Turkey’s health ministry confirmed local Covid-19 transmission exceed imported ones after the death toll increased to 44, and total cases approach 2,000. It further announced the distribution of a novel drug from China aimed at reducing treatment to four days, without specifying the name. China additionally provided Turkey with one million fast-acting diagnostic kits. The EUR/TRY already completed a breakdown below its resistance zone, and yesterday’s dismal Eurozone PMI data is adding to downside pressures on this currency pair.

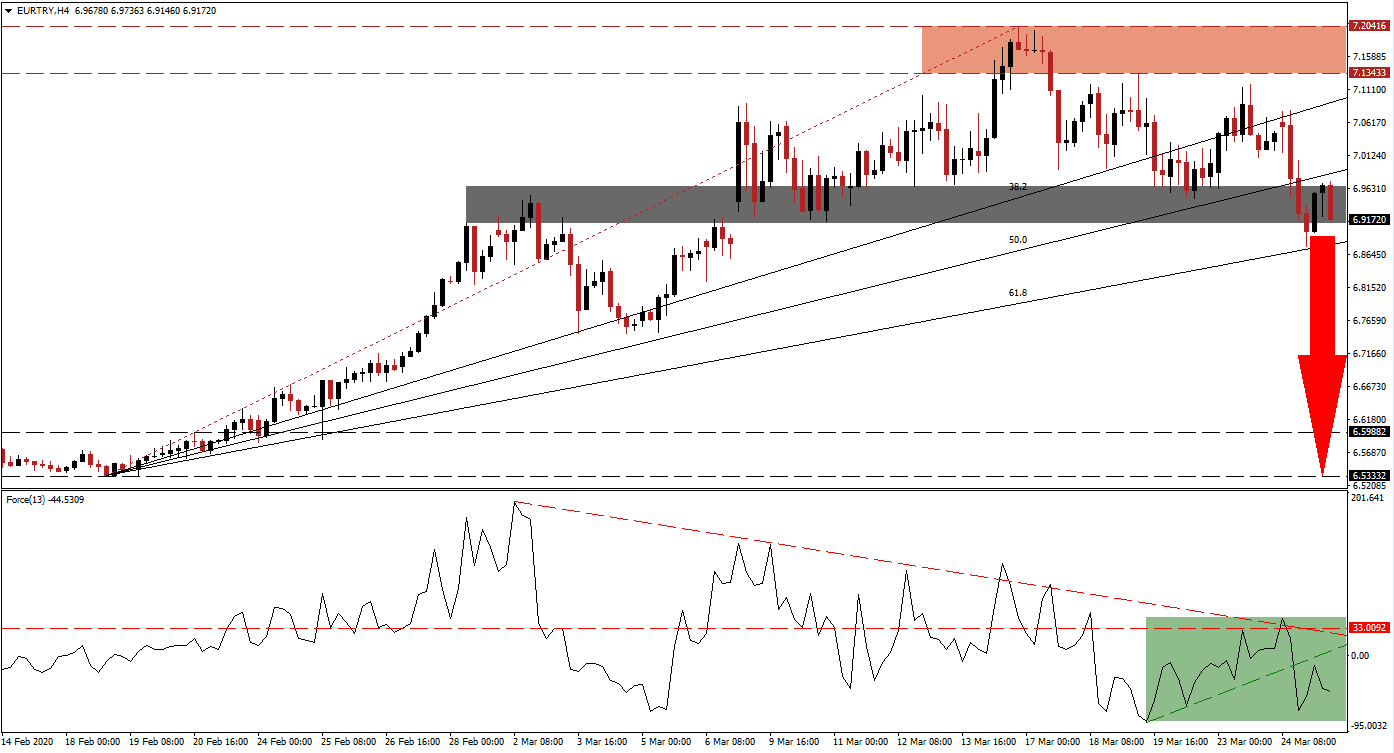

The Force Index, a next-generation technical indicator, highlights the rise in bearish momentum after converting its horizontal support level into resistance. A significant descending resistance level pressured the Force Index below its ascending support level, as marked by the green rectangle. This technical indicator contracted below the 0 center-line, ceding control of the EUR/TRY to bears. You can learn more about the Force Index here.

Following the breakdown in this currency pair below its resistance zone located between 7.13433 and 7.20416, as identified by the red rectangle, the bullish trend was broken. A series of four lower highs established a bearish chart pattern. Downside pressures increases after the EUR/TRY converted its ascending 50.0 Fibonacci Retracement Fan Support Level in resistance. With Turkey receiving assistance from China and the Eurozone scrambling for a proper response, the former is on track to handle Covid-19 more efficiently.

A sustained push in the EUR/TRY below the short-term support zone located between 6.91022 and 6.96610, as marked by the grey rectangle, is anticipated to spark a massive sell-off. The 61.8 Fibonacci Retracement Fan Support Level will provide support form where this currency pair is cleared to accelerate to the downside. This currency pair will face its long-term support zone between 6.53332 and 6.59882, with an insignificant support level surrounding the intra-day low of 6.74620.

EUR/TRY Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 6.91750

Take Profit @ 6.53750

Stop Loss @ 7.01750

Downside Potential: 3,800 pips

Upside Risk: 1,000 pips

Risk/Reward Ratio: 3.80

In the event of a breakout in the Force Index above its ascending support level, the EUR/TRY could spike into its resistance zone. Due to the dominant fundamental conditions, any advance from current levels is expected to be a temporary event. Forex traders are recommended to use this as an opportunity to place additional sell orders on the back of an increasingly bearish outlook for this currency pair.

EUR/TRY Technical Trading Set-Up - Limited Reversal Scenario

Long Entry @ 7.08000

Take Profit @ 7.18500

Stop Loss @ 7.03500

Upside Potential: 1,050 pips

Downside Risk: 450 pips

Risk/Reward Ratio: 2.33