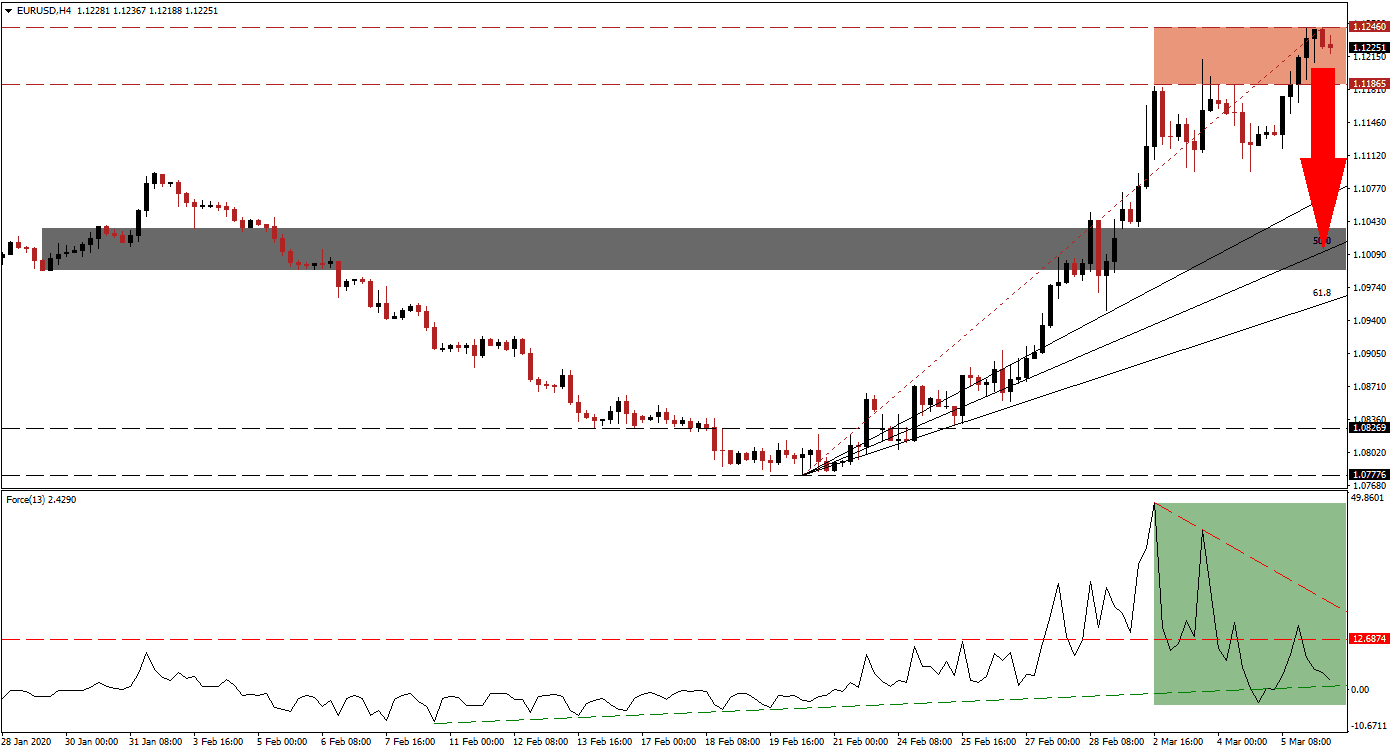

After the US Federal Reserve implemented a panic interest rate cut of 50 basis points, the first monetary adjustment between official FOMC meetings since the 2008 global financial crisis, the EUR/USD accelerated into its resistance zone. Italy, the third-largest economy in the Eurozone, is likely to enter a recession, causing a ripple effect across the EU. Germany has led economic disappointments with few exceptions, France has struggled, and Italy is expected to provide the third and final element for a recession. Price action is positioned to enter a corrective phase, accompanied by a spike in volatility.

The Force Index, a next-generation technical indicator, confirmed the new 2020 high, but the formation of a negative divergence signals an end to the advance. The Force Index collapsed below its horizontal support level, converting it into resistance, as marked by the green rectangle. Its descending resistance level applies downside pressure, favored to pressure this technical indicator below its ascending support level and into negative territory. Bears will then regain control of the EUR/USD. You can learn more about the Force Index here.

Difficulties in trade negotiations between the EU and the UK are anticipated to add further long-term downside pressure on this currency pair. The EU fails to fully comprehend Brexit, insisting the UK will operate based on the EU regulatory framework, granting the European Court of Justice jurisdiction. A breakdown in the EUR/USD below its resistance zone located between 1.11865 and 1.12460, as marked by the red rectangle, will spark a profit-taking sell-off, closing the gap to its ascending 38.2 Fibonacci Retracement Fan Support Level.

One key level to monitor is the intra-day low of 1.10954, the low of a reversed breakdown in this currency pair, which resulted in a fresh 2020 high. More net sell orders are favored once price action descends below it, providing fuel for an accelerated contraction. The next short-term support zone awaits the EUR/USD between 1.09922 and 1.10360, as marked by the grey rectangle, enforced by its 50.0 Fibonacci Retracement Fan Support Level. A breakdown below it will invalidate the bullish uptrend.

EUR/USD Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 1.12250

Take Profit @ 1.10250

Stop Loss @ 1.12850

Downside Potential: 200 pips

Upside Risk: 60 pips

Risk/Reward Ratio: 3.33

A double breakout in the Force Index, elevating it above its descending resistance level, may inspire more upside in the EUR/USD. The upside potential for an extension of the advance in this currency pair appears limited to its next resistance zone located between 1.13777 and 1.14113. Structural issues embedded deep inside the Eurozone create a bearish bias for this currency pair. Forex traders should view any breakout attempt as a selling opportunity.

EUR/USD Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 1.13150

Take Profit @ 1.14000

Stop Loss @ 1.12850

Upside Potential: 85 pips

Downside Risk: 30 pips

Risk/Reward Ratio: 2.83