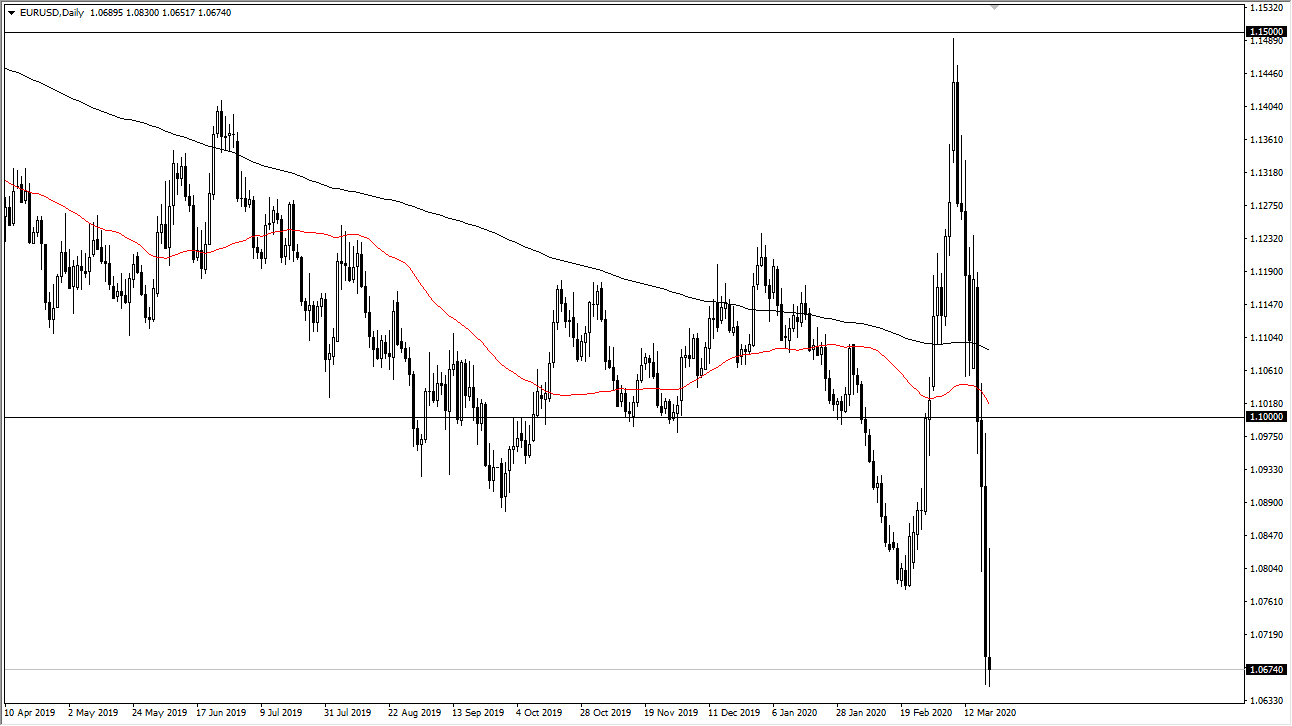

The Euro initially tried to rally during the trading session on Friday, reaching as high as 1.08 and above. However, we turn right back around to fall apart and form a very ugly inverted hammer. Because of this, the market is likely to continue going lower if it can’t hang on to any of the gains, even in the face of this massive selloff that we have seen and oversold condition.

That being said, when you look at the monthly chart you can see that the 1.05 level is significant support. That is where I do believe we are going, and at this point it’s obvious that rallies are going to be sold into. With the European Union under lockdown essentially, it’s difficult to imagine a scenario where the Euro suddenly takes off. Quite frankly, the markets are going to have to see some type of problem in the United States that outdoes the issues in the European Union to change things. Because of this, I think that we will continue to see opportunities on shorter-term charts that show signs of weakness. I believe that the 1.08 level will continue to be resistance, just as the 1.10 level will be.

In fact, it’s not until we clear the 1.10 level on a daily close that I’m looking for a significant bounce. I do believe that the 1.05 level will cause a significant bounce eventually, but we may have to spend some time in that area. If that area does get broken though, it means that we are going to parity. That would be levels not seen since a few years after the inception of the Euro, showing just how poorly the currency is doing currently. I believe that the US dollar has further to go as far as strength is concerned but we are getting stretched and there will be the occasional rally here. When you look at the longer-term charts though, we have been in a downtrend, so these moves do make sense, although the volatility is not something that you would’ve seen coming previously. I have zero interest in trying to buy this market, at least not until we get closer to the 1.05 level on signs of stability. At that point though, it becomes more of a longer-term “buy-and-hold” attempt at a trend change from what I see. I believe that the Euro is going to continue to suffer for several weeks, if not months.