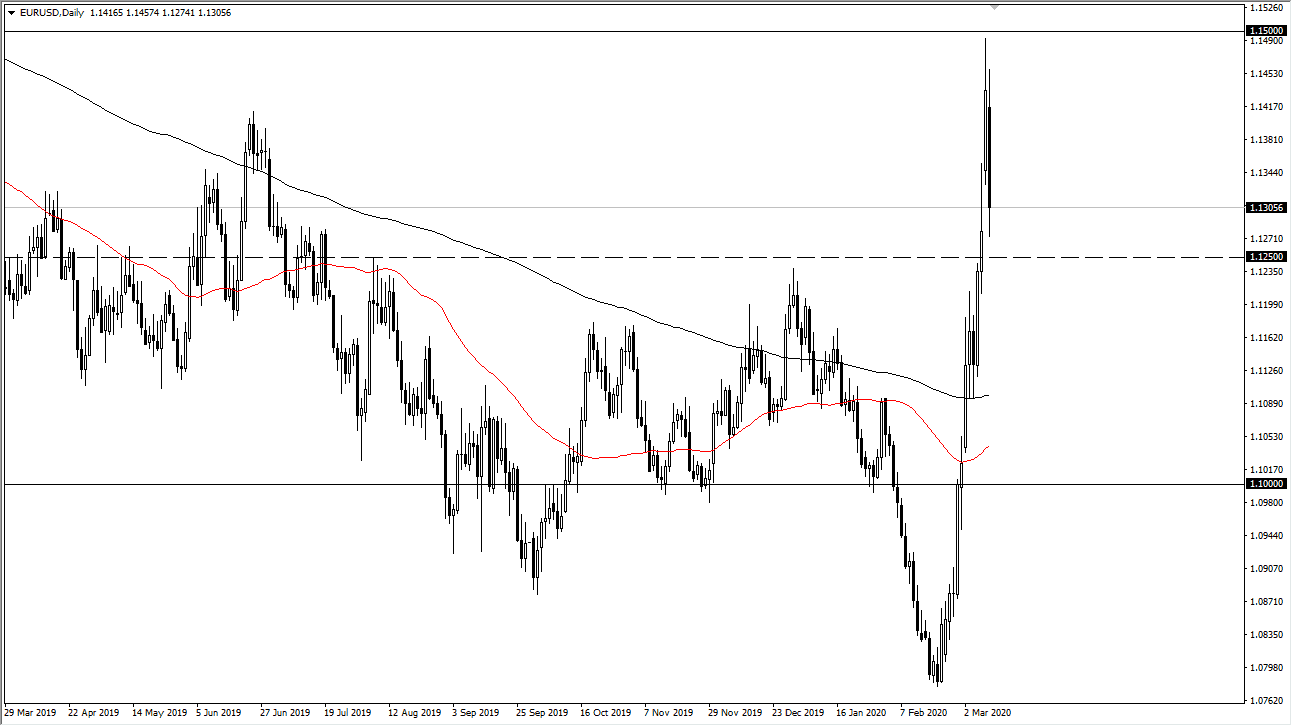

The Euro initially tried to rally a bit during the trading session on Tuesday, but gave up gains near the 1.1450 level again, only to break down below the 1.13 handle during the trading session. This is a market that had a gap from the Monday opening, and now the gap has been filled. At this point, the market could very well turn right back around to reach to the upside. The 1.1250 level underneath is an area that has been important more than once, so I think that offers a massive amount of support. If the Euro was to break down below there, then we probably drop quite a bit from there.

Looking at this chart, it’s obvious that the market is overbought, so at this point it’ll be interesting to see whether or not that gap gets blown through. One would have to take a serious look at the weekly candlestick to see if there’s going to be a major trend change, because recently we have priced in the idea of an additional 50 basis points in rate cut coming out of the Federal Reserve. That being said, the market is also going to have to factor in the idea of some type of global slowdown and let us not forget that the European Union is still looks extraordinarily soft and looks likely to go into a recession. In other words, this most recent move has been about bringing down the value of the dollar, not raising the value of the Euro.

Looking at the size of the scandal, although impressive it still pales in comparison of the massive run. At this point, the market does need to give back some, so I believe that this is all going to come down to whether or not the US fiscal stimulus is enough to bring down the value of the dollar further. If it’s not, then it’s likely that this pair needs to fall from here. Below the 1.1250 level, I would be very interested in shorting again. Otherwise, a short-term bounce could come into play, but I still think that the 1.15 level is going to offer stubborn resistance and it will be difficult to break, although not impossible based upon what we have seen recently. Looking at this chart, it is probably better to trade based upon weekly candlesticks more than anything else. Volatility continues to be a major issue.