New Zealand reported its first case of Covid-19 and calls for the Reserve Bank of New Zealand to cut interest rates are on the rise, especially after the Reserve Bank of Australia implemented one yesterday. Expectations for one have elevated the EUR/NZD into its resistance zone, but bullish momentum collapsed. The exhausted upside makes price action vulnerable to a profit-taking sell-off. New Zealand is braced for a shock to its tourism, education, and commodity sectors, but the overall impact of the virus on the global supply chain is vastly underestimated. You can learn more about a profit-taking sell-off here.

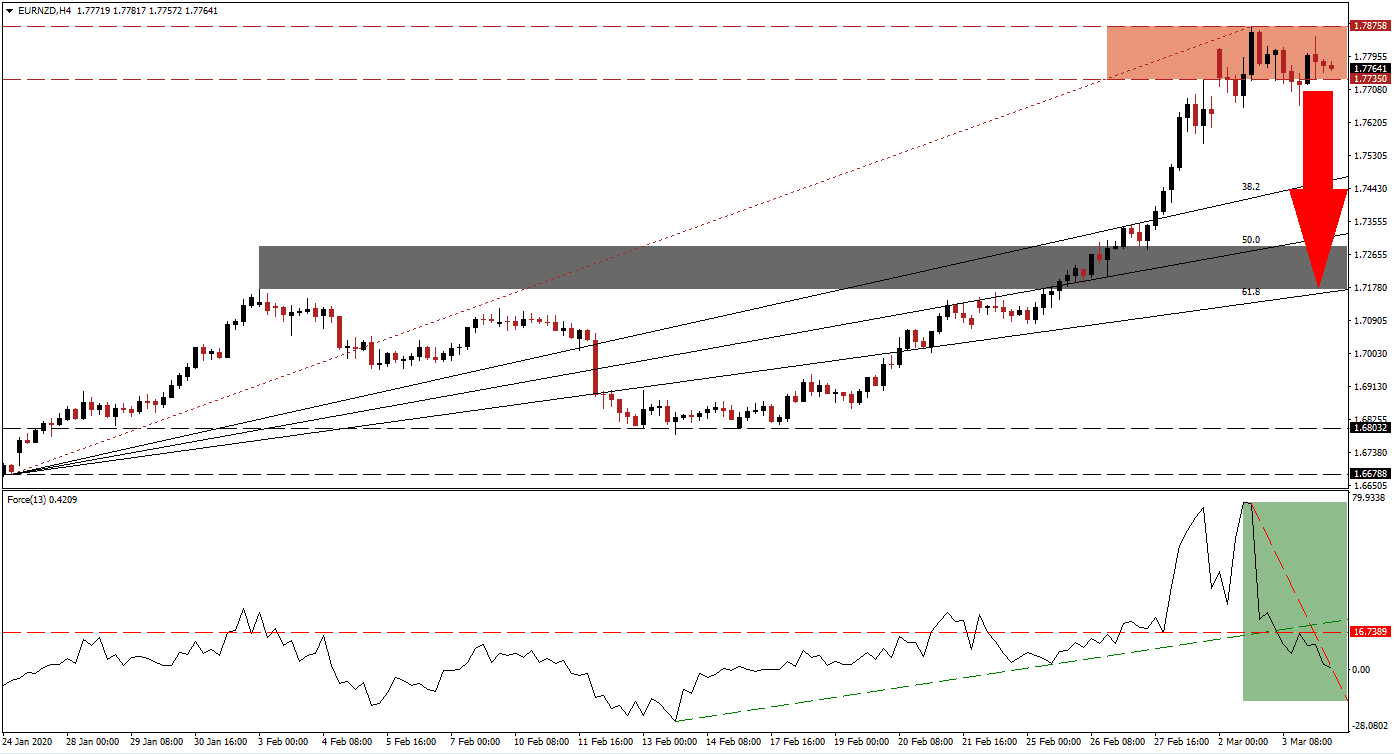

The Force Index, a next-generation technical indicator, initially spiked to a new 2020 high as this currency pair advanced into its resistance zone. Momentum quickly contracted, resulting in a breakdown in the Force Index below its ascending support level. It was followed by a conversion of its horizontal support level into resistance, as marked by the green rectangle. A steep descending resistance level emerged, adding to downside pressure. This technical indicator is now expected to cross below the 0 center-line, ceding control of the EUR/NZD to bears.

Breakdown pressures are on the rise, positioning this currency pair for a breakdown below its resistance zone, initiating a more massive correction. This zone is located between 1.77350 and 1.78758, as marked by the red rectangle. It will allow the EUR/NZD to close the gap to its ascending 38.2 Fibonacci Retracement Fan Support Level. Forex traders are advised to monitor the intra-day low of 1.75635, the low of a candlestick forming the bottom range of its resistance zone. A breakdown is likely to result in the addition of new net short positions.

Economic data out of the Eurozone has been soft while the European Central bank maintains its dovish tone, adding to downside pressures in the Euro. A breakdown is anticipated to take the EUR/NZD into its next short-term support zone located between 1.71745 and 1.72880, as marked by the grey rectangle. The 61.8 Fibonacci Retracement Fan Resistance Level enforces this zone. More downside will require a fresh catalyst. You can learn more about a support zone here.

EUR/NZD Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 1.77650

Take Profit @ 1.71750

Stop Loss @ 1.79000

Downside Potential: 590 pips

Upside Risk: 135 pips

Risk/Reward Ratio: 4.37

A breakout in the Force Index above its ascending support level may inspire a renewed push higher in the EUR/NZD. Given the long-term fundamental outlook in this currency pair, past the Covid-19 disruptions, the outlook remains bearish for the Euro. Therefore, an extended correction is expected. Any breakout from current levels should be considered an excellent short-selling opportunity. The next resistance zone awaits price action between 1.81260 and 1.82140.

EUR/NZD Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 1.79500

Take Profit @ 1.82000

Stop Loss @ 1.78500

Upside Potential: 250 pips

Downside Risk: 100 pips

Risk/Reward Ratio: 2.50