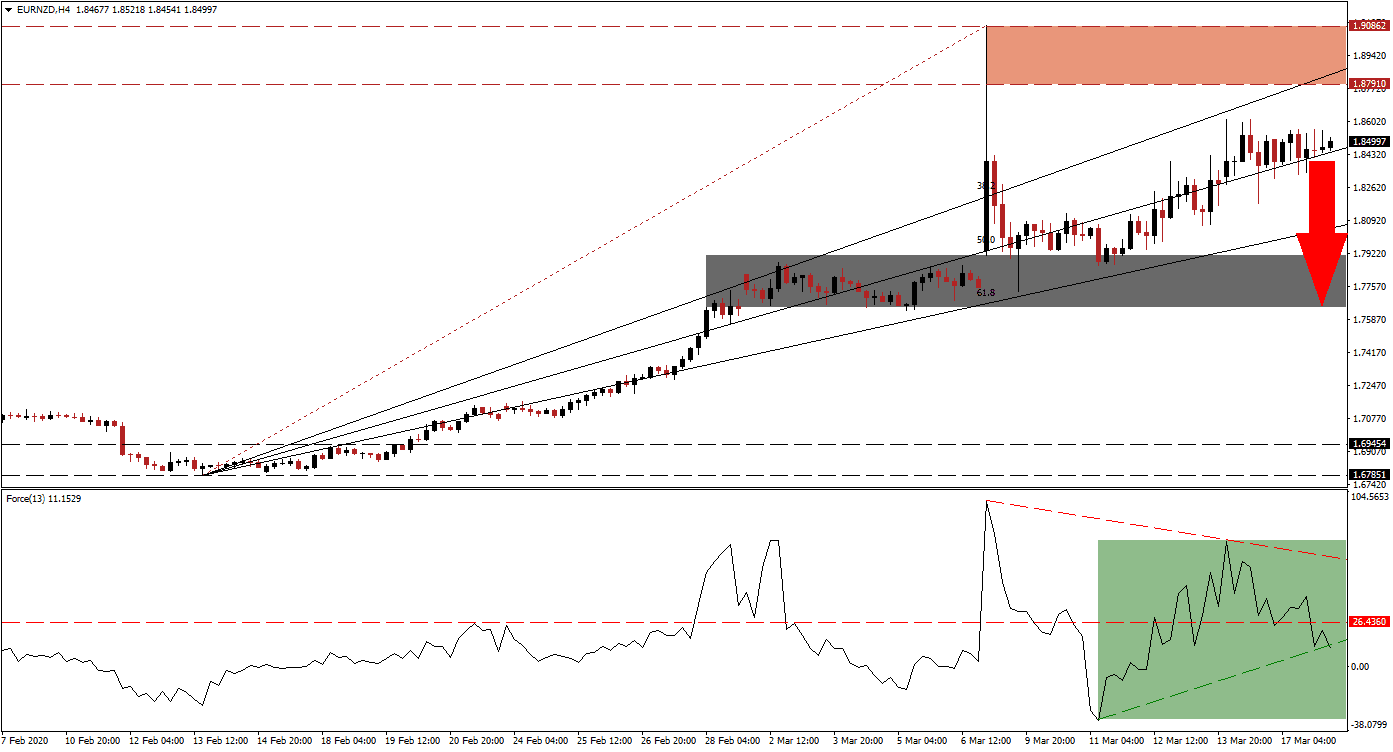

Most foreign travel into the European Union is banned for thirty days as the EU shut its external borders. Yesterday’s ZEW data out of Germany and the Eurozone for March were reported significantly worse than markets priced. Short-selling bans have been implemented in select assets together with rule changes regarding the transparency of short positions. Direct interference with financial markets usually results in more panic, adding bearish pressures to the Euro. The EUR/NZD is losing bullish momentum, and a breakdown below its ascending 50.0 Fibonacci Retracement Fan Support Level is expected to initiate a profit-taking sell-off.

The Force Index, a next-generation technical indicator, started to retreat after recording a lower high from where its descending resistance level pressured it into a breakdown below its horizontal support level, converting it into resistance. The Force Index is now challenging its ascending support level, as marked by the green rectangle. This technical indicator is anticipated to slide into negative conditions, ceding control of the EUR/NZD to bears. You can learn more about the Force Index here.

Price action is currently positioned above its 50.0 Fibonacci Retracement Fan Support Level and below its 38.2 Fibonacci Retracement Fan Resistance Level. The latter has crossed into its resistance zone located between 1.87910 and 1.90862, as marked by the red rectangle, with the bottom range dating back to March 2008. New Zealand announced its NZ$12.1 billion economic rescue package, its central bank slashed interest rates to an all-time low of 0.25% and announced a quantitative easing program via bond purchases. The European Central Bank surprised markets by not lowering rates last week. The positive catalyst for the EUR/NZD is now fading quickly.

Forex traders are recommended to monitor the intra-day high of 1.82790, the peak of the last candlestick that spanned both Fibonacci Retracement Fan levels engulfing this currency pair. A breakdown will clear the path for the EUR/NZD to accelerate into its short-term support zone located between 1.76454 and 1.79148, as marked by the grey rectangle, which includes a price gap to the upside. More downside will require a new fundamental catalyst with the focus shifting to economic data to gauge the severity of disruptions caused by Covid-19. You can learn more about a breakdown here.

EUR/NZD Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 1.85250

Take Profit @ 1.76500

Stop Loss @ 1.88000

Downside Potential: 875 pips

Upside Risk: 275 pips

Risk/Reward Ratio: 3.18

A reversal in the Force Index above its descending resistance level is likely to push the EUR/NZD into a breakout attempt. Due to actions taken by regulators in the Eurozone and individual member countries to limit the operability of equity markets, the outlook for the Euro remains increasingly bearish. Forex traders are advised to consider any price spike from current levels as a great selling opportunity. The next resistance zone is located between 1.95690 and 1.98520.

EUR/NZD Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 1.91500

Take Profit @ 1.97500

Stop Loss @ 1.88500

Upside Potential: 600 pips

Downside Risk: 300pips

Risk/Reward Ratio: 2.00