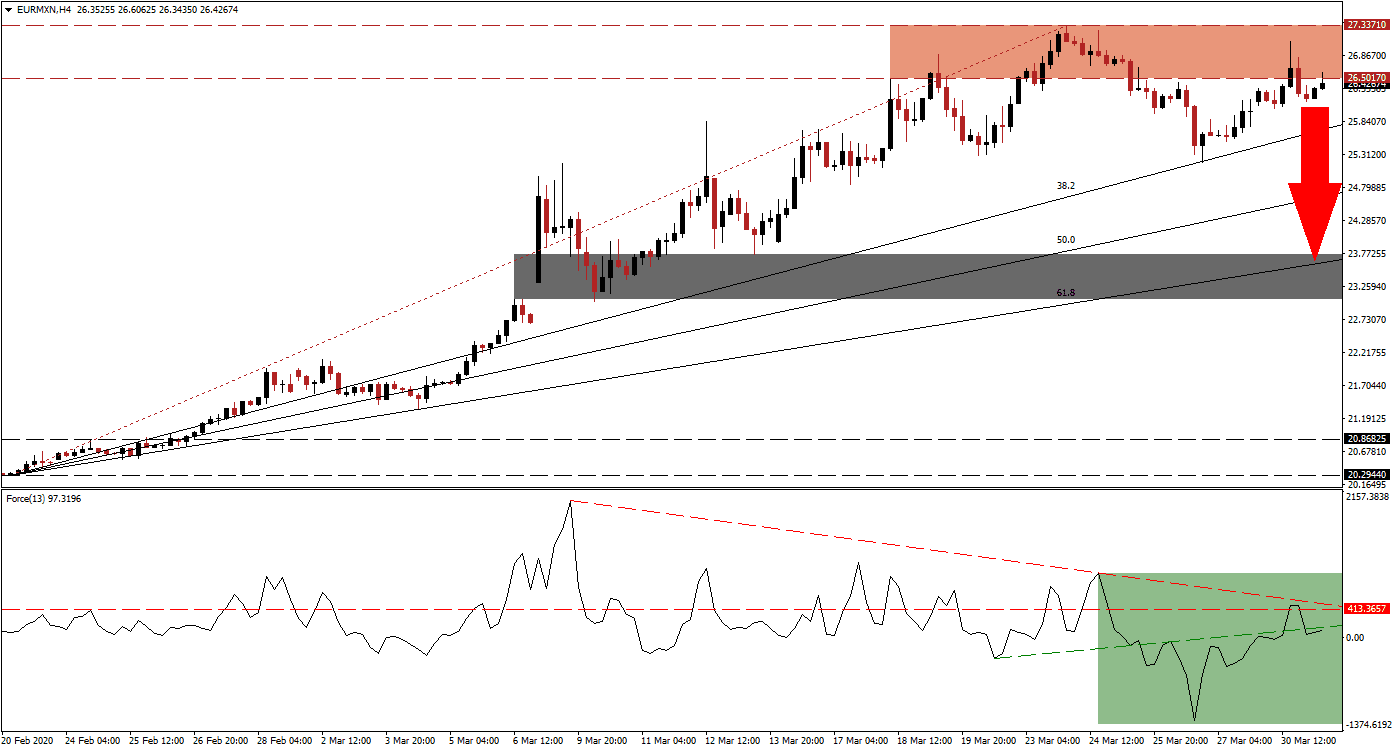

Mexican President López Obrador rejects calls for a full lockdown in Latin America's second-largest economy. He asked his citizens to resume daily life in support of the economy. Mexican GDP forecasts call for an annualized contraction of 3.7%, with the second-quarter potentially dropping by as much as 35.5%. Weakness out of the Eurozone before the Covid-19 outbreak, combined with the inability for a unified response, is adding to a bearish outlook for the Euro. The European Central Bank’s quantitative easing program adds to downside pressure. After the EUR/MXN was rejected by its resistance zone, a profit-taking sell-off is favored on the back of Euro weakness.

The Force Index, a next-generation technical indicator, points towards the presence of a negative divergence. It formed after price action converted its short-term resistance zone into support, while the Force Index contracted. After pushing below its horizontal support level, turning it into resistance, bearish conditions intensified. This technical indicator moved below its ascending support level, as marked by the green rectangle. The descending resistance level is adding to downside pressure, expected to drive it below the 0 center-line, granting bears control of the EUR/MXN. You can learn more about the Force Index here.

This currency pair created a lower high inside of its resistance zone located between 26.50170 and 27.33710, as identified by the red rectangle, followed by a third breakdown in the EUR/MXN. Mexico’s finance ministry assured investors of the country’s stable fiscal condition. The government has not approved an economic stimulus yet. Further details are anticipated as soon as today. Local governments decided to follow guidelines implemented elsewhere in the world.

Breakdown pressures are rising with the ascending 38.2 Fibonacci Retracement Fan Support Level closing in on the bottom range of its resistance zone. A breakdown is likely to initiate a more massive correction. The EUR/MXN is positioned to accelerate down into its short-term support zone located between 23.05789 and 23.75088, as marked by the grey rectangle. You can learn more about a breakdown here.

EUR/MXN Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 26.50000

Take Profit @ 23.75000

Stop Loss @ 27.10000

Downside Potential: 2,750 pips

Upside Risk: 600 pips

Risk/Reward Ratio: 4.58

Should the Force Index maintain a breakout above its descending resistance level, the EUR/MXN could spike higher. Mexico’s lax approach to the Covid-19 pandemic has the potential to spiral the economy to the downside. Forex traders are recommended to monitor this risk closely. Underlying conditions do not support more upside, and the next resistance zone awaits price action between 28.15721 and 28.70400, which would take this currency pair to a new all-time high.

EUR/MXN Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 27.40000

Take Profit @ 28.15000

Stop Loss @ 27.10000

Upside Potential: 750 pips

Downside Risk: 300 pips

Risk/Reward Ratio: 2.50