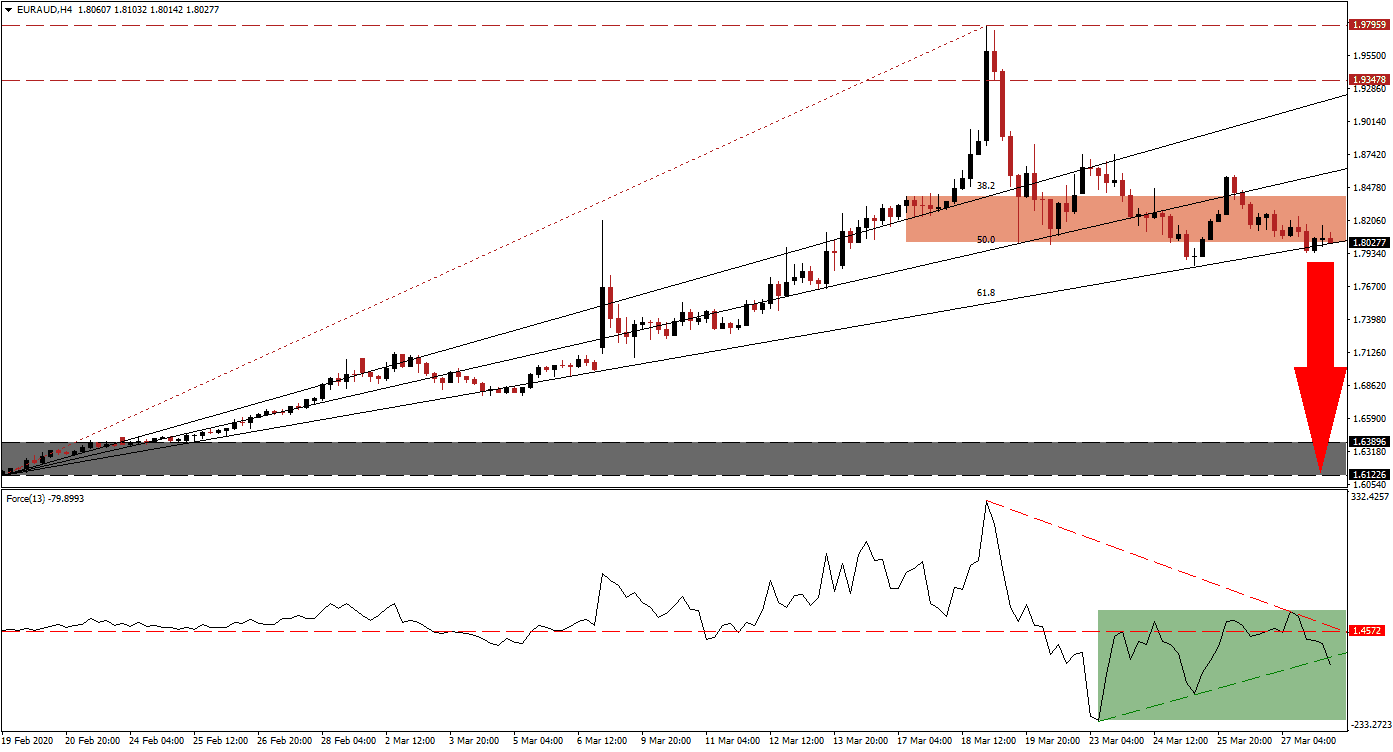

Australia is rumored to announce the third stimulus as soon as this week. Plans to put the economy into hibernation include banks to freeze interest payments and mortgages, preventing debt to accumulate at a time business remain on lockdown. The initial period will last six months, but Prime Minister Morrison noted an extension, if necessary. After the EUR/AUD spiked into its long-term resistance zone, a quick reversal followed, pressuring price action into its ascending 61.8 Fibonacci Retracement Fan Support Level.

The Force Index, a next-generation technical indicator, contracted from a new 2020 high, converting its horizontal support level into resistance, before recovering off of a multi-week low. After reaching its descending resistance level, the Force Index was rejected once again, as marked by the green rectangle. It has now pushed through its ascending support level while bears have taken control of the EUR/AUD. This technical indicator is expected to slide deeper into negative territory.

With the Australian government at the forefront of the Covid-19 pandemic, ensuring the economy will be able to rebound sufficiently, and the Eurozone unable to deliver a unified response, a more massive correction in the EUR/AUD is anticipated. Price action is on the verge of a double breakdown below its short-term resistance zone enforced by its 61.8 Fibonacci Retracement Fan Support Level. This zone is located between 1.80267 and 1.84027, as marked by the red rectangle.

Forex traders are advised to monitor the intra-day low of 1.78345, the last occurrence when this currency pair recovered off of its 61.8 Fibonacci Retracement Fan Support Level. A sustained breakdown will clear the path for the EUR/AUD to accelerate into its support zone located between 1.61226 and 1.63896, as identified by the grey rectangle. The Australian economy, closely tied to the fate of the Chinese one, is in a dominant position to recover quickly from the pandemic, granting a long-term fundamental catalyst to price action. You can learn more about a breakdown here.

EUR/AUD Technical Trading Set-Up - Double Breakdown Scenario

Short Entry @ 1.80300

Take Profit @ 1.63000

Stop Loss @ 1.84700

Downside Potential: 1,730 pips

Upside Risk: 440 pips

Risk/Reward Ratio: 3.93

In case of a breakout in the Force Index above its descending resistance level, the EUR/AUD could attempt a price action reversal. Given the dominant bearish fundamental scenario for price action, any advance is limited to its 38.2 Fibonacci Retracement Fan Resistance Level. It is closing in on the bottom range of its resistance zone located between 1.93478 and 1.97959. Forex traders should consider this an outstanding short-selling opportunity.

EUR/AUD Technical Trading Set-Up - Limited Price Action Reversal Scenario

Long Entry @ 1.88300

Take Profit @ 1.93500

Stop Loss @ 1.85700

Upside Potential: 520 pips

Downside Risk: 260 pips

Risk/Reward Ratio: 2.00