Core inflation in Singapore turned negative for the first time since 2010, and the Money Authority of Singapore (MAS) announced it is closely following the impact of Covid-19 on inflation. The central bank is anticipated to adjust the band of the Singapore Dollar nominal effective exchange rate. Singapore announced an initial stimulus of S$6.4 billion, with a second one rumored above A$15 billion. The EUR/SGD rebounded from the breakdown below its resistance zone, but a renewed push to the downside is pending. PMI data out of France and Germany showed a significantly more massive collapse in the service sector than forecast.

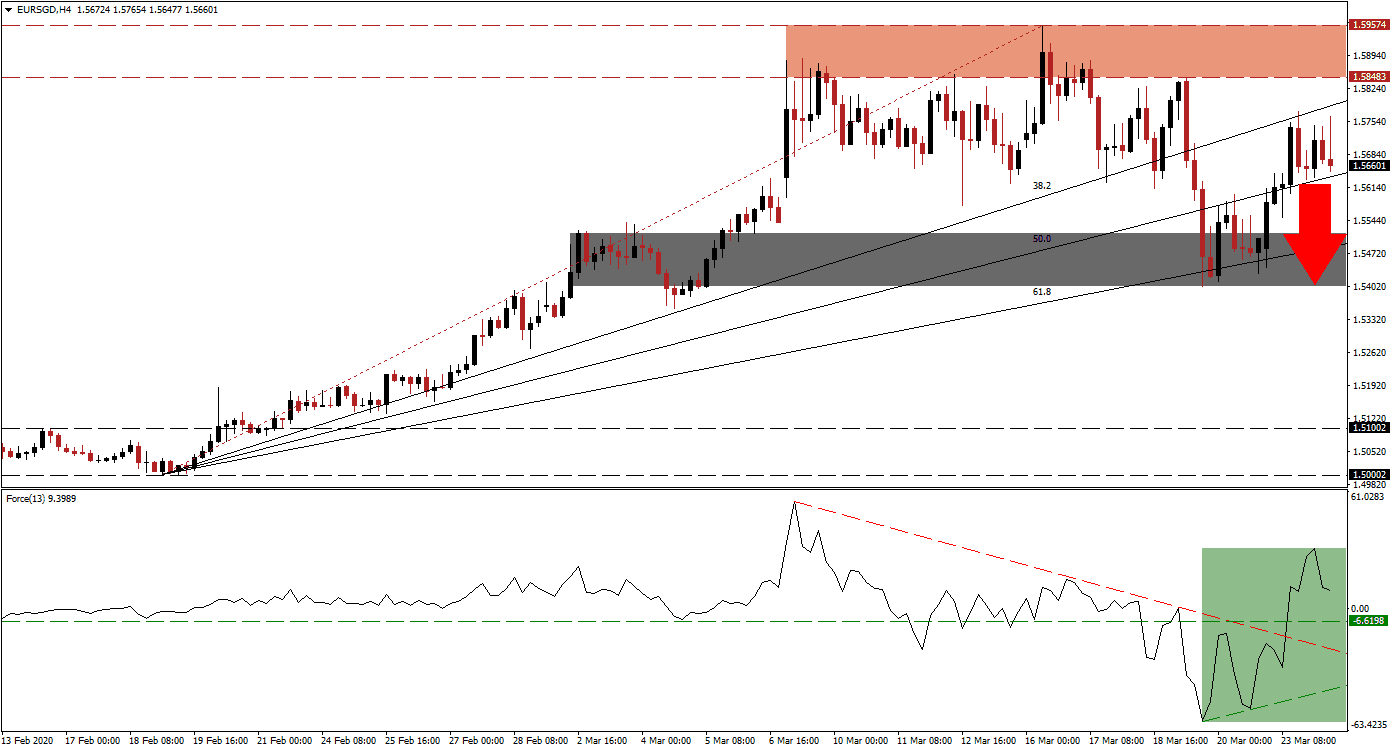

The Force Index, a next-generation technical indicator, shows a reversal after two higher lows resulted in the formation of an ascending support level. The Force Index spiked above its descending resistance level, as marked by the green rectangle, and converted its horizontal resistance level into support. It additionally pushed into positive territory but started to retreat off of a lower high. This technical indicator is expected to cede control of the EUR/SGD to bears after crossing below the 0 center-line.

This currency pair ended its advance with the breakdown below its resistance zone located between 1.58483 and 1.59574, as identified by the red rectangle. A brief contraction below the 61.8 Fibonacci Retracement Fan Support Level was reversed, but the EUR/SGD stalled after reaching its ascending 38.2 Fibonacci Retracement Fan Resistance Level. Breakdown pressures are now on the rise after today’s preliminary March PMI data out of the Eurozone showed the manufacturing sector contracted less than predicted while the services sector is experiencing a critical slowdown, not priced into the Euro.

One critical level to monitor is the 50.0 Fibonacci Retracement Fan Support Level. A sustained push below it will attract the next wave of net sell orders to this currency pair, fueling a pending contraction in the EUR/SGD. Structural economic weakness out of the Eurozone will trump potential monetary easing by the MAS. Price action is positioned to challenge its short-term support zone located between 1.54034 and 1.55156, as marked by the grey rectangle. An extension of the breakdown sequence is likely. You can learn more about a support zone here.

EUR/SGD Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 1.56600

Take Profit @ 1.54000

Stop Loss @ 1.57450

Downside Potential: 260 pips

Upside Risk: 85 pips

Risk/Reward Ratio: 3.06

In the event of more upside in the Force Index, enabled by its descending resistance level acting as support, the EUR/SGD is anticipated to attempt a push higher. The upside potential remains confined to the resistance zone, as dominant fundamental conditions favor more downside. Forex traders are advised to take advantage of temporary price spikes with new short positions amid a rapidly worsening Eurozone outlook.

EUR/SGD Technical Trading Set-Up - Limited Reversal Scenario

Long Entry @ 1.58000

Take Profit @ 1.59200

Stop Loss @ 1.57450

Upside Potential: 120 pips

Downside Risk: 55 pips

Risk/Reward Ratio: 2.18