Economic data out of the Eurozone continues to underperform, led by its export engine Germany. The European Central Bank is deliberating an interest rate cut of 10 basis points, challenging the Euro's resilience. It may not result in a massive sell-off, given the current levels in the currency, but it will limit upside potential. Italy, home to one of the largest Covid-19 cases outside of China, is on track to enter a recession, expected to drag down most of Europe with it. Therefore, more downside is likely in the EUR/JPY following the breakdown below its short-term resistance zone.

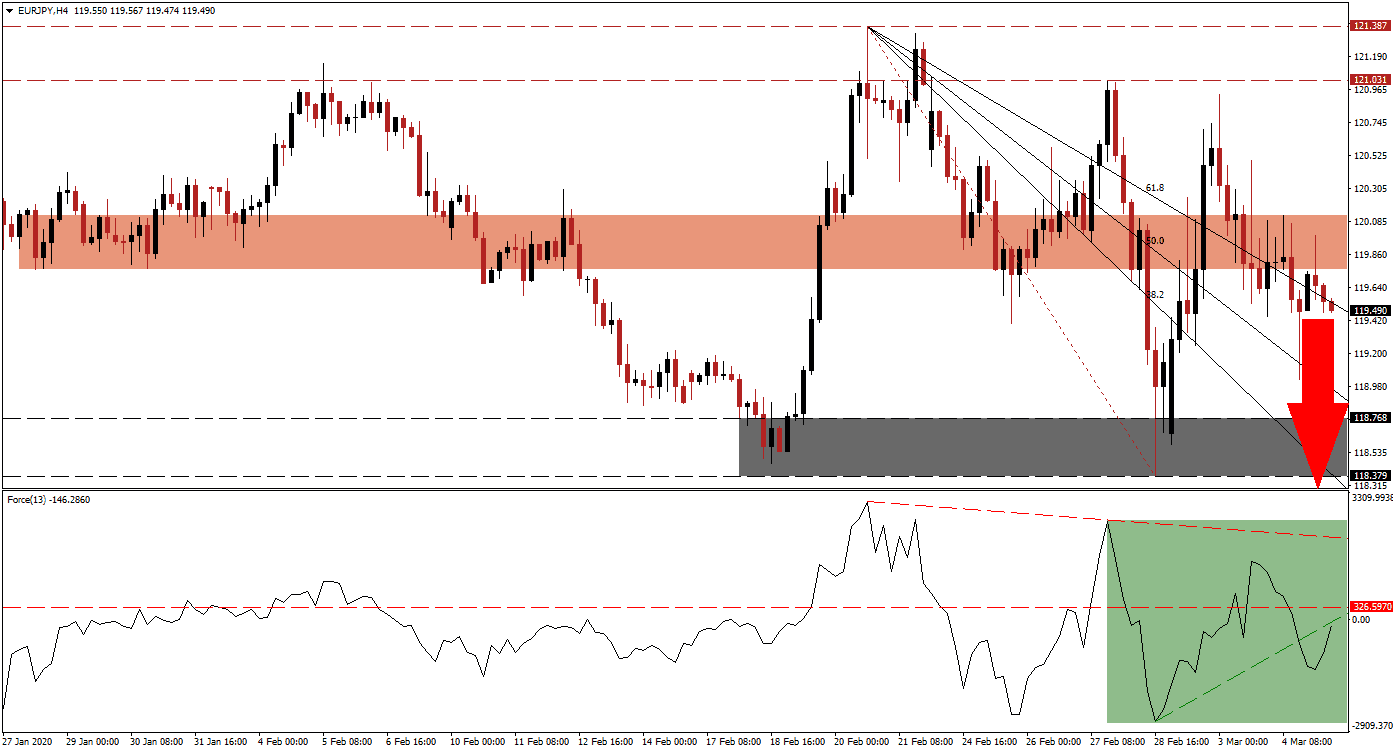

The Force Index, a next-generation technical indicator, corrected from a lower high, converting its horizontal support level into resistance. It pierced through its ascending support level in negative conditions, as marked by the green rectangle, which now acts as temporary resistance. The Force Index is currently challenging it, but a rejection is favored. Its descending resistance level likely to maintain downside pressure on this technical indicator, keeping the bearish trend in the EUR/JPY intact.

Volatility spiked with this currency pair gyrating between its long-term resistance and support zones, before calm returned following the breakdown in the EUR/JPY below its short-term resistance zone. This zone is located between 119.762 and 120.123, as marked by the red rectangle. The Bank of Japan vowed to provide liquidity in support of its ailing export sector. An interest rate cut remains an option. You can learn more about the support and resistance zones here.

Safe-haven demand for the Japanese Yen creates a bearish bias for this currency pair as Covid-19 disrupts the global economy. The EUR/JPY has now pushed below its descending 61.8 Fibonacci Retracement Fan Support Level, converting it into resistance. It added to bearish pressures from where a contraction into its support zone located between 118.379 and 118.768, as marked by the grey rectangle, is anticipated. With the 38.2 Fibonacci Retracement Fan Support Level already below this zone, the Fibonacci Retracement Fan is favored to guide price action farther to the downside.

EUR/JPY Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 119.450

Take Profit @ 118.000

Stop Loss @ 119.900

Downside Potential: 145 pips

Upside Risk: 45 pips

Risk/Reward Ratio: 3.22

A breakout in the Force Index above its descending resistance level may allow the EUR/JPY to spike higher. Given the fundamental outlook for the global economy, any advance from current levels will present Forex traders an excellent short-selling opportunity. The next resistance is located between 121.031 and 121.387 from where a breakout will require a significant fundamental catalyst, which remains unlikely over the next few months.

EUR/JPY Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 120.300

Take Profit @ 121.150

Stop Loss @ 119.900

Upside Potential: 85 pips

Downside Risk: 40 pips

Risk/Reward Ratio: 2.13