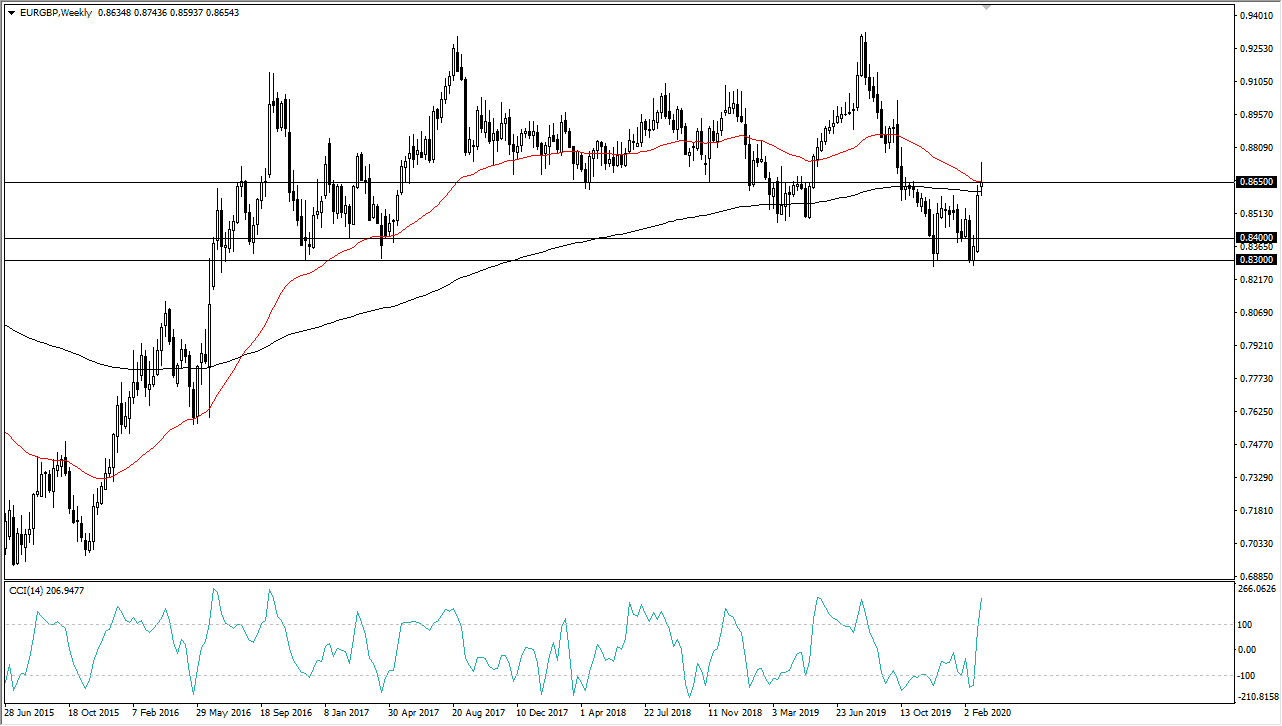

The Euro has rallied a bit against the British pound as of late, but quite frankly it does look as if it is going to run into some trouble in the area currently focused on. The 0.8650 level continues to be an area of interest, and it also attracts the attention of the 50 and the 200 week EMA indicators. Because of this, I believe that we will make some type of longer-term decision rather early in the month, and if the 0.8650 level does in fact offer significant resistance, I think it is going to be difficult for the market to continue higher over the longer term. At that point, I fully anticipate that the pair goes back down towards the 0.84 level, perhaps even as low as the 0.83 level.

One of the things that you will need to pay attention to is the British pound against the US dollar. If it can start to recover that may end up putting a lot of downward pressure on this market. For what it’s worth, the Commodity Channel Index is at an oversold area, but it has not rolled over yet. This shows just how stretch this market has gotten and therefore how likely it is to break down.

I do believe that the British pound is probably eventually going to be in better shape than the Euro, because quite frankly the British economy is doing much better than the EU relatively speaking. There is probably an interest rate cut coming from the Bank of England rather soon, but that is already known in the marketplace. The question now is whether or not the European Union does some type of monetary policy, perhaps quantitative easing which would only hurt the currency even further. It will be interesting to see how this plays out, because the Federal Reserve has already cut interest rates by 50 basis points, so it does put a little bit of strength into both of these currencies when measured against the all-important greenback.

If the market breaks above the 0.87 level, then it’s likely to go to the 0.90 level. Remember, this pair tends to move at a crawl, so be very patient in general. All things being equal though, it does look to me like we could pull back down into the previous consolidation area. All things being equal though, if we were to break down below the 0.83 level we would really start to take off to the downside, perhaps reaching towards the 0.80 level.