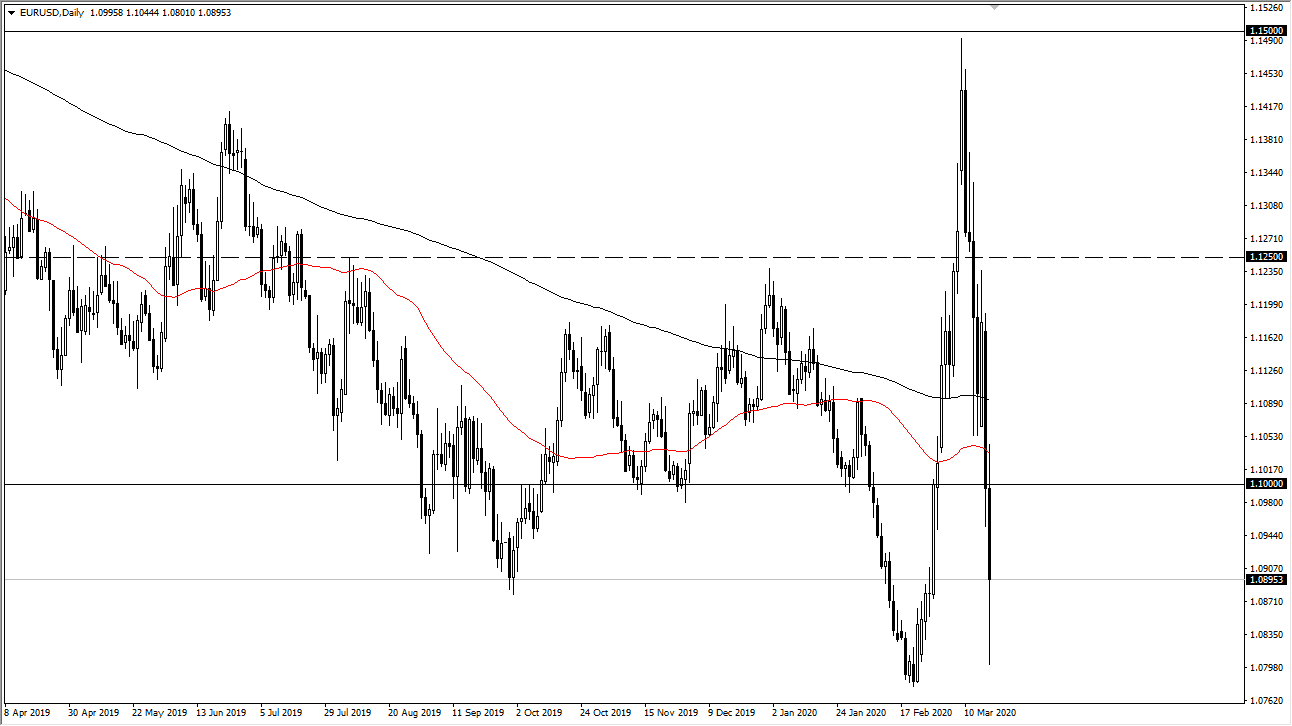

The Euro had a wild trading session during the day on Wednesday, as we initially tried to rally towards the 1.1050 level before rolling over and slamming into the 1.08 level. That is the bottom of the overall range that we have been in and I do believe that the Euro is going to try to recover sooner or later. In fact, by the end of the day we had recovered 100 pips. I think that initially the market will probably try to continue the downtrend, but eventually we could see the market rally again.

The alternate scenario of course would be a break down below the 1.08 level and therefore it’s likely that the Euro would go looking towards the 1.05 level after that. Don’t get me wrong, I don’t think it’s going to be easy either way, but quite frankly this is a market that has overextended itself in both directions. You can see just how volatile it’s been over the last couple of weeks and all things being equal, as long as the 1.08 level holds as support, then it stands to reason that the 1.1150 level should be somewhat of a magnet for price.

The massive amount of liquidation that we have seen over the last several weeks suggests that dollar demand is going to continue to be relatively strong, but any time we get relief at all, the Euro will be one of the beneficiaries of this. The Euro sees a lot of action around the 1.1150 level, so I think it’s only a matter of time before we get back to that area but at the end of the day and until we get some type of clarity when it comes to the effects of the virus on the global economy, this is a market that probably swings back and forth wildly and demands that you need to keep your position size relatively small. Because of this, you need to be cautious but keep in your position size down is one of the easiest ways to mitigate some of your risk. One of the best things I have ever done for my trading career was survived the 2008 fiasco. One of the main reasons I survived that is I cut back my position size, thereby every time I got whipsawed, although frustrating, it was yet just another paper cut.