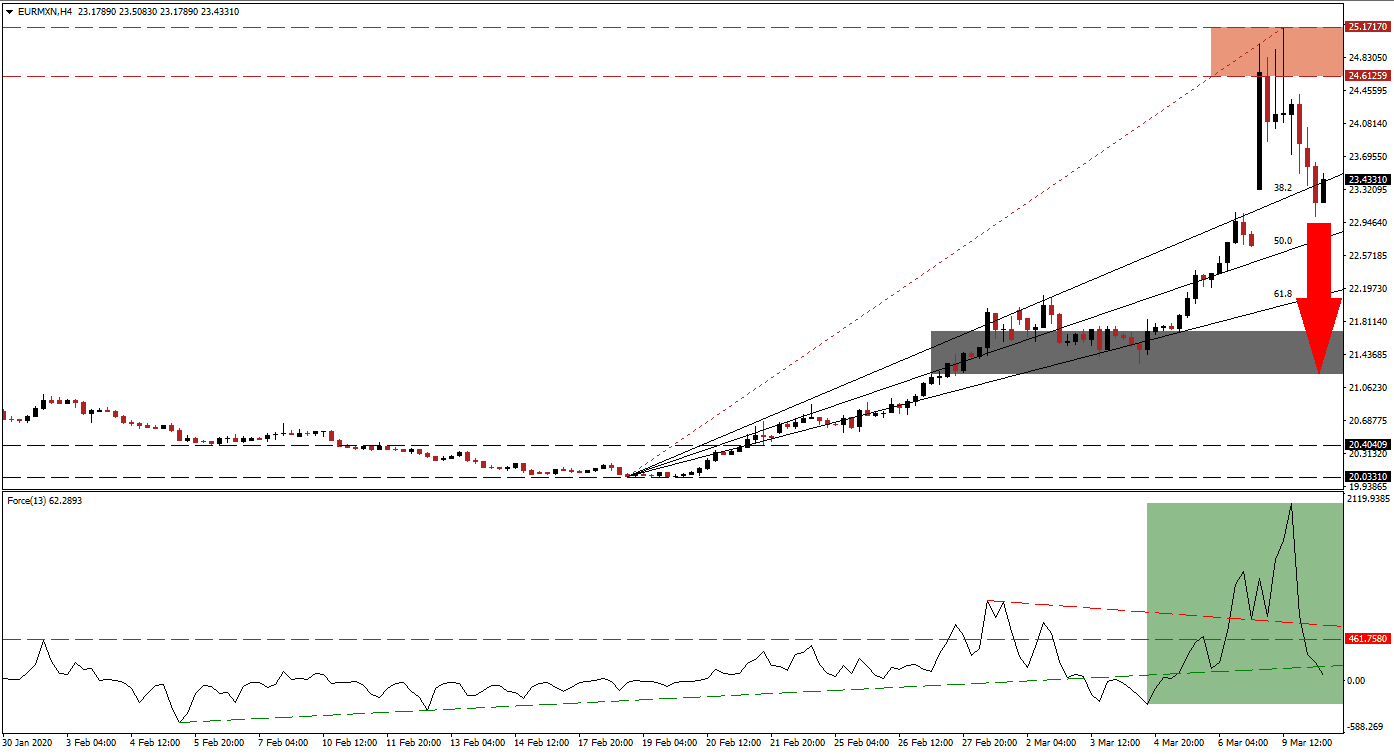

Following the collapse of the OPEC+ deal to limit supply in favor of price stability, oil prices suffered their most critical breakdown since the US invasion of Iraq in 1991. It sent a ripple effect throughout the global economy, displacing Covid-19 related fears. While the virus generates a short-term shock to the supply chain and domestic demand, weak oil prices provide a long-lasting negative impact. The EUR/MXN soared to a new all-time high, forming a new resistance zone. A profit-taking sell-off quickly emerged amid a collapse in bullish momentum.

The Force Index, a next-generation technical indicator, initially accelerated to a new 2020 peak before a massive reversal materialized. It took the Force Index back below its descending resistance level, which acted as a temporary support. The horizontal support level was then converted into resistance, followed by a push below its ascending support level, as marked by the green rectangle. This technical indicator is expected to cross below the 0 center-line, ceding control of the EUR/MXN to bears. You can learn more about the Force Index here.

More downside is favored, especially after yesterday’s strong CPI reading out of Mexico, making an interest rate cut unlikely. The central bank noted last week that there is little room for monetary easing. Low oil prices are seen as a boost to consumer spending, but given current global economic conditions, they may not result in hoped-for spending. The rejection of the EUR/MXN by its resistance zone located between 24.61259 and 25.17170, as marked by the red rectangle, closed the gap to its ascending 38.2 Fibonacci Retracement Fan Support Level.

Financial markets anticipate US President Trump to announce a stimulus package today. The US Federal Reserve is under pressure to deliver a 75 basis point interest rate cut, following last week's 50 basis point panic-cut. The European Central Bank is considering to ease monetary policy further and to boost its bond-buying program. A combination of both events adds a bullish fundamental driver to the Mexican Peso, creating an environment for the EUR/MXN to extend its breakdown into its short-term support zone. This zone is located between 21.21696 and 21.70189, as marked by the grey rectangle.

EUR/MXN Technical Trading Set-Up - Breakdown Extension Scenario

- Short Entry @ 23.43500

- Take Profit @ 21.21750

- Stop Loss @ 24.10000

- Downside Potential: 22,175 pips

- Upside Risk: 6,650 pips

- Risk/Reward Ratio: 3.34

Should the Force Index recover above its descending resistance level, the EUR/MXN is expected to challenge its resistance zone once again. A sustained breakout remains unlikely as a result of the current fundamental outlook, supported by technical developments. Forex traders are advised to take advantage of any price spike from current levels with new short-positions.

EUR/MXN Technical Trading Set-Up - Limited Breakout Scenario

- Long Entry @ 24.35000

- Take Profit @ 25.15000

- Stop Loss @ 24.05000

- Upside Potential: 8,000 pips

- Downside Risk: 3,000 pips

- Risk/Reward Ratio: 2.67