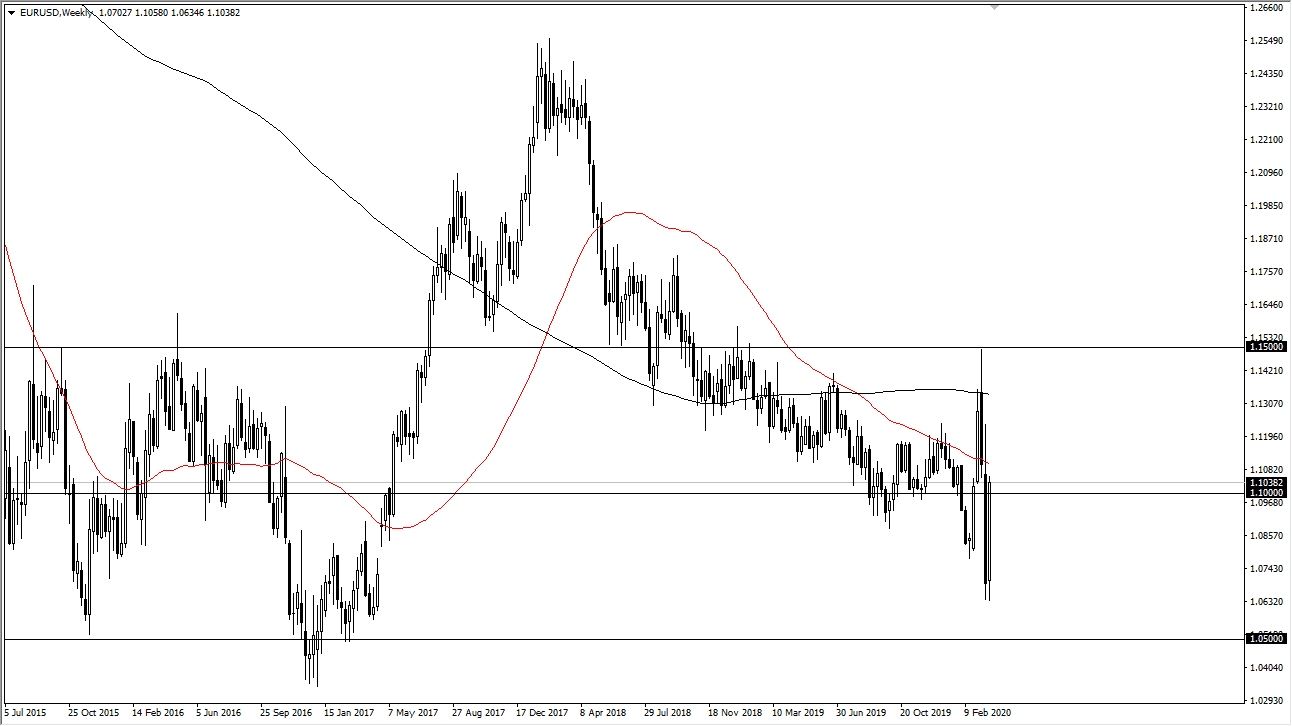

The Euro has been all over the place during the month of March, as markets are trying to figure out what to do with themselves. Ultimately, the market reached as high as the 1.15 level, only to turn around and dip all the way down towards the 1.06 level in the blink of an eye. This type of volatility is very difficult to deal with, as traders seem to get into one trend, only to have the think blow up in their face again.

With the Federal Reserve throwing a ton of money at the markets and loosening monetary policy even further, that has put some pressure on the US dollar towards the end of the month. However, the European Central Bank is also extraordinarily loose, right along with the rest of the central banks around the world. Ultimately, what this tells me is that we are very likely to see the 1.15 level as a ceiling, with the 1.06 level underneath as a bit of a floor. Longer-term, the 1.05 level is important as support as well, and quite frankly I don’t know that I trust any rally in the Euro for the longer-term. This means that you may have to watch the EUR/USD pair rally a couple hundred points, but eventually the exhaustion comes in and we rolled right back over.

The European Union continues to struggle in general, so keep in mind that it will eventually show itself in the currency pair price. Overall, I think the US dollar will still be in demand somewhat, unless of course the Federal Reserve gets what it wants, but I think it’s a little early to think that they’ve one that fight. There will be a lot of questions about global growth, and the European Union certainly is going to continue to suffer. It is because of this that even if we see extreme US dollar weakness for the month, I believe that the Euro will probably lag some other currencies. Because of this, I still favor the downside. If the pair does rally rather significantly, then I believe that selling the US dollar against other currencies will probably do a bit better, perhaps the Australian dollar or the Canadian dollar, especially if the oil markets get a bit of a bid. At this point, I think we are still in the middle of an extreme amount of volatility that isn’t going to go anywhere anytime soon.