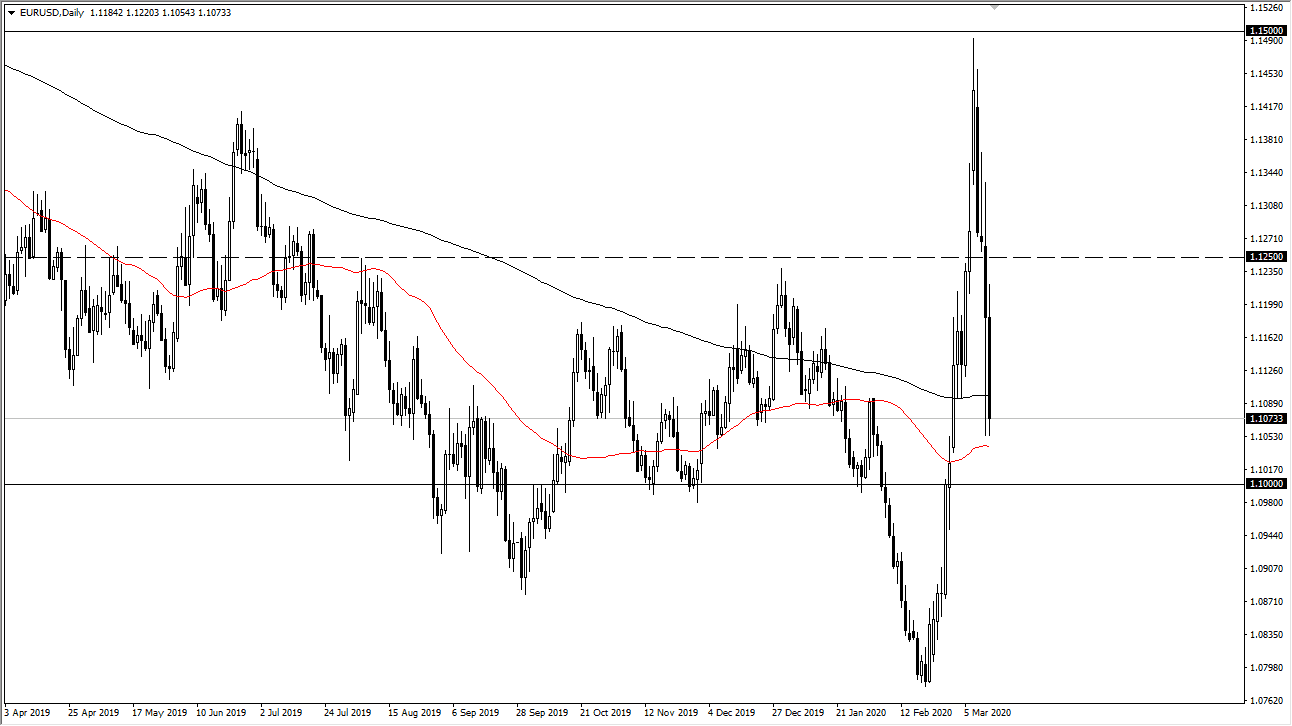

The Euro got crushed during trading on Friday as Germany has announced that it was willing to break its budget. This of course is a very negative turn of events, at least as far as the currency is concerned. At this point, the market found itself reaching towards the bottom of the candlestick from Thursday before it paused. Quite frankly, markets are trading on pure emotion right now so it’s difficult to do any meaningful technical analysis. In this scenario, all we can do is look at the longer-term charts and try to make some type of sense out of them. Underneath, I see the 1.10 level underneath to be massive support, just as the 1.15 level above should be thought of as a massive resistance barrier. For what it’s worth, the 1.1250 level should be an area that people look at as potential “fair value”, but that doesn’t necessarily mean that it will hold. Remember, it’s going to be about the latest headline more than anything else.

I believe that if we break down below the 1.10 level, that would be an extraordinarily negative sign for the Euro. However, looking at the longer-term charts I can suggest that if we can stay above that level it’s likely that we could see a return and a rally going forward. Whether or not it can hold is a completely different question but clearly by now you are aware the fact that there is only so much you can predict. In times like this, there are only two things that you can do as far as trading is concerned: you can cut your position size down because of the massive amount of volatility, and you need to be very stringent with your stop loss orders. I believe that if you are trying to buy this pair right now, you absolutely must be out if we are below the 1.10 level. Just as if you are looking to short this pair, if the market bounces above the 1.12 level, it’s time to get out. When you look at the Euro, you can see that nothing has happened other than a gentle drift lower over the last couple of years. The last couple weeks have clearly been completely different, showing you just how jittery the markets are. Be cautious with your position size is more than anything else. This is not the time to have dreams about turning $1000 and $1 million, because it’s much easier to turn that amount of money into $0.