After the EUR/JPY moved into its short-term resistance zone, the price action struggled to push higher. Cracks across the Eurozone become evident, renewing fears of a break-up. Germany and France are unlikely to allow their project to fail, but the delayed response to Covid-19 shows several members taking an active approach while others resort to selfish measures. Italy calls for the issuance of corona-bonds across the Eurozone, rejected fiscally stable members. The European Central Bank boosted its asset-purchase program to €120 billion per month while lowering the rate it charges banks to borrow from it to -0.75%. You can learn more about a resistance zone here.

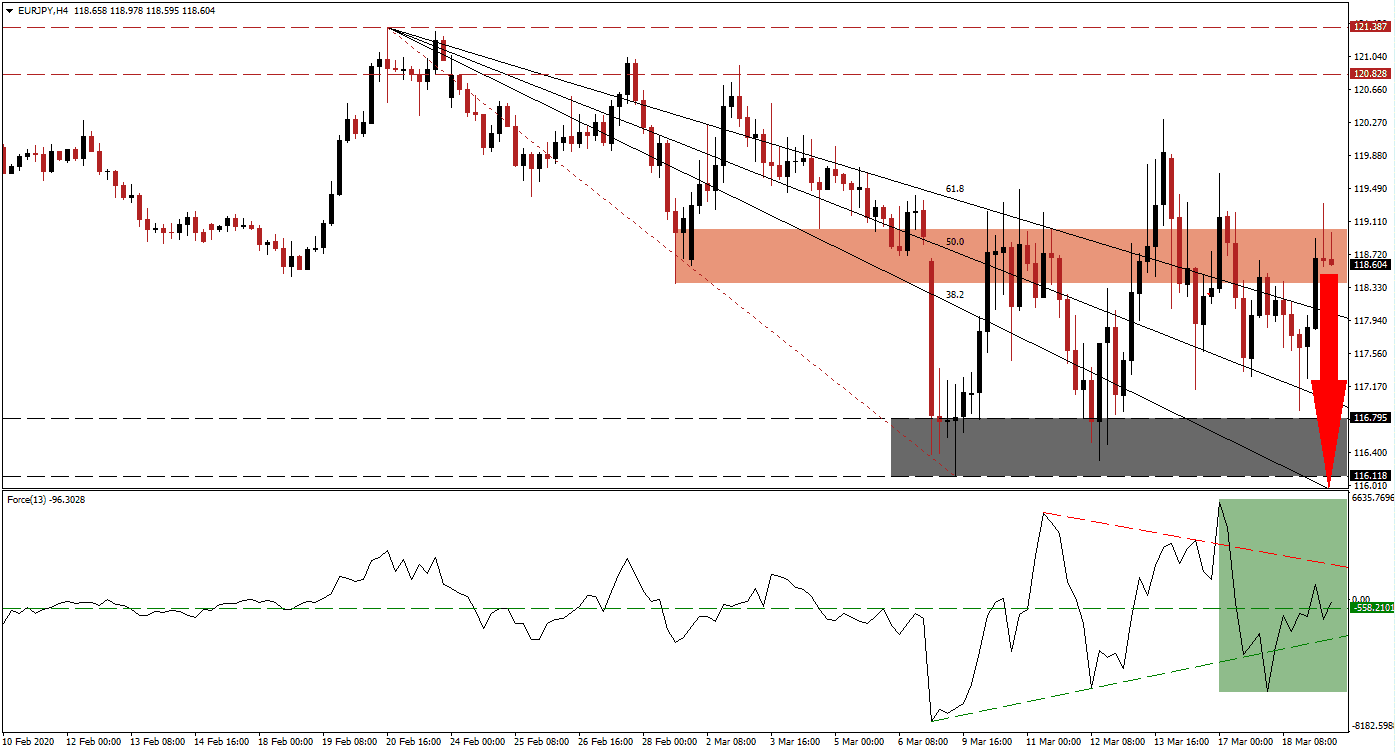

The Force Index, a next-generation technical indicator, shows the reversal following a brief drop below its ascending support level. Bullish momentum carried it above its horizontal resistance level, converting it into support, as marked by the green rectangle. Bears remain in control of the EUR/JPY with the Force Index below the 0 center-line. More downside pressure is provided by its descending resistance level. This technical indicator is expected to complete a double breakdown, initiating a renewed sell-off.

This currency pair is now seeking direction after pushing into its short-term resistance zone located between 118.379 and 119.014, as marked by the red rectangle. The EUR/JPY was able to eclipse its descending 61.8 Fibonacci Retracement Fan Resistance Level, turning it into temporary support. Price action reversed the previous four breakouts above this level. Conditions for a fifth reversal are dominant on the back of weak bullish momentum. You can learn more about the Fibonacci Retracement Fan here.

Safe-haven demand keeps the Japanese Yen supported, but the Bank of Japan has noted its willingness to interfere. An exchange rate in the USD/JPY of 100.000 is the rumored metric for when the central bank plans to manipulate its currency. A minor profit-taking sell-off in the EUR/JPY is favored, which will allow it to retrace back into its support zone located between 116.118 and 116.795, as marked by the grey rectangle. With the 38.2 Fibonacci Retracement Fan Support Level below this zone, a breakdown extension is possible.

EUR/JPY Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 118.600

Take Profit @ 116.000

Stop Loss @ 119.400

Downside Potential: 260 pips

Upside Risk: 80 pips

Risk/Reward Ratio: 3.25

Should the Force Index push through its descending resistance level, the EUR/JPY is likely to attempt a breakout. Due to deteriorating economic conditions in the Eurozone, the outlook for this currency pair is increasingly bearish. The upside potential is reduced to its next long-term resistance zone located between 120.828 and 121.387. It will present Forex traders with an exceptional opportunity to take new net short positions.

EUR/JPY Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 119.750

Take Profit @ 121.000

Stop Loss @ 119.250

Upside Potential: 125 pips

Downside Risk: 50 pips

Risk/Reward Ratio: 2.50