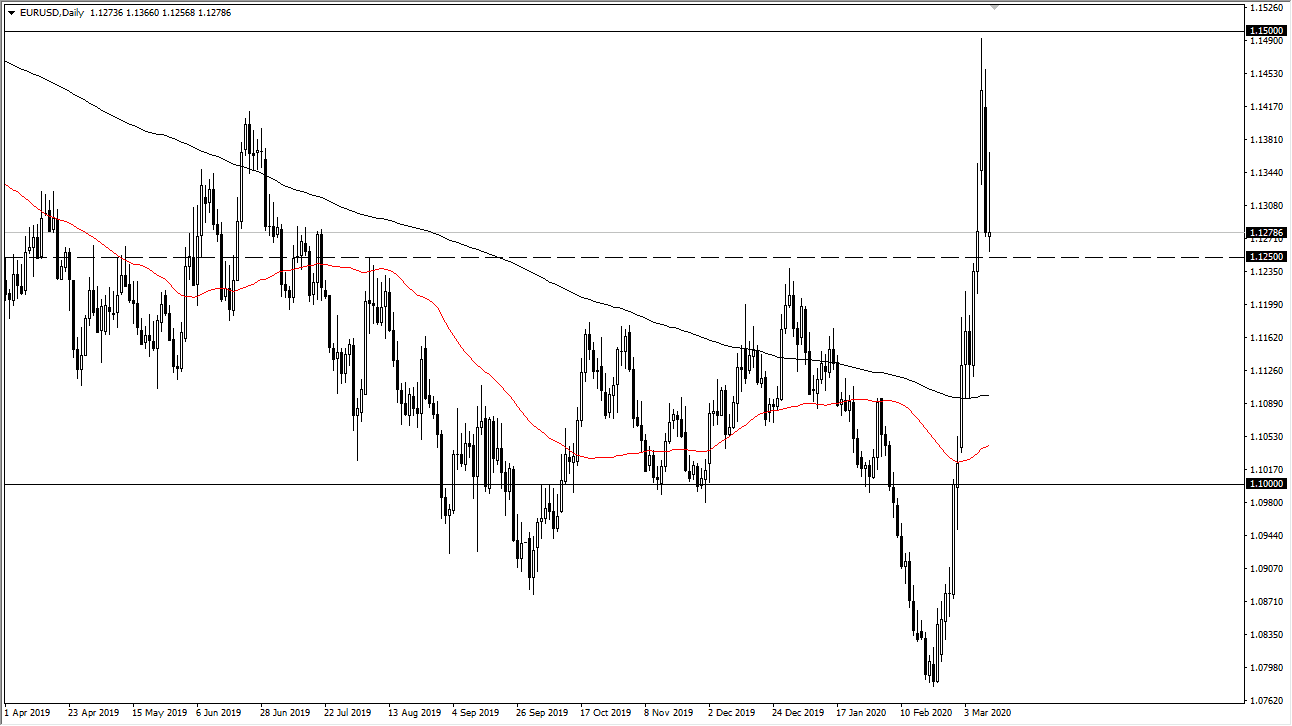

The Euro initially tried to rally during the trading session on Wednesday but gave back quite a bit of the gains in order to show signs of concern. Initially, this market rallied rather significantly during the day, but now there are a lot of questions as to what the ECB will have to do next. After all, the European Union it is almost certainly going to enter a recession so it seems unlikely that there will be anything driving money into the Euro other than money running away from the US dollar. As things stand right now the ECB is very likely to have to do some type of stimulus, as the 1.1250 level underneath should continue to offer support. If that level gives way that is likely that we break down even further.

I think at this point with Christine Largarde suggesting during the day that the ECB was in fact going to have to do something, traders are starting to pay attention to see whether or not it is going to be something extraordinary. At this point in time, the English were the most recent to cut interest rates, and now the Europeans or to do something. Any rally at this point will continue to be a lot of selling just waiting to happen, and quite frankly after the action during the trading session on Wednesday, one would anticipate that the ECB will act quite shortly.

A breakdown below the 1.1250 level could open up a move down towards the 1.11 handle, possibly even the 200 day EMA just below there. A breakdown below that level opens up the door to an even lower level, reaching down towards the 1.10 level. Of particular note above is the 1.14 handle, which has shown a lot of resistance over the last couple of days, so any move towards that area should be a nice selling opportunity as things stand right now, it looks as if the weekly candlestick will more than likely form some type of shooting star. Looking at this chart, we have been overbought so it’s not a huge surprise to see that the market is continuing to struggle in this general vicinity. If we were to turn around a break above the 1.15 handle, it would change everything but right now I find it very difficult to suggest, at least in the short term.