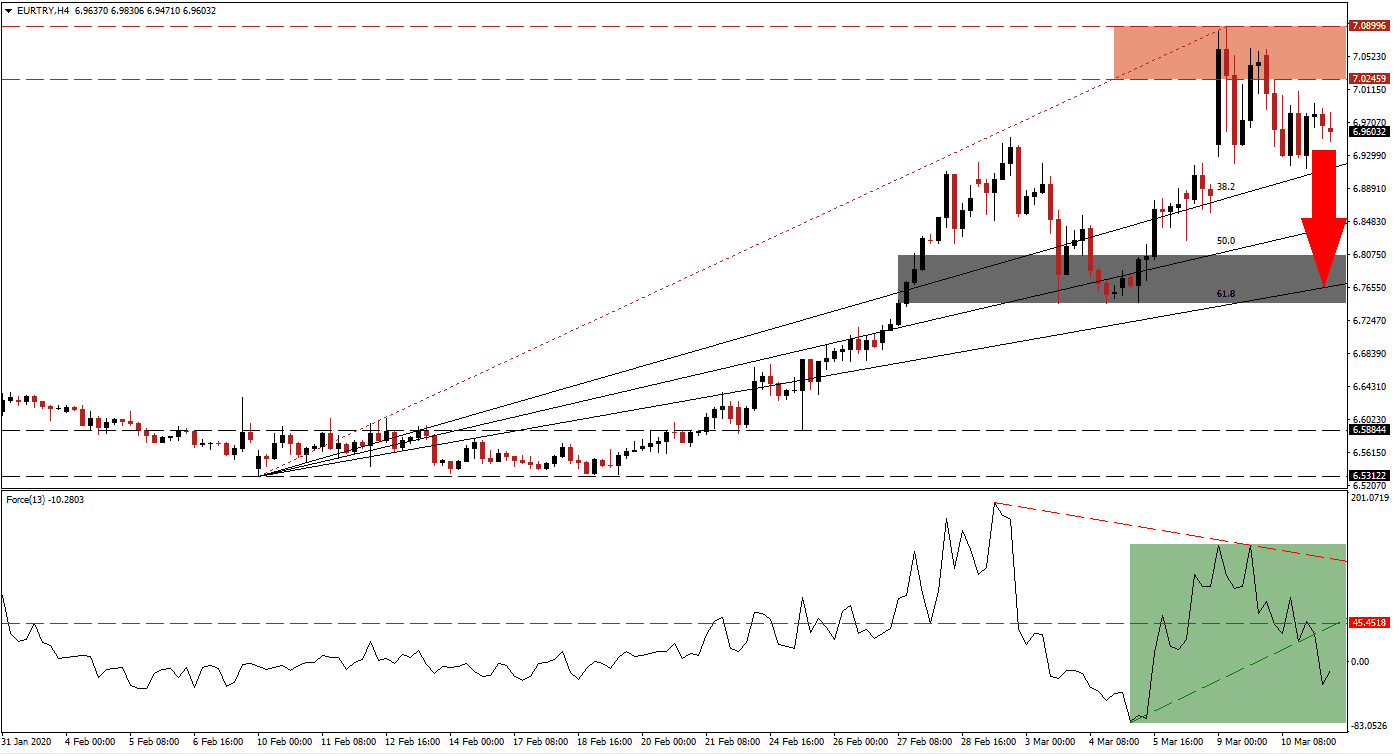

Turkey may not feel a direct impact from Covid-19, but the anticipated global economic contraction will pose a challenge to its current recovery. Lower oil prices are unlikely to deliver the necessary boost to domestic spending to counter the pending decrease in global trade volume. Despite the ongoing slowdown, Turkey broke export records in January and February, a trend now threatened by developing global problems. Monday’s oil price collapse ignited a price spike in the EUR/TRY into its resistance zone, which resulted in a breakdown from where more downside is anticipated.

The Force Index, a next-generation technical indicator, provided a reversal signal in the form of a negative divergence. As this currency pair advanced to a new 2020 high, the Force Index recorded a lower high and reversed. A breakdown below its horizontal support level converted it into support. Bearish pressures were sufficient to extend the move below its ascending support level, as marked by the green rectangle, which now acts as resistance. This technical indicator also moved into negative conditions, placing bears in control of the EUR/TRY.

Immediately after price action accelerated into its resistance zone located between 7.02459 and 7.08996, as marked by the red rectangle, the EUR/TRY struggled, resulting in a series of lower highs before completing a breakdown. The ascending 38.2 Fibonacci Retracement Fan Support Level is approaching, and this currency pair is well-positioned to convert it into resistance with a contraction below it. With ongoing economic weakness across the Eurozone, the European Central Bank is likely to deliver an interest rate cut, adding downside pressure on the Euro.

Forex traders are advised to monitor the intra-day high of 6.92012, the peak before this currency pair spiked higher with a price gap to the upside. A push below this level is favored to result in the next wave of net sell orders in the EUR/TRY. It is expected to drive price action into its next short-term support zone located between 6.74630 and 6.80547, as marked by the grey rectangle. The 61.8 Fibonacci Retracement Fan Support Level is crossing through this zone, potentially pausing the pending sell-off. You can learn more about the Fibonacci Retracement Fan here.

EUR/TRY Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 6.96000

Take Profit @ 6.77000

Stop Loss @ 7.01000

Downside Potential: 1,900 pips

Upside Risk: 500 pips

Risk/Reward Ratio: 3.80

Should the Force Index push through its descending resistance level, the EUR/TRY may reverse its breakdown. Due to uncertainty over how the European Central Bank will react to Covid-19 and the collapse in oil prices, coupled with resilience in the Turkish economy, the upside potential is severely limited. Forex traders are advised to take advantage of any price action recovery with fresh sell orders inside of its resistance zone.

EUR/TRY Technical Trading Set-Up - Limited Reversal Scenario

Long Entry @ 7.03000

Take Profit @ 7.08500

Stop Loss @ 7.00750

Upside Potential: 550 pips

Downside Risk: 50 pips

Risk/Reward Ratio: 2.44