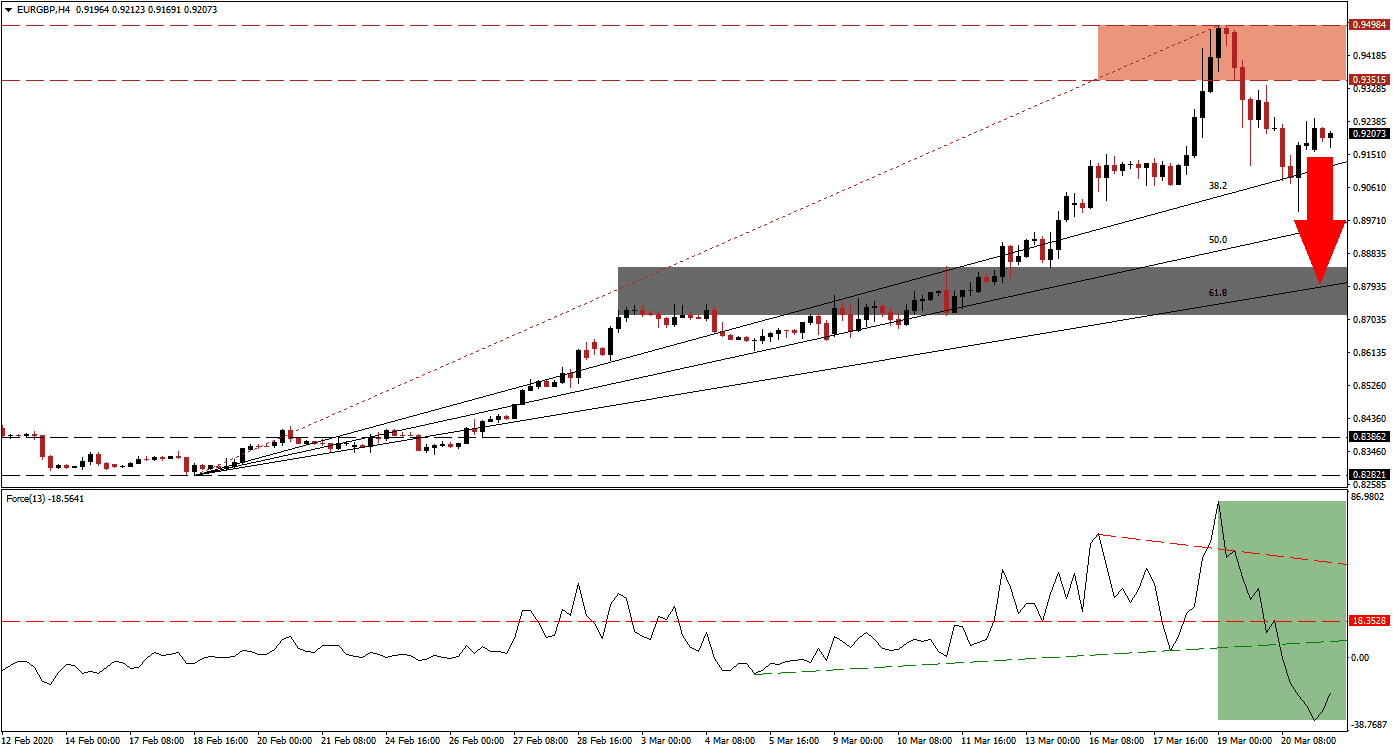

Following the initial UK response to Covid-19, regarded as laid back, the government of Prime Minister Boris Johnson kicked into gear. The British Pound plunged over the past month. Selling pressure eased after the Chancellor of the Exchequer announced a £330 billion in business loan guarantees as part of a £350 billion stimulus package. The UK operates from a foundation of relative fiscal strength, providing a long-term fundamental catalyst. After the EUR/GBP spiked into its resistance zone, a breakdown ended the advance.

The Force Index, a next-generation technical indicator, collapsed from a multi-year peak to a 2020 low. After the initial spike briefly took it above its descending resistance level, the reversal converted its horizontal support level into resistance. It was followed by a breakdown below its ascending support level, as marked by the green rectangle, and below the 0 center-line. Bears are in control of the EUR/GBP, and while a rebound in this technical indicator is expected, the ascending support level acts as temporary resistance. It is favored to keep bearish pressures intact.

Panic selling pushed the EUR/GBP into its resistance zone located between 0.93515 and 0.94984, as marked by the red rectangle. It did not reflect fundamentals, considering the weak fiscal and economic condition of the Eurozone. The breakdown gave way to a profit-taking sell-off into its ascending 38.2 Fibonacci Retracement Fan Support Level. This currency pair dipped below it before reversing and is now faced with more selling pressure. You can learn more about the Fibonacci Retracement Fan here.

Since the Eurozone cannot announce a unified approach to economic weakness, the sole option remains the European Central Bank and its depleted arsenal. The most significant assistance offered was the interest rate its charges to banks, lowered to -0.75%, in an attempt to inspire a carry trade. The hope is that individual governments will provide the required boost to the economy. An extension of the breakdown in the EUR/GBP is anticipated to take it into its short-term support zone located between 0.87150 and 0.88435, as identified by the grey rectangle.

EUR/GBP Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 0.92000

Take Profit @ 0.88000

Stop Loss @ 0.92750

Downside Potential: 400 pips

Upside Risk: 75 pips

Risk/Reward Ratio: 5.33

Should the Force Index accelerate through its descending resistance level, the EUR/GBP is likely to challenge its resistance zone once again. The upside is limited to the top range of it, barring an unexpected fundamental shock to the existing outlook. Forex traders are recommended to take advantage of any price spike with new sell orders, as the outlook is increasingly bearish for this currency pair.

EUR/GBP Technical Trading Set-Up - Limited Reversal Scenario

Long Entry @ 0.93100

Take Profit @ 0.94750

Stop Loss @ 0.92400

Upside Potential: 165 pips

Downside Risk: 70 pips

Risk/Reward Ratio: 2.36