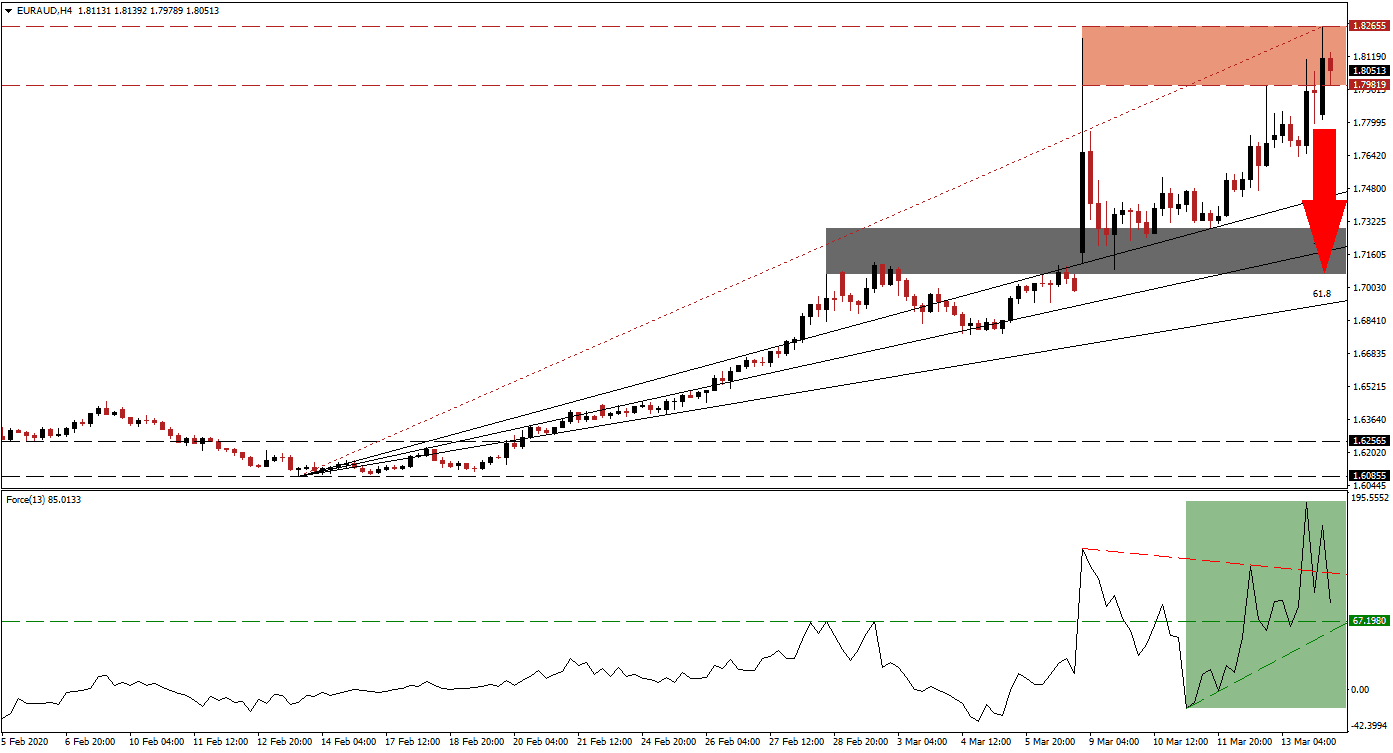

After the European Central Bank (ECB) surprised financial markets by keeping interest rates unchanged, the Euro received a bullish fundamental catalyst. Most major central banks rushed into panic-cuts, adding fear and volatility across the financial system. The response to Covid-19 has been more extreme than that during the 2008 global financial crisis, suggesting that the global economic fallout will be more severe. Following the advance in the EUR/AUD into its resistance zone, bullish momentum collapsed, and a breakdown is now pending.

The Force Index, a next-generation technical indicator, initially confirmed the new 2020 high in this currency pair with a peak of its own. It has now collapsed below its descending resistance level, which acted as temporary resistance, as marked by the green rectangle. A push below its horizontal support level is expected to convert it into resistance from where a breakdown below its ascending support level is favored. This technical indicator will then be positioned to move below the 0 center-line and place bears in control of the EUR/AUD.

Australia’s government announced an A$17.6 billion economic stimulus package as recession fears have spiked. Over 6 million welfare recipients will receive a one-off cash payment of A$750, wages of 120,000 apprentices will be subsidized, and small businesses may qualify for a maximum of A$25,000 in assistance. The government is proactive to limit economic damages, providing a long-term fundamental catalyst for the EUR/AUD. A breakdown in price action below its resistance zone located between 1.79819 and 1.82655, as marked by the red rectangle, is anticipated to emerge.

This currency pair is vulnerable to a profit-taking sell-off, closing the gap to its ascending 38.2 Fibonacci Retracement Fan Support Level. Adding to downside pressures are expectations for more quantitative easing by the ECB, keeping the Euro depressed in an attempt to support its export sector. The corrective phase is likely to take the EUR/AUD into its short-term support zone located between 1.70668 and 1.72862, as marked by the grey rectangle. It is enforced by its 50.0 Fibonacci Retracement Fan Support Level, but more downside cannot be ruled out. You can learn more about a profit-taking sell-off here.

EUR/AUD Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 1.80500

Take Profit @ 1.71250

Stop Loss @ 1.82750

Downside Potential: 925 pips

Upside Risk: 225 pips

Risk/Reward Ratio: 4.11

In case of a sustained breakout in the Force Index above its descending resistance level, the EUR/AUD may attempt to extend its rally. Given the fundamental outlook for this currency pair, the upside potential remains limited to its next resistance zone. Any advance from current levels will present Forex traders with a great selling opportunity. Price action will challenge its resistance zone, following a breakout, between 1.86050 and 1.88800, dating back to November 2008.

EUR/AUD Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 1.83750

Take Profit @ 1.87500

Stop Loss @ 1.82000

Upside Potential: 375 pips

Downside Risk: 175 pips

Risk/Reward Ratio: 2.14